TL;DR: KYC API Pricing is less about the lowest per-check rate and more about selecting a KYC API model that fits your volume, risk, and growth. Different pricing structures can create unexpected cost jumps as usage scales. To choose confidently, compare total cost and outcomes not just the headline KYC price.

What is KYC API Pricing?

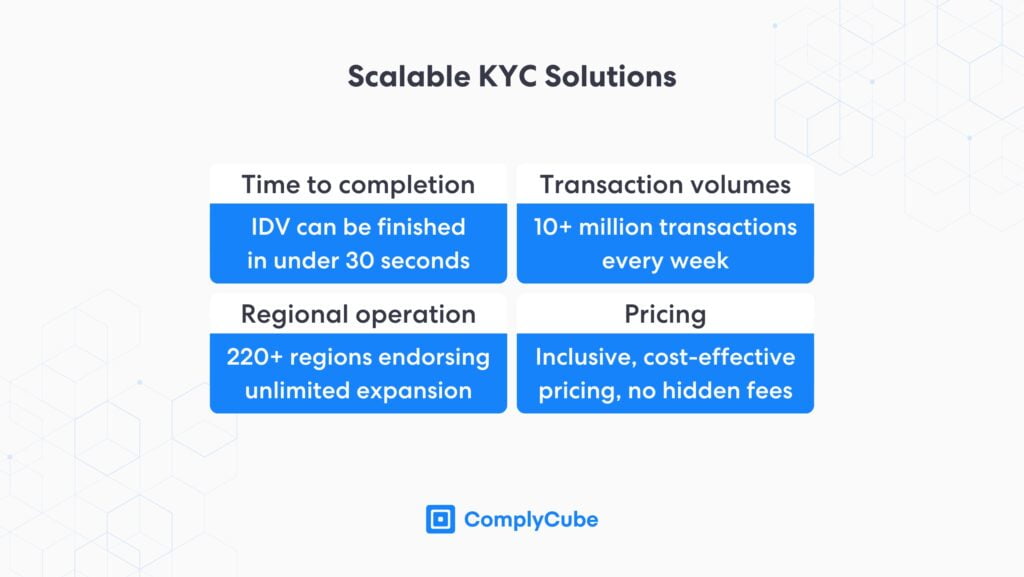

KYC API pricing is a key compliance concern within teams while evaluating identity verification vendors in 2025. As regulatory attention continues to rise across sectors and geographies, companies need to balance cost management with compliance precision. Selecting an affordable KYC APIs is no longer just about finding the lowest price, it is about finding scalability with compliance without compromising on verification quality.

This guide explains the pricing models shaping the KYC API market, the cost variables that affect vendor pricing, and how businesses can make informed investment decisions. We’ll also explore how ComplyCube enables organisations to optimise cost, performance, and compliance outcomes through transparent, modular pricing and intelligent verification flows.

Understanding KYC API Pricing Models

KYC API pricing structures vary considerably between vendors based on the differences in architecture, product maturity, and market focus. Model choice can have a substantial impact on compliance cost and scalability of business.

1. Per-Call KYC API Pricing

It entails charging a fixed amount per verification request, such as document verification, biometric verification, or AML screening. It is easy and uncomplicated but can be expensive for high-volume operations.

2. Tiered KYC API Pricing

Vendors offer levels of pricing based on usage levels. As the number of verifications increases, the per-call cost decreases. The model promotes volume but creates price cliffs when volume fluctuates wildly.

3. Volume-Based Subscriptions

Customers pre-pay for a bundle of verifications on a monthly or annual basis. It provides cost predictability and bulk discounts. Unused verifications may not roll over, so there can be waste in case of wrong estimates.

4. Flat-Rate KYC API Pricing or Custom Bundles

Some providers offer flat monthly rates or custom packages combining multiple services such as IDV, biometric liveness, and AML filtering. That model best suits mature compliance companies that want the flexibility and ease of use.

