TL;DR: Crypto money laundering and scams now pose a serious and growing threat to global financial compliance. Criminals are exploiting digital assets to conceal illicit flows using mixers, DeFi platforms, and anonymity tools. This guide helps businesses detect crypto scam patterns, identify red flags, and implement robust AML controls to stay ahead of criminal tactics.

Why Crypto Money Laundering Is a Growing Compliance Risk for Businesses

Cryptocurrency adoption has accelerated worldwide, with transaction volumes surpassing $20 trillion in recent years. Yet regulatory frameworks only began to mature in 2019, when bodies such as the Financial Action Task Force (FATF) issued formal guidance on virtual assets. As digital currencies become more integrated into global finance, businesses face growing exposure to crypto-enabled crime, including crypto scams, money laundering, and terrorist financing.

Crypto money laundering poses increasingly sophisticated threats to both regulators and financial institutions. Criminals exploit digital assets such as Bitcoin and other privacy coins to conceal illicit proceeds. By leveraging tactics like mixers, DeFi platforms, and cross-chain transfers, they obscure transaction origins and frustrate conventional due diligence methods.

Despite efforts by FATF, FinCEN, and the European Banking Authority, illicit crypto scam activity continues to rise. In 2023, the estimated value of unlawful transactions approached $24 billion. Cross-border flows and decentralised infrastructures compound the challenge of detecting and disrupting these schemes. Businesses must now take proactive steps to strengthen AML controls, mitigate risk, and meet evolving compliance obligations.

This guide outlines the mechanisms behind money laundering and explains how firms can identify red flags, respond to regulatory expectations, and implement best-in-class compliance practices.

Understanding Crypto Money Laundering

Criminals laundered an estimated $2.8 billion through crypto exchanges in 2019, and the illegal activity continues to this day. Cryptocurrency exchanges are continually used to funnel illicit funds, facilitate tax evasion, and abuse the financial system, making combating money laundering a critical priority for international legal frameworks and conventions.

To meet regulatory compliance with AML legislation, cryptocurrency platforms must adhere to Financial law enforcement agencies, such as FinCEN and the Internal Revenue Service (IRS) in America. In order to do this, exchanges must perform an AML compliance strategy, including a thorough Identity Verification (IDV), Customer Due Diligence (CDD), and ongoing monitoring, including transaction monitoring.

The Crypto Money Laundering Process Explained

Cryptocurrency money laundering is a complex and evolving process that involves the use of digital currencies to conceal the origin of illicit funds. This practice poses a significant concern for law enforcement agencies and financial institutions, as it can facilitate a wide range of criminal activities, including terrorist financing and proliferation financing.

The money laundering process typically involves three key stages: structuring, layering, and integration. Structuring, also known as smurfing, involves breaking down large transactions into smaller ones to avoid detection by regulatory authorities. Layering is the process of moving funds through multiple accounts or jurisdictions to obscure their origin, making it difficult for investigators to trace the money trail. Finally, integration involves incorporating the illicit funds into the legitimate financial system, often through investments or purchases that appear lawful.

Digital currency like Bitcoin and Ethereum have made it easier for criminals to launder money due to their high degree of anonymity and the ease with which they can be transferred across borders. However, law enforcement agencies and financial institutions are not standing idly by. They are actively combating decentralized money laundering by implementing stringent anti-money laundering (AML) regulations and leveraging advanced technologies, such as blockchain analysis, to track and detect illicit transactions. These efforts are crucial in preventing the misuse of digital currencies and protecting the integrity of the financial system.

CryptoCurrency Money Laundering Cases

These processes form the basis of a rigorous Know Your Customer (KYC) strategy, which is vital when performing ongoing AML processes. Financial intelligence units (FIUs) play a crucial role in these processes, working alongside law enforcement agencies to track and prevent illicit fund flows. KYC solutions exist to bear the burden of compliance with regulatory bodies and prevent financial crime. Part of the KYC process involves verifying the legitimacy of customers’ financial accounts to prevent the storage of illicit funds.

These illicit developments are creating an urgency for tighter AML and KYC requirements that comply with international standards, like the Bank Secrecy Act and FinCEN’s Travel Rule. For more information on the travel rule and money laundering, read The Crypto Travel Rule: The Need for AML Compliance Software.

