London, June 30, 2025 – ComplyCube, the global KYC and AML leader, has secured the “RegTech Partner of the Year” award for the second year running at the British Bank Awards 2025, hosted by Smart Money People. This accolade underscores ComplyCube’s unwavering commitment to excellence in delivering cutting-edge compliance solutions and reinforces its position as a RegTech powerhouse in the banking sector.

Leader in Fraud Prevention and Anti-Money Laundering (AML)

The RegTech Partner of the Year category honours exceptional regulatory technology solutions for the UK banking sector. ComplyCube secured the top prize amid fierce competition, bolstered by strong endorsements from its extensive client base, including major financial institutions that rely on the platform for fraud detection and compliant customer onboarding.

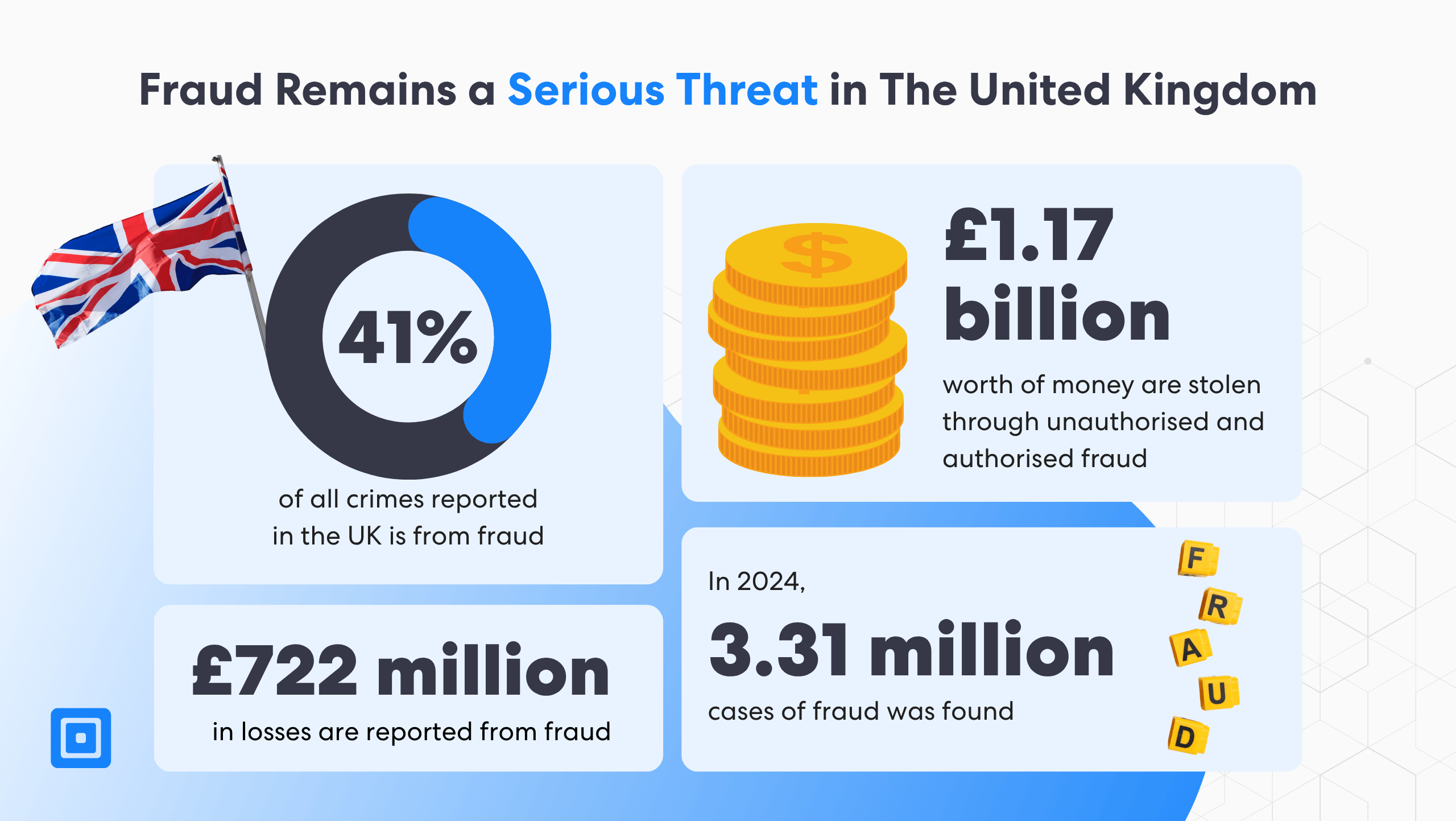

In 2024, 3.31 million fraud cases were reported in the UK, contributing to an estimated £722 million in losses to consumers and businesses. This alarming figure underscores the urgent need for advanced RegTech solutions to protect businesses and consumers from increasingly sophisticated threats.

