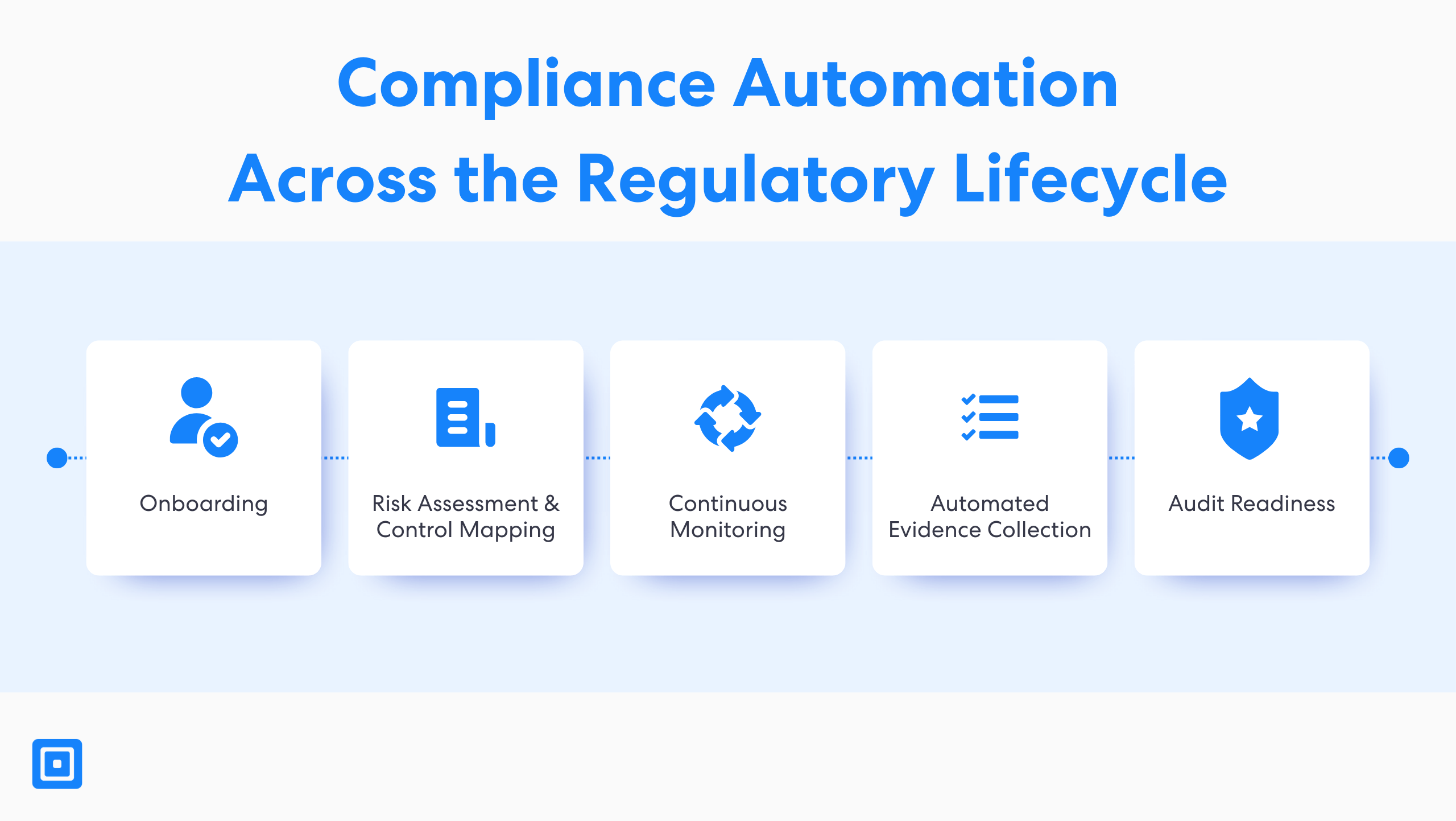

TL;DR: Compliance automation software is a strategic asset. By adopting compliance automation tools, companies reduce manual efforts, accelerate onboarding, and ensure consistent, risk-aligned decisions. The ROI of automated regulatory compliance is around better agility, lower fraud, and faster growth driven by smart compliance automation systems.