On July 13, British police announced they had confiscated around $250 million worth of digital currency involved in an ongoing money-laundering operation. This made it one of the largest-ever crypto seizures. It followed a $160 million crypto confiscation made just three weeks prior.

Bad Actors and Crypto Scams

Compared to traditional financial institutions, cryptocurrencies are decentralized and have low barriers to entry. Their anonymous nature makes them convenient and easy to transfer across international borders, posing significant challenges to safeguarding financial systems against illicit activities.

There is good news, however. Anti-Money Laundering (AML) regulations are becoming more efficient in tackling this issue. Less than 1% of all crypto transactions today are estimated to relate to illegal activity, compared to 35% in 2012. A large part of that decrease has to do with businesses becoming compliant with AML regulations and learning how to spot money laundering crypto red flags.

Where Crypto Money Laundering Thrives

Money laundering activity is often concentrated in certain regions or countries where the regulatory environment is weak or corrupt. These areas provide a safe haven for criminals to launder their illicit funds and serve as hubs for the transfer of these funds to other parts of the world.

Several factors contribute to the concentration of money laundering activities in these regions. The lack of effective AML regulations allows criminals to operate with relative impunity. Corruption within local governments and law enforcement agencies further exacerbates the problem, creating an environment where illicit activities can thrive. Additionally, the presence of organized crime groups in these regions facilitates the laundering of money on a large scale.

Case Study: DOJ’s Record $225M Seizure in Crypto Scam Bust

In June 2025, the U.S. Department of Justice announced the seizure of over $225 million in USDT linked to an international crypto scam, the largest of its kind to date. The operation targeted more than 400 victims through a fraudulent investment scheme known as “pig butchering.” In this crypto scam model, perpetrators build fake personal relationships with victims to convince them to transfer funds to fraudulent crypto trading platforms.

The laundered funds moved through a complex network of wallets and exchange accounts, primarily involving OKX and Tether. U.S. law enforcement agencies, including the FBI, IRS, and Secret Service, executed the seizure using advanced blockchain analytics to trace the transactions and identify the illicit flow of funds.

This case illustrates how criminals leverage stablecoins and digital currency exchanges to bypass traditional financial safeguards. It also reinforces the importance of implementing transaction monitoring, wallet screening, and suspicious activity or crypto scam detection. For regulated entities, the investigation highlights the scale of modern crypto-enabled fraud and the need for proactive AML compliance measures for crypto scams.

Non-compliant crypto exchanges also play a significant role in this concentration. These exchanges can act as conduits for illicit funds, allowing criminals to convert their illegally gained money into digital currencies and integrate it into the legitimate financial system. By exploiting these weak points in the global financial system, money launderers can continue their operations with minimal risk of detection.

AML Policies and Regulations for Crypto Platforms

To determine if your business is affected, check whether your country has implemented FATF recommendations into national law. This often includes specific obligations under Virtual Asset Service Provider (VASP) regimes, such as registration, KYC enforcement, and ongoing reporting. Even if you’re based outside a FATF jurisdiction, local laws may still apply based on where your users or transactions originate. Ignoring these requirements can expose your business to regulatory action across borders.

Sophisticated Crypto Money Laundering Techniques

Modern money laundering operations increasingly rely on advanced, multi-layered tactics that obscure the origin of illicit funds. Criminals use shell companies, nested accounts, and trusts to create complex transactional structures. These financial instruments serve as intermediaries, allowing launderers to distance themselves from the source of the funds while appearing to operate within legitimate business channels.