Which KYC API Pricing Is Best For Your Business?

The ideal API Pricing model depends on business size, speed of onboarding, and compliance risk exposure. Startups may like the ease of pay-as-you-go, while banks or large fintech players are benefited by subscription predictability. For more on KYC pricing, read “How Much Does KYC Cost?”

Key Cost Drivers Behind KYC API Pricing

While the pricing models provide the structure, the real cost of KYC APIs is determined by a chain of underlying technical and operational drivers. Understanding these drivers enables organisations to budget correctly and avoid hidden costs.

1. Geographic and Document Coverage

Global operations require KYC solutions that can verify ID documents in several hundred countries. The wider the coverage, the more investment in document templates, OCR models, and mapping compliance rules, all of which affect costs.

2. Verification Layer Complexity

More advanced solutions past simple ID verification, such as adding biometric liveness, AML screening, and fraud detection, have a higher cost of operations and infrastructure. Multilayered checks enhance reliability while affecting pricing.

3. Accuracy and False Positive Handling

Solution vendors that invest in low false-positive rates, manual fallback processes, and continuous model training return better-quality results. This raises the cost of operations but reduces long-term risk to clients.

4. Usage Patterns and Infrastructure Load

Extended onboarding periods might cause spikes in volume. APIs must handle high concurrency, geographic load balancing, and failover processes, all with enterprise-class price plans.

Case Study: Nationwide Building Society, KYC API Pricing and FCA Fines

Problem

Nationwide had inadequate financial crime systems and controls over a multi-year period (Oct 2016–Jul 2021). This seriously weakened customer risk assessment / due diligence refresh and transaction monitoring contributing to serious fraud risk exposure.

Solution

Nationwide initiated a large-scale financial crime transformation programme (from July 2021), and cooperated with the regulator’s investigation (earning a settlement discount).

Outcome

- FCA imposed a £44,078,500 financial penalty with the final notice dated 11 December 2025.

- The fine reflected a 30% settlement discount due to agreement/cooperation.

- The case publicly reinforced that longstanding control gaps can create material, avoidable cost.

Total Cost of Ownership (TCO) Implications

In determining KYC API cost, with one eye on per-call pricing only telling half the story, actual budgeting must take into consideration the Total Cost of Ownership (TCO), such as integration, scalability, and ongoing operational overheads.