What is Compliance Automation Software?

For many organisations, regulatory compliance and compliance related tasks have long been treated as a necessary cost of doing business. However, that mindset is changing fast. For example, compliance frameworks are helping financial services, fintechs, and digital-first businesses scale securely and cost-effectively. With AI-powered tools, companies are transforming their governance, risk, and compliance (GRC) operations. They are turning compliance from a back-office function into a driver of strategic initiatives and faster market entry.

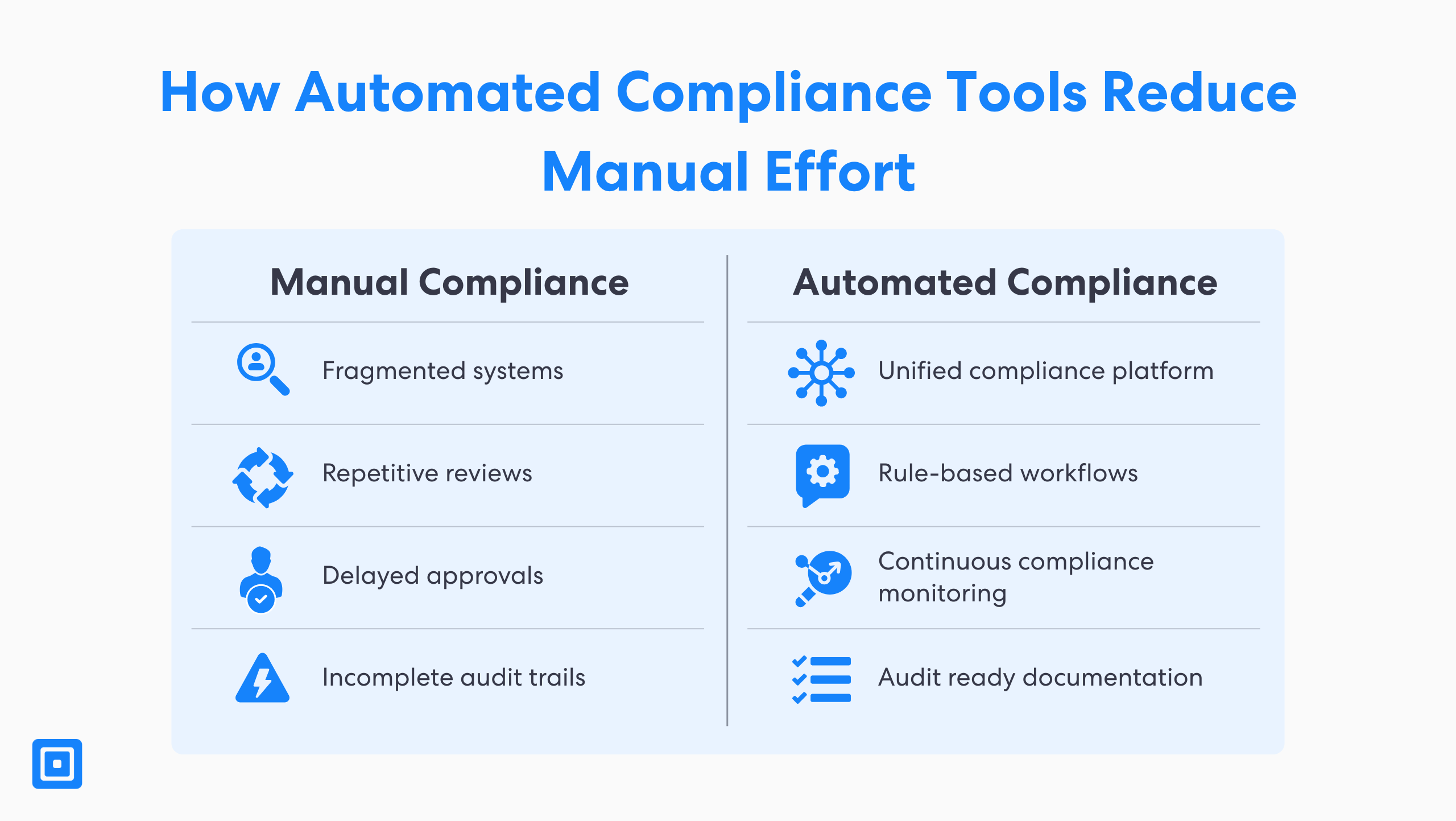

As global expectations grow, firms are recognising the power of automating key compliance requirement processes. Such processes as Know Your Customer (KYC), Anti-Money Laundering (AML), and broader risk-based compliance workflows. Manual compliance management has become too slow, costly, and inconsistent to keep up with changing regulations.