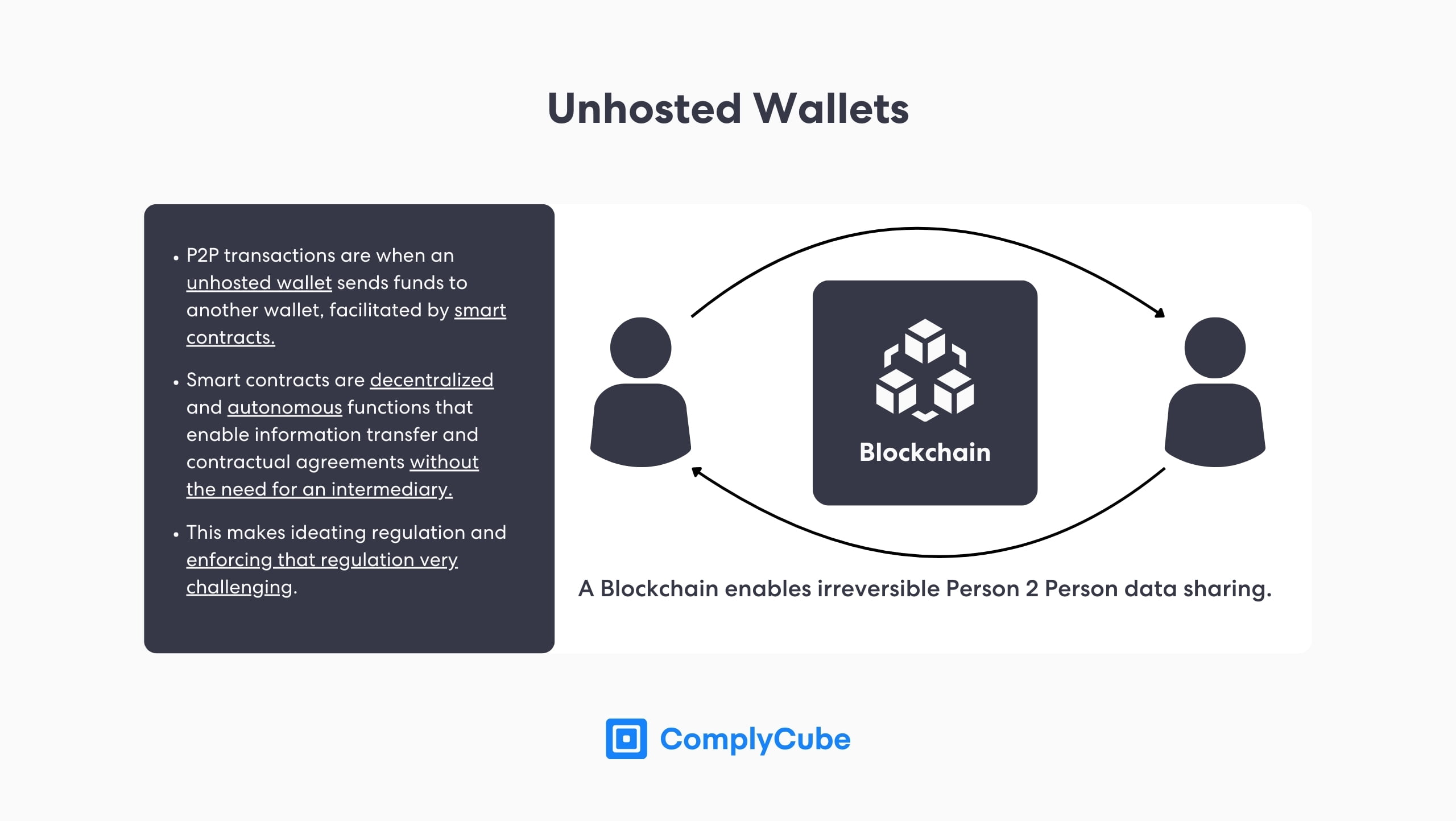

In addition to these legal entities, money launderers often employ anonymization technologies such as encryption tools, privacy-focused wallets, and proxy servers to conceal their identities. The emergence of Decentralised Finance (DeFi) platforms has further enabled illicit actors to bypass centralised controls. By using smart contracts and peer-to-peer exchanges without KYC requirements, criminals can circulate funds with minimal traceability.

Criminals now exploit tools and tactics that overwhelm legacy compliance systems. These include cross-chain transactions, anonymization services, and non-custodial DeFi platforms. Traditional AML frameworks, which were built for traceable, account-based finance, often fail to keep pace with the pseudonymous and borderless nature of crypto scams. According to Joshua Dent, Business Manager at ComplyCube, effective crypto compliance requires more than robust onboarding. It demands continuous, intelligent monitoring that can adapt to laundering methods across asset types, jurisdictions, and blockchain protocols.

Effective crypto compliance requires more than robust onboarding

To further mask illicit flows, bad actors may employ a combination of false invoicing, manipulated receipts, and rapid fund movement across multiple currencies and jurisdictions. Funds may be layered across mixers, converted into privacy coins, or routed through crypto ATMs with limited oversight. These techniques make traditional transaction monitoring insufficient without enhancements like behavioural analytics, cross-chain intelligence, and continuous risk scoring.