According to the National Crime Agency (NCA), nearly 41% of all UK crimes involve fraud. This growing challenge has made fraud prevention a top priority for financial institutions. ComplyCube is recognized a trusted partner in this fight, helping banks leverage cutting-edge verification technology to ensure both security and a seamless user experience.

ComplyCube continues to demonstrate excellence in regulatory technology, offering cutting-edge solutions – Jacqueline Dewey, CEO, Smart Money People

Jacqueline Dewey, CEO of Smart Money People highlights the significance of ComplyCube’s solutions, “Congratulations to ComplyCube for winning RegTech partner of the year for the second consecutive year. ComplyCube continues to demonstrate excellence in regulatory technology, offering cutting-edge solutions that not only help organisations stay compliant but also improve the safety and integrity of their customer interactions. A huge well done to the entire ComplyCube team on this fantastic achievement.”

Pioneering RegTech Partner Solutions

ComplyCube stands out for its developer-friendly and highly secure solutions that address evolving regulatory requirements such as Know Your Customer (KYC), Identity Verification (IDV), and Anti-Money Laundering (AML) across global jurisdictions.

At the heart of ComplyCube’s platform is an advanced AI engine capable of detecting sophisticated fraud patterns in real-time. This includes powerful machine learning models that continuously evolve to recognize new types of fraudulent practices, such as identity theft and synthetic fraud. By leveraging AI-powered fraud detection, businesses can detect and prevent fraud in real-time, saving significant fraud reimbursement costs and minimizing operational and financial risks to businesses.

Our mission at ComplyCube is to continuously raise the bar in RegTech

According to UK Finance, criminals stole over £1 billion in 2024 alone, underscoring the urgent need for advanced RegTech solutions to protect businesses and individuals. “Winning the RegTech Partner of the Year award is a major achievement for the team,” says Dr. Tarek Nechma, CEO of ComplyCube. “It is not just a recognition of our hard work but also reflects our commitment to staying ahead of evolving threats. As fraudsters become more adept at exploiting technological gaps, our mission at ComplyCube is to continuously raise the bar in RegTech, ensuring our solutions remain resilient in the face of emerging challenges.”

Building the Blueprint of a Safer Ecosystem

This recognition adds to a growing list of industry accolades, including ComplyCube’s leadership position 2025 G2 Spring Report for Anti-Money Laundering, Digital Onboarding, and Biometric Authentication. The award follows recent listings in the RegTech100, FinTech Breakthrough Awards, and FinCrime50, further cementing ComplyCube’s reputation as a leading innovator in compliance technology.

“The ComplyCube team is incredibly proud of this milestone, with the RegTech Partner of the Year award underpinning our strong commitment to providing sophisticated, reliable compliance solutions across the UK’s financial sector. We aim to continue testing the limits of RegTech, empowering banks with the tools to fulfil regulatory demands in the UK and abroad, confidently.” adds Mohamed Alsalehi, CTO of ComplyCube.

We aim to continue testing the limits of RegTech, empowering banks with the tools to fulfil regulatory demands in the UK and abroad

As a trusted RegTech provider, ComplyCube empowers banks and financial institutions to strengthen compliance, streamline onboarding, and combat financial crime at scale. Its advanced platform delivers best-in-class tools for AML screening, identity verification, and real-time fraud prevention, built for the demands of modern compliance teams. Discover how ComplyCube equips financial institutions with tools to stay ahead of evolving compliance challenges.

About ComplyCube

ComplyCube is a global leader in AML and KYC compliance solutions. It is also a government-approved Identity Service Provider (IDSP) under the UK’s Digital Identity and Attributes Trust Framework (DIATF). With flexible and robust SDKs and APIs, ComplyCube’s solutions are trusted by companies across the finance industry and more to navigate complex compliance requirements. With smart and configurable verification methods, ComplyCube enables businesses to swiftly identify fraudsters, reduce false positives, and provide the right level of identity assurance tailored to each client’s needs.

About Smart Money People

Smart Money People is the leading financial services review site in the UK. With over 2.3 million reviews, the company aims to deliver key insights and transparent reviews across the financial industry to empower consumers to make informed decisions about various financial products, such as SaaS platforms, credit cards, insurance, and more. The firm organizes the British Bank Awards annually, aiming to honor excellence and recognize outstanding innovation in the industry.