Conversely, automated tools streamline monitoring, risk assessments, and audit preparation. Generally speaking, compliance tools now focus on delivering real, measurable ROI while reducing regulatory exposure. This supports long-term compliance readiness keeping up with industry regulations.

Automated Compliance Software is No Longer Optional

At the present time, in the UK and EU, compliance teams are under pressure to keep up with fast-changing regulations across multiple compliance frameworks. These include the Fifth Anti-Money Laundering Directive (5AMLD), General Data Protection Regulation (GDPR), and eIDAS. Given these points, manual compliance processes with repetitive tasks often fall short of keeping in line with changes. This is especially prevalent as businesses face a growing number of overlapping rules and reporting obligations.

Automated compliance software is no longer optional.

“Automated compliance software is no longer optional. We’ve reached a point where the pace, scale, and complexity of regulatory change can’t be managed manually. What used to be a periodic review cycle is now a continuous obligation. Automation gives compliance teams the visibility, control, and consistency they need to meet these expectations without slowing down growth or draining internal resources.” says Solutions Consultant, Milosh Caunhye.

Automated compliance tools help organisations manage these challenges more efficiently. They reduce manual intervention or effort, improve regulatory adherence, and support multiple frameworks at once. By automating decision-making, monitoring, and reporting, teams can adapt more easily to regional differences and shifting requirements. These tools also help prove compliance by clearly tracking and demonstrating compliance status to regulators, stakeholders, and customers.

How Automated Compliance Tools Improve Audit Readiness

Automated compliance tools are vital for organisations that want to scale without adding headcount. They support high-volume onboarding, reduce human error, and make compliance monitoring more efficient. These tools also enable smarter, risk-based decision-making by automating workflows and applying consistent policy rules.

Therefore, automation takes care of repetitive and routine compliance tasks, freeing teams to focus on more strategic work such as investigating risks or data breaches. Unlike manual processes, which are time-consuming and prone to error, automation streamlines workflows for better accuracy and speed. Many compliance automation tools also include built-in policy templates and rule libraries, helping teams save time when creating documentation.

Compliance Automation Platforms for Global Growth

Digital-first organisations often face fragmented compliance activities across jurisdictions. Without unified systems, tracking compliance status becomes difficult and incomplete. A thorough compliance automation platform consolidates these activities. It offers central dashboards, control visibility, and automated evidence collection for clean audit trails across multiple compliance frameworks.

Modern compliance platforms integrate with cloud services to support real-time data collection and monitoring. Tools such as ComplyCube offer built-in automation that gives teams instant visibility into compliance tasks and status. Features such as continuous controls monitoring replace manual checks with standardised, automated oversight. This ensures nothing gets missed.