Understanding these evolving methods is critical for compliance teams seeking to adapt their AML frameworks. Only by embracing dynamic, AI-driven tools and a risk-based approach can businesses stay ahead of laundering tactics that continue to evolve in both scale and sophistication.

Crypto Money Laundering Red Flags to Watch For

Criminals are increasingly exploiting cryptocurrency platforms to launder illicit funds by bypassing traditional financial safeguards. The FATF’s 2024–2025 updates confirm that regulatory enforcement remains uneven, and that virtual asset platforms are regularly misused for layering, anonymity, and cross-border obfuscation.

The following indicators are commonly associated with crypto-enabled money laundering:

1. Unusual transaction patterns

Frequent transfers, large round-number values, and transactions just below reporting thresholds may indicate structuring or layering activity.

2. Geographical exposure

Transactions involving high-risk or non-compliant jurisdictions increase the likelihood of regulatory evasion. FATF grey-listed and blacklisted regions are key risk areas.

3. Suspicious or inconsistent identity data

Frequent updates to user details, use of unverifiable documents, or mismatches across KYC records suggest potential identity fraud or synthetic identity use.

4. Anonymity-enhancing techniques

Tools such as mixers, tumblers, privacy coins, and peer-to-peer platforms are used to obscure asset origins and ownership.

5. Unverifiable source of funds

Inability or refusal to explain the origin of crypto assets, especially across DeFi protocols or layered wallets, may indicate illicit activity.

6. Wallet and platform behaviour anomalies

Indicators include sudden switching between custodial and non-custodial wallets, use of obfuscated wallet addresses, and inconsistent wallet activity.

Unusual Transaction Patterns

Irregular patterns relating to the size, frequency, or type of transactions may be red flags pointing to crypto scams or money laundering activity, including:

- Customers making several high-value transfers within a short amount of time, such as a 24-hr period

- Structuring transaction amounts to fall below reporting thresholds

- Depositing funds into accounts with previously identified stolen currency

- Transferring crypto to service providers located in areas with low regulation standards

- Frequent large-value transfers from multiple accounts into a single account

- Immediate withdrawal of deposits without any transaction history, especially when large sums are emptied from newly opened accounts.

- Converting deposits into numerous currencies with a high amount of incurred fees, even exchanging at a loss

- Converting substantial sums of fiat currency into crypto without a reasonable business premise

Geographical Risks

Criminals involved in money laundering exploit countries with weak regulations involving digital assets. So be on the lookout for:

- Funds are transferred to exchanges or service providers located in regions with inadequate or non-existent AML regulations

- Customers sending or receive funds from exchanges located in other countries than the one the customer lives or operates in

- Customers that establish business addresses in countries that do not have Suspicious Activity Reports up to FATF standards

Anonymity Used to Launder Money

Cryptocurrency uses advanced technology to ensure that users and exchanges are secure from data breaches. Illicit actors often exploit cross-chain bridges for money laundering purposes, transferring and converting illicit funds across various blockchains. However, this also makes it difficult for regulators to detect crypto scams, fraudulent activity or which cryptocurrency transactions might contain illicit funds. Still, there are red-flag indicators that can lead investigators in the right direction:

- Customers who move funds from public blockchains to exchanges where the funds are immediately converted into privacy coins.

- Unlicensed customers who act as service providers.

- Users who regularly conduct high-value transactions on peer-to-peer (P2P) crypto exchanges, especially unlicensed ones.

- Frequent or high-volume transactions on platforms that offer crypto mixing services to disguise the origin of the funds.

- Customers who frequently conduct high-value transactions on platforms that fail to comply with international standards of know-your-customer (KYC) or customer due diligence (CDD) procedures.

- Multiple transactions involving crypto ATMs, often located in areas with known financial crime risks.

- Usage of proxies or other services intended to disguise IP addresses and domain names when registering for an exchange.

Suspicious User Behaviour and Illicit Actors

Businesses should intercept customers with insufficient or forged identification documents at the KYC stage. In addition, there are different types of suspicious behavior that companies should mark as money laundering activities and red flags:

- Transactions originating from untrustworthy IP addresses or domains that differ from the country the customer operates or resides in.

- Multiple crypto wallets that are controlled by the same IP address.

- Regular use of cryptocurrencies linked to fraudulent behaviour or Ponzi schemes.