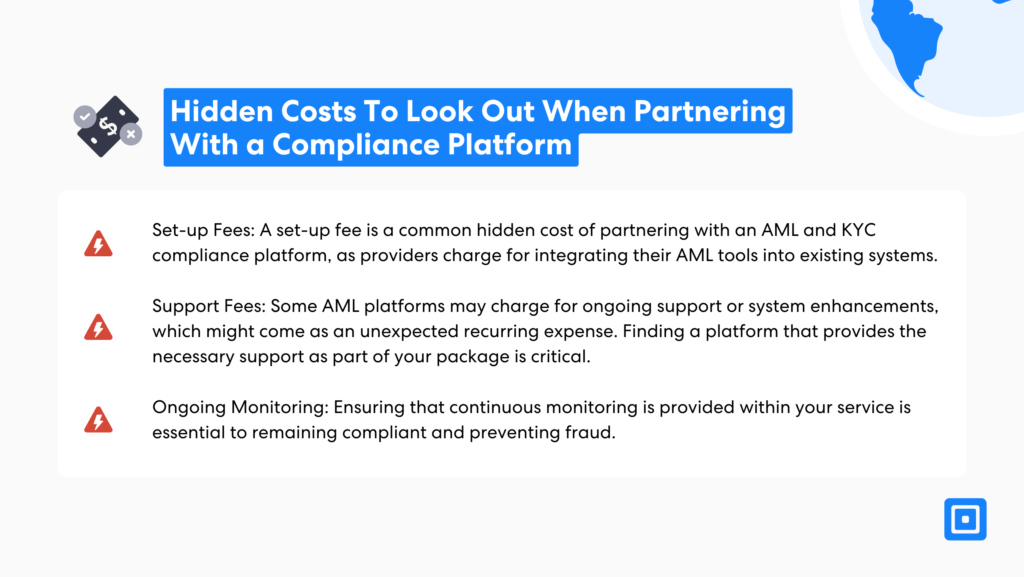

1. Integration and Setup Costs

Initial configuration charges vary based on the architecture of the vendor. REST APIs with robust SDKs and sandbox environments reduce time-to-market and developer frustration. But there are vendors who purchase setup support, test materials, or specialist technical support at additional costs.

2. Maintenance and Compliance Updates

Continuous maintenance, from bug fixes, new doc templates, and compliance upgrades, can be bundled, but perhaps not. Sneaky costs can arise if consumers are charged for every update or minor tweak.

3. Automation and No-Code Workflows

No-code orchestration platforms reduce the reliance on engineering teams. These platforms enable business users to build and edit compliance flows cost-effectively, decreasing operational costs in the long term.

4. Support, SLA, and Monitoring

Premium SLAs, 24/7 support, and real-time monitoring dashboards are possible add-ons. They are essential for high-risk sectors but need to be factored into the overall pricing strategy.

KYC API Pricing Benchmarks and What to Expect in 2025

KYC API pricing in 2025 is fuelled by evolving regulatory needs, advanced fraud, and the evolution of AI-powered verification. While actual prices vary on the vendor and the setup, industry benchmarks serve as a place to start comparing.

1. Typical Price Ranges

- ID Document Verification: $0.10 to $1.50 per check, depending on the type of document and region.

- Biometric Liveness & Face Match: $0.25 to $2.00 per session.

- AML and Watchlist Screening: $0.05 to $0.80 per search.

Bundling (combining IDV, biometric, and AML checks) can offer efficiency, especially whenboarding thousands of customers monthly.

2. Regional Price Variations

Pricing is based on regional risk exposure and document diversity. For example:

US and Canada: Reasonable prices due to coverage by digital ID and relatively homogenous document structure.

EU and UK: Higher compliance mandates (e.g., GDPR, DIATF) may increase verification costs.

APAC and LATAM: Prices are highly volatile due to document heterogeneity and region-level verification infrastructure.

3. Impact of Regulation and Risk

Categories more vulnerable to money laundering, such as crypto or fintech, generally require more screening, which increases average cost. Changes to regulation (such as from FATF or local AML regulators) also introduce new technical requirements that influence vendor cost. For more on regulatory requirements, read “Understanding KYC Requirements UK.”