Enhancing the Audit Ready Documentation Process

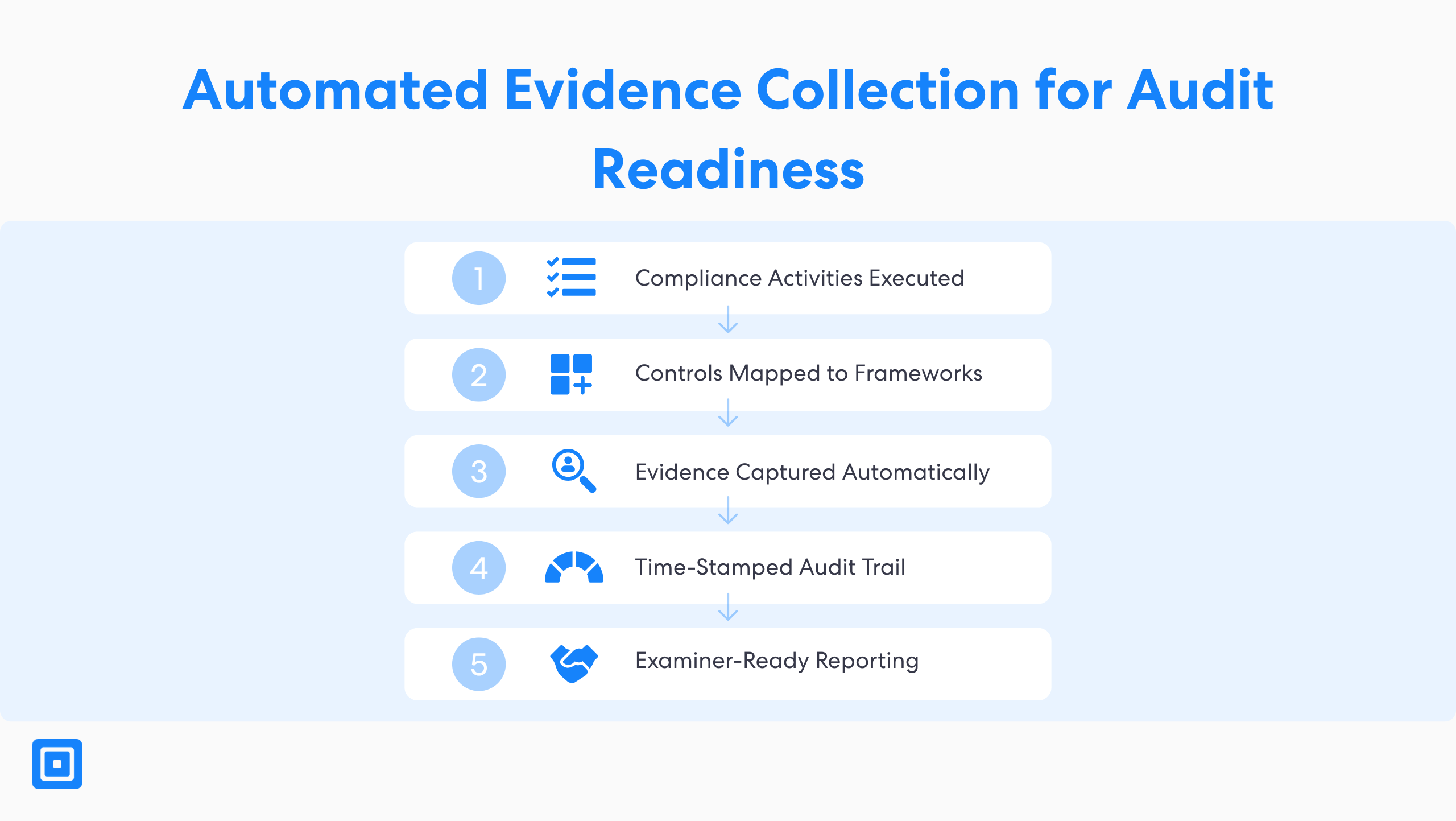

When preparing for audits, firms must ensure transparency, consistency, and timely delivery of evidence. Automated compliance software makes this easier by tagging evidence, flagging high-risk cases, and mapping controls to the right frameworks. This reduces the need for manual review and allows teams to focus on more strategic work.

Most compliance automation tools offer features for audit preparation, such as evidence collection and control mapping, but some may lack advanced capabilities to handle complex compliance scenarios or seamless integration with other systems. With built-in control mapping and the ability to map controls across systems, teams can swiftly respond to audit findings and demonstrate defensible security controls.

Streamlining Operations with Compliance Automation Software

Modern compliance automation tools are designed with role-based access controls, ensuring that only authorized personnel can access, edit, or manage sensitive compliance data and documentation. This granular approach to access management is essential for safeguarding compliance efforts, as it minimizes the risk of data breaches and unauthorized changes to critical compliance records.

For the most part, by assigning specific roles and permissions, organizations can streamline compliance operations. It allows compliance teams to focus on their designated tasks while reducing manual effort and the potential for human error. Additionally, role-based access not only enhances audit readiness by maintaining clear records of who accessed or modified compliance documentation.

