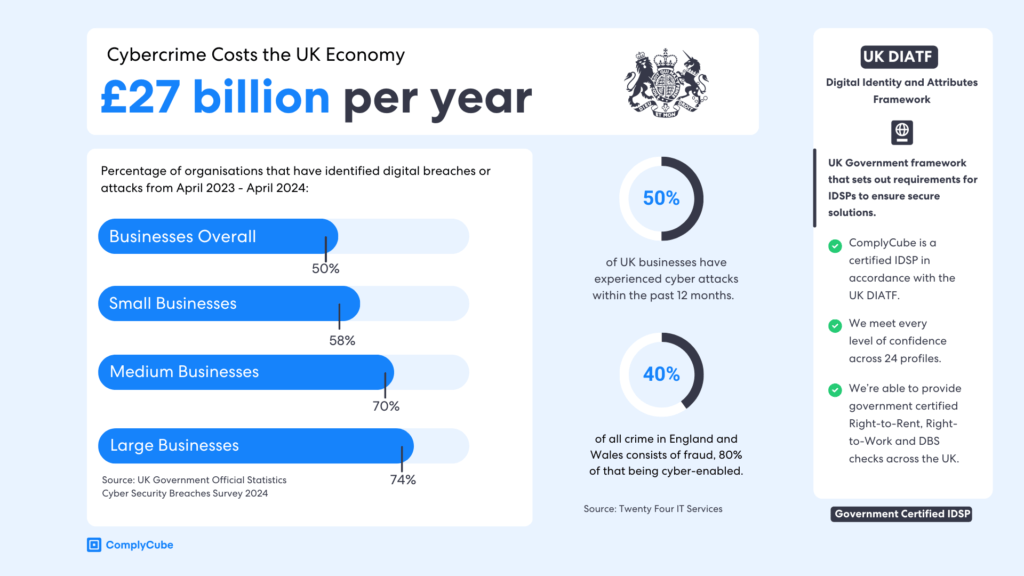

Regulatory bodies must tighten the standards for identity service providers to ensure that IDV solutions can robustly counteract fraudulent practices. The UK government’s Department of Science, Innovation and Technology (DSIT) has therefore published the UK DIATF initiative, which sets out requirements for Identity Service Providers (IDSP) to ensure secure solutions.

The Need for Stringent Standards

The initiative was implemented due to the ever-evolving threat of digital fraud. Demand for comprehensive IDV and AML solutions has consistently grown since the COVID-19 pandemic, with many businesses pivoting online and technological advancements lending themselves to sophisticated fraud. The global IDV market (having been valued at $10.45 billion in 2023) is now projected to increase from $11.97 billion in 2024 to an impressive $39.82 billion in 2032, with a CAGR of 16.2%.

This substantial increase is inherently tied to the rise of digital fraud and cyber attacks. The UK government’s Cyber Security Breaches Survey recently revealed that 50% of UK businesses have suffered a cyber-attack or security breach in the previous 12 months. Cybercrime amounts to a hefty annual cost of £27 billion for the UK economy.