Measuring ROI Beyond KYC API Pricing

1. Fraud Mitigation and Onboarding Precision

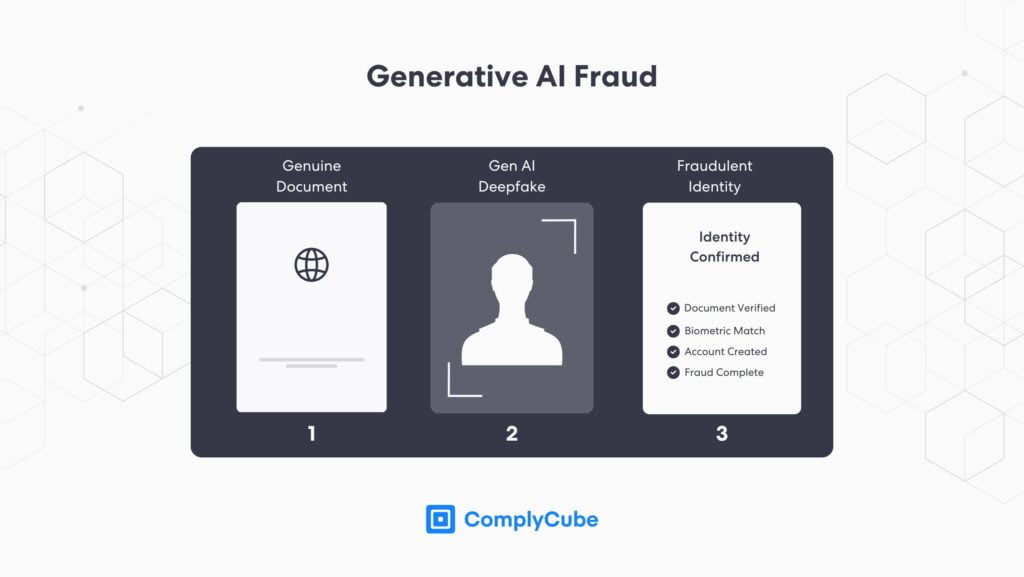

High-precision KYC APIs abolish abandonment, false positives, and manual verification during onboarding. These improvements accelerate revenue growth, enhance customer satisfaction, and protect against reputational harm from fraudulent accounts.

2. Regulatory Risk Mitigation

Automation of compliance reduces the risk of regulatory breaches and fines. Real-time screening for PEP and sanctions, logging of audits, and liveness detection all contribute to robust compliance that finds favor with regulators.

3. Operational Efficiency

Automated orchestration and passive liveness detection solutions lower user friction. It results in higher completion rates and lower support intervention, improving scalability and customer satisfaction.

4. Strategic Growth Enablement

Flexible KYC APIs for emerging markets, languages, and ID types make it possible for organisations to grow without re-negotiating compliance processes. ROI in such a case is through faster market entry and localisation.

Key Takeaways

- The best KYC API pricing model depends on volume, onboarding, and exposure.

- Costs rise with global coverage, layered verification and higher targets.

- Total cost of ownership matters, variables can materially change the real price.

- 2025 benchmark ranges vary widely by check type and region/risk.

- ComplyCube helps keep KYC costs predictable with configurable workflows.