Furthermore, role-based access also helps mitigate risks associated with accidental or intentional data exposure. Ultimately, this feature empowers organizations to manage compliance more efficiently and securely, supporting a culture of accountability and collaboration across compliance teams.

Navigating Multiple Regulatory Environments in the Audit Process

With the regulatory landscape is constantly evolving, with organizations often needing to comply with multiple frameworks such as SOC 2, ISO 27001, HIPAA, and GDPR. Of course then, the right compliance automation software will be built for adaptability, enabling businesses to seamlessly navigate various regulatory frameworks without increasing manual effort. These compliance automation tools allow organizations to map controls across different standards, automate evidence collection, and maintain continuous compliance regardless of jurisdiction.

In other words, by supporting multiple frameworks, automation software simplifies compliance processes. It reduces the complexity of managing diverse regulatory requirements, and strengthens overall compliance posture. This adaptability ensures that organizations can demonstrate compliance with confidence, efficiently manage evidence collection, and stay audit-ready across all relevant frameworks, including SOC 2, ISO 27001 and other industry standards.

Turning Compliance Automation Data into Strategic Advantage

Today, compliance automation tools do more than just streamline compliance processes. They transform compliance data into actionable insights that drive strategic decision-making. With advanced reporting capabilities, compliance teams gain real-time visibility into compliance status, enabling them to proactively address gaps and optimize compliance management.

Automated reporting features make it easy to generate audit ready documentation, demonstrate compliance to regulators and stakeholders, and maintain ongoing compliance management across the organization. By leveraging these insights, organizations can continuously improve their compliance programs, respond swiftly to new regulatory requirements, and turn compliance management into a source of competitive advantage.

ROI of Compliance Automation Software

Consequently, ROI from automation software isn’t just about reducing labour costs. Automation reduces time to onboard, flags fraud faster, and supports continuous compliance via perpetual checks. When calculating ROI, it’s important to consider the cost of compliance automation tools.

In that case, the cost of compliance automation tools varies widely based on features, organizational size, and the number of users. Additionally, successful compliance automation implementation requires clear ownership of the project within the organization. As regulatory environments evolve, firms using automation can pivot quickly without reengineering manual flows, minimising disruption and maximising responsiveness.

A New Growth Lever: Automating Compliance to Drive Revenue

N companies that automate compliance don’t just manage compliance, they monetise efficiency. Rapid onboarding boosts customer conversion, while adaptive flows lower churn in high-friction industries. Organisations using advanced compliance automation report reduced SLA violations, improved client trust, and a proactive stance in mitigating risks.

Generally speaking, automation also enhances security practices. It helps protect sensitive data, ensuring regulatory requirements are met and confidential information is safeguarded.

Case study: Healthcare Compliance Automation For Audit Preparation

Outdated, manual compliance in regional healthcare system

A regional healthcare system serving over 2 million patients and operating more than 15 facilities struggled with outdated, manual compliance procedures in the face of growing regulatory demands.

Overcoming fragmented systems across cloud and on-premises environments

Under those circumstances, the system implemented a compliance automation solution to integrate with existing systems and break down silos. The technology combined automated compliance checks, policy mapping, role‑based access control, real‑time monitoring, and automated reporting pipelines.

Continuous compliance operations with proactive alerting

- Reduced audit preparation time by approximately 70 %, cutting weeks from manual workflows

- Achieved 100 % compliance coverage with continuous monitoring across facilities

- Freed 20 + hours per month of staff time previously spent on documentation

- Scaled compliance support for a 10× growth in data volume without adding overhead

Real-Time Regulatory Tracking with Compliance Automation

Staying compliant in a dynamic regulatory environment requires constant vigilance. Compliance automation tools equipped with real-time regulatory tracking empower organizations to monitor updates to regulatory frameworks and compliance requirements as they happen. As a result, this capability enables compliance teams to quickly adapt their compliance programs, maintain continuous compliance, and ensure audit readiness even as regulations evolve.

Therefore, by proactively tracking regulatory changes, organizations can reduce the risk of compliance violations. They can strengthen their compliance posture, and demonstrate a commitment to regulatory requirements. Real-time regulatory tracking is a critical feature for organizations seeking to stay ahead of compliance challenges and maintain robust compliance programs across multiple regulatory frameworks.