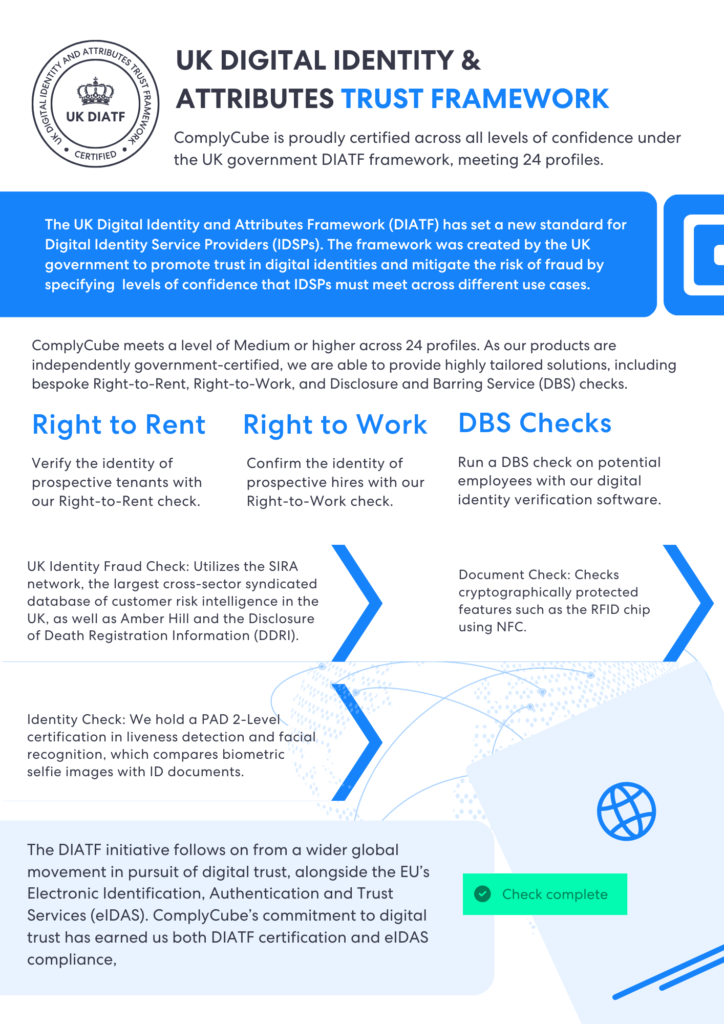

The DIATF initiative represents the dawn of a modernized approach to identity verification in the UK, introducing the concept of certified reusable digital IDs. In doing so, the framework also sets out requirements for IDSPs to follow that ensure both single-use and reusable digital identities enhance privacy and security beyond traditional, physical forms of identification such as passports. Varying levels of compliance from IDV providers with the framework’s mandates translate into differing levels of confidence, with the Home Office requiring a medium level of confidence as a minimum for IDSPs providing Right-to-Rent or Right-to-Work checks.

The UK government’s DIATF initiative follows a wider global movement to promote digital trust. It is also backed by existing schemes like the EU’s Electronic Identification, Authentication, and Trust Services (eIDAS), an established initiative that similarly aims to promote confidence in digital identities across Europe.

5 Reasons to Choose ComplyCube’s DIATF-Certified Checks

Finding the right partner can be challenging, but choosing a certified IDSP provider comes with many benefits. Government-backed right-to-rent, right-to-work, and DBS checks that are provided by a certified IDSP are subject to mandated standards that ensure their security. ComplyCube’s DIATF-certified checks offer the following benefits:

1. Integration with Risk Intelligence Networks

ComplyCube’s DIATF-certified Right-to-Work, Right-to-Rent, and DBS checks include the UK Identity Fraud check, which has access to the high-intelligence SIRA network, Amber Hill, and the Disclosure of Death and Registration Information (DDRI).

The SIRA network is the largest cross-sector syndicated database of customer risk intelligence in the UK, leveraging data from over 170 UK institutions. Similarly, access to Amber Hill and the DDRI enables the quick identification of synthetic fraud. Leveraging these databases allows for the corroboration of critical information, ensuring the highest level of accuracy.

2. Trusted Tailored Solutions

ComplyCube is proudly certified across every confidence level under the DIATF, meeting 24 profiles. Their products are independently government-certified, so they’re uniquely positioned to provide highly tailored services, including bespoke Right-to-Rent, Right-to-Work, and Disclosure and Barring Service (DBS) checks.

Other than the key components of the Right-to-Rent, Right-to-Work, and Disclosure and Barring Service (DBS) checks (which are Document Verification, Identity Verification, and the UK Identity Fraud Check), additional features can be leveraged to customize solutions. These include extensive AML Screening, electoral roll registration, Credit Bureau Check, or Proof of Address Check.

3. Advanced Fraud Prevention

Being DIATF-certified means that IDSPs must have robust measures in place to prevent fraud. ComplyCube’s solutions include sophisticated Document Checks that leverage Optical Character Recognition (OCR), which accurately extracts details such as names, birth dates, and other information from identity documents. This significantly reduces data entry errors and operational risk while enhancing UX and CX. ComplyCube also extracts signatures, ID photos, and MRZ details.

ComplyCube’s AI-powered ISO 30107-3 and PAD-Level 2 liveness detection software can differentiate authentic customer presence from sophisticated presentation attacks like deepfakes.

4. UK Government Certified DBS, Right-to-Rent and Right-to-Work Checks

Certified IDSPs provide government-certified solutions that enable employers and landlords across the UK to conduct enhanced DBS and Right-to-Work checks for employees and Right-to-Rent checks for tenants while remaining compliant with government standards.

ComplyCube leverages digital identity verification software, including an expert Document Check with OCR and MRZ analysis, a Biometric Identity Check with advanced Liveness Detection technology, and the UK Identity Fraud Check. Additional optional solutions, such as a Proof of Address Check or AML screening, are also available.

5. Regulatory Adherence

Partnering with a DIATF-certified provider means offering solutions that meet the stringent standards of the UK Government. Prioritizing regulatory compliance is critical for businesses to avoid hefty fines and penalties. Choosing a certified IDSP, therefore, ensures adherence to the latest and most rigorous regulatory requirements.

ComplyCube’s IDSP-Certified Commitment to Compliance

Complying with both eIDAS and UK DIATF regulations, ComplyCube’s commitment to enhancing trust online has earned them five new certifications in 2024 alone, including UK DIATF, ISO 9001, Age Check Systems, ISO 27001:2022 upgrade, and PAD Level 2. Their rigorous compliance with global standards reinforces their position as a reputable market leader within the IDV sector, making them an ideal provider to partner with.

About ComplyCube

ComplyCube is a leading SaaS & API platform, offering an all-in-one solution for Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Customer (KYC) compliance on a global scale. Having recently been named “RegTech Partner of the Year” by the British Bank Awards, they’ve certainly made their mark on the identity verification sector. ComplyCube boasts the fastest omnichannel integration within the market, proudly offering Low/No-Code solutions, API, Mobile & Web SDKs, Client Libraries, and CRM Integrations.

For more information, contact one of our compliance experts.