How ComplyCube Optimises KYC API Pricing

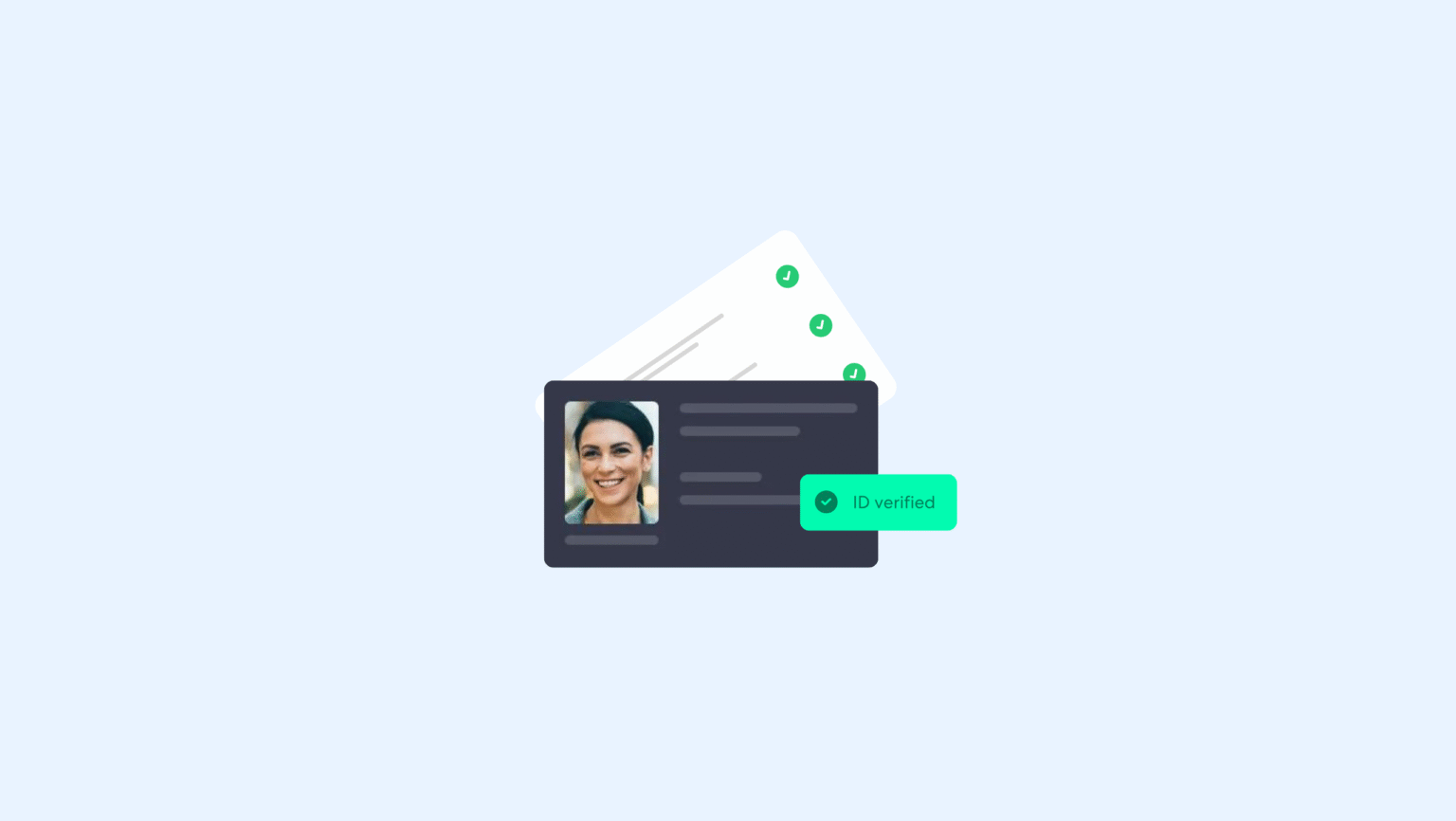

ComplyCube’s KYC API is priced on the principles of transparency, adaptability, and performance. It enables customers to scale without unexpected expenses or compliance compromises.

For more information on how to fortify your business with global watchlist screening, get in touch with one of our compliance experts.

Frequently Asked Questions

What are the most common KYC API pricing models in 2025?

Most providers price by per-call, tiered usage, volume subscriptions, or bundled/flat packages. Each variable affects scalability differently as verification volumes fluctuate. A practical way to choose is to map each model against your expected monthly volumes and “spike” scenarios so you can spot where costs jump.

What factors increase KYC API pricing the most?

The biggest cost drivers are global coverage (countries + document types), verification complexity (adding liveness/screening), accuracy/false-positive handling, and infrastructure load during spikes. Higher-risk customer segments and stricter onboarding policies typically push you toward more layered checks, which increases overall spend.

What “hidden costs” should be included when estimating KYC API total cost of ownership (TCO)?

Beyond per-check fees, include integration/setup, ongoing maintenance and compliance updates, workflow tooling, and premium support/SLA/monitoring add-ons. You should also account for internal operations time (case handling, false-positive reviews, and exception management), because these costs often scale with volume.

How much does KYC cost per check in 2025 (typical benchmark ranges)?

Benchmarks cited include roughly $0.10–$1.50 for ID document verification, $0.25–$2.00 for liveness/face match, and $0.05–$0.80 for AML/watchlist screening (varying by region and risk). The most accurate estimate comes from pricing the exact workflow you’ll run (countries, document mix, pass rates, retries, and fallbacks) rather than using a single blended average.

How does ComplyCube approach KYC API pricing for scaling teams?

ComplyCube’s approach emphasizes transparent, scalable pricing aligned to onboarding volume and risk needs, with modular checks that can be composed into workflows. In practice, that means you can right-size the checks you use now and expand coverage or add layers later without rebuilding your onboarding flow.