No-Code Compliance Automation Software & Audit Preparation

Audit readiness depends on accurate data, clean processes, and defensible logic. No-code flows let compliance teams configure audit preparation processes directly, cutting time-to-resolution and ensuring security and compliance. ComplyCube’s no-code orchestration allows teams to escalate reviews, document exceptions, and enable workflows without developer input.

This level of flexibility makes it easier to adjust to changing audit requirements or internal policy updates. Teams can quickly adapt controls, update decision paths, and maintain audit-ready documentation without needing to engage engineering. This empowers compliance teams to work faster and stay in control, even as regulations evolve. You can learn more about no-code workflows here: Simplify AML with No-Code Compliance Workflow Software

Ease of Adoption of Compliance Automation Software

The effectiveness of compliance automation hinges on how quickly and easily organizations can implement and start using the software. The right compliance automation tools are designed for rapid adoption, featuring intuitive interfaces and straightforward workflows that minimize the learning curve. This ease of adoption allows organizations to accelerate their time to value, quickly streamlining compliance processes and improving compliance posture without the need for extensive training or technical expertise.

Automated compliance management becomes accessible to teams of all sizes, enabling them to reduce manual effort, enhance compliance management, and lower the risk of non-compliance from day one. By choosing compliance automation software that prioritizes user experience, organizations can unlock the full benefits of automation and maintain a strong, proactive approach to regulatory compliance.

Key Takeaways

- Compliance automation software turns regulatory tasks into business enablers.

- Automated compliance tools reduce manual review and support consistent decisioning.

- Automated evidence collection streamlines audits across multiple frameworks.

- Continuous compliance monitoring improves audit readiness and risk management.

- A central compliance automation platform enables secure, scalable compliance workflows.

Compliance Automation Software at ComplyCube

Today, ComplyCube is purpose-built to streamline and scale your compliance automation efforts. Whether you’re managing KYC, AML, or internal compliance controls, ComplyCube’s platform centralises and automates the entire process. It reduces manual effort, improving consistency, and enabling faster, audit-ready outcomes.

That is to say, with no-code workflow orchestration, real-time sanctions screening, and automated evidence collection, ComplyCube empowers compliance teams to manage complex requirements across multiple frameworks. The solution supports control mapping, dynamic decisioning, and continuous compliance monitoring. It gives teams full oversight and defensible audit trails without engineering dependencies.

In summary, if you’re looking to reduce compliance costs, accelerate onboarding, and ensure perpetual audit readiness, ComplyCube offers the tools to automate with confidence. Talk to our compliance experts to enhance your customer due diligence workflows.

Frequently Asked Questions

What is compliance automation software?

Today, compliance automation software streamlines regulatory operations by using AI, analytics, and rule-based workflows to replace manual effort in tasks such as onboarding, monitoring, and audit documentation. It helps organisations maintain continuous compliance, reduce risk exposure, and scale regulatory processes efficiently.

How do compliance automation tools assist with regulatory adherence?

Compliance automation tools improve regulatory adherence by standardising compliance activities across teams and jurisdictions. They reduce human error, apply risk-based logic in real time, and enforce policies consistently, especially across complex and changing frameworks such as the FCA Handbook, GDPR, or eIDAS.

What does automated evidence collection involve?

Automated evidence collection refers to the real-time capture and organisation of compliance evidence, such as ID document checks, decision logs, control status, and user actions, throughout the compliance process. This ensures complete, time-stamped audit trails and improves both internal reviews and third-party audits.

How can businesses manage compliance across multiple frameworks?

Firms can manage compliance across multiple frameworks by implementing a centralised platform with built-in control mapping, flexible workflows, and configurable compliance rules. As a result, this enables teams to scale their compliance programs globally while maintaining consistency, audit readiness, and local regulatory alignment.

How does ComplyCube help automate compliance?

ComplyCube supports automating compliance through its unified platform offering real-time screening, biometric verification, no-code policy orchestration, and automated evidence collection. With support for IDV, AML, KYB, and continuous monitoring, it helps businesses stay ahead of audits while reducing costs and manual effort.