- Customers who often change their contact and identification information.

- Customers using multiple IP addresses to conduct transactions or access crypto platforms.

- Customers who often transact with the same senders or receivers, resulting in significant gains or losses, could be flagged as illicit addresses.

- Senders who do not possess a working understanding of decentralized money (including but not limited to the elderly) yet still conduct regular or high-value transactions.

- Customers making substantial digital currency purchases beyond their established financial means.

Source of Funds

Funding sources can identify many money-laundering operations. For example, any of the following should raise a red flag:

- Funds involving accounts linked to known illicit actors and illegitimate operations such as fraud, ransomware, extortion, darknet markets, or illegal gambling sites.

- Crypto wallets connected to several credit cards that withdraw sizeable sums of fiat currency.

- Funds sourced from initial coin offerings (ICOs) that may be fraudulent, third-party mixing services, or platforms that do not comply with AML standards.

- Substantial deposits that are converted directly into privacy coins or withdrawn into a different fiat currency.

Key Takeaways

- Crypto money laundering exploits anonymity, cross-border transfers, and regulatory blind spots to conceal illicit funds.

- Common red flags include structured transactions, high-risk geographies, use of mixers or privacy coins, and inconsistent customer behaviour.

- Regulators such as FATF and FinCEN require crypto platforms to implement robust AML measures, including KYC, CDD, and transaction monitoring.

- Sophisticated crypto money laundering methods like chain-hopping and DeFi misuse require dynamic, intelligent compliance systems.

- ComplyCube provides AI-driven tools to help businesses detect risk, automate workflows, and stay aligned with global regulatory standards.

Implementing AML Controls in Crypto Businesses

Recognizing the red flags associated with crypto money laundering is only the first step. To effectively mitigate risk, digital currency platforms must implement a comprehensive, risk-based AML framework that aligns with international standards such as those set by the Financial Action Task Force (FATF).

An effective compliance program should include:

Customer Due Diligence (CDD): Risk-based identity verification to assess customer profiles and assign appropriate risk levels.

Sanctions and PEP Screening: Real-time screening against global sanctions lists and politically exposed persons databases.

Adverse Media Monitoring: Continuous scanning for negative news involving customers or entities linked to financial crime.

Suspicious Behaviour Detection: AI-driven systems to flag transactional anomalies and detect laundering patterns in real time.

Biometric Authentication: Use of facial recognition and liveness detection to prevent impersonation and synthetic identity fraud.

Phonetic and Linguistic Screening: Advanced name-matching technologies to account for transliterations, aliases, and regional variants in global KYC data.

ComplyCube’s SaaS platform enables crypto businesses to automate these compliance measures through flexible APIs, low-code tools, and dynamic risk scoring. With the continued expansion of the crypto market, the threat landscape will only become more complex. Adopting a scalable, intelligent KYC and AML infrastructure is essential not just for regulatory alignment, but for securing long-term business viability.

Frequently Asked Questions

What is crypto money laundering?

Crypto money laundering is the process of using digital currencies like Bitcoin to conceal the origin of illicit funds. Criminals exploit blockchain anonymity to move funds through multiple accounts, exchanges, or privacy tools to integrate illegal proceeds into the legitimate financial system.

What are common red flags in crypto money laundering?

Red flags with crypto scams include frequent high-value transfers, structuring transactions to avoid reporting thresholds, use of mixing services, anonymity-enhancing tools, and transfers to or from high-risk jurisdictions. Businesses should also monitor accounts with no transaction history but sudden large deposits or withdrawals.

How can crypto businesses stay compliant with AML regulations?

Crypto platforms must implement Know Your Customer (KYC) processes, Customer Due Diligence (CDD), transaction monitoring, and sanctions screening. Compliance also includes aligning with FATF recommendations and local laws such as the Bank Secrecy Act or the EU’s AMLD.

Why is KYC important in preventing crypto scams?

KYC helps verify the identity of users and prevents stolen or synthetic identities from accessing the platform. It acts as a first line of defense against crypto scams and money laundering, reducing the risk of onboarding bad actors.

What role does ComplyCube play in preventing crypto money laundering and crypto scams?

ComplyCube provides AML and KYC tools including biometric checks, real-time monitoring, and AI-driven risk detection. Its platform supports crypto businesses in automating compliance workflows and identifying suspicious behaviour early.