TL;DR: As regulations evolve, businesses must implement robust compliance programs without slowing operational growth. As such, banking AML compliance workflow software is becoming essential, enabling firms to stay compliant while maintaining agility. This guide explores how no-code workflows help reshape and modernize compliance for today’s teams.

What is Low/No-Code Compliance Workflow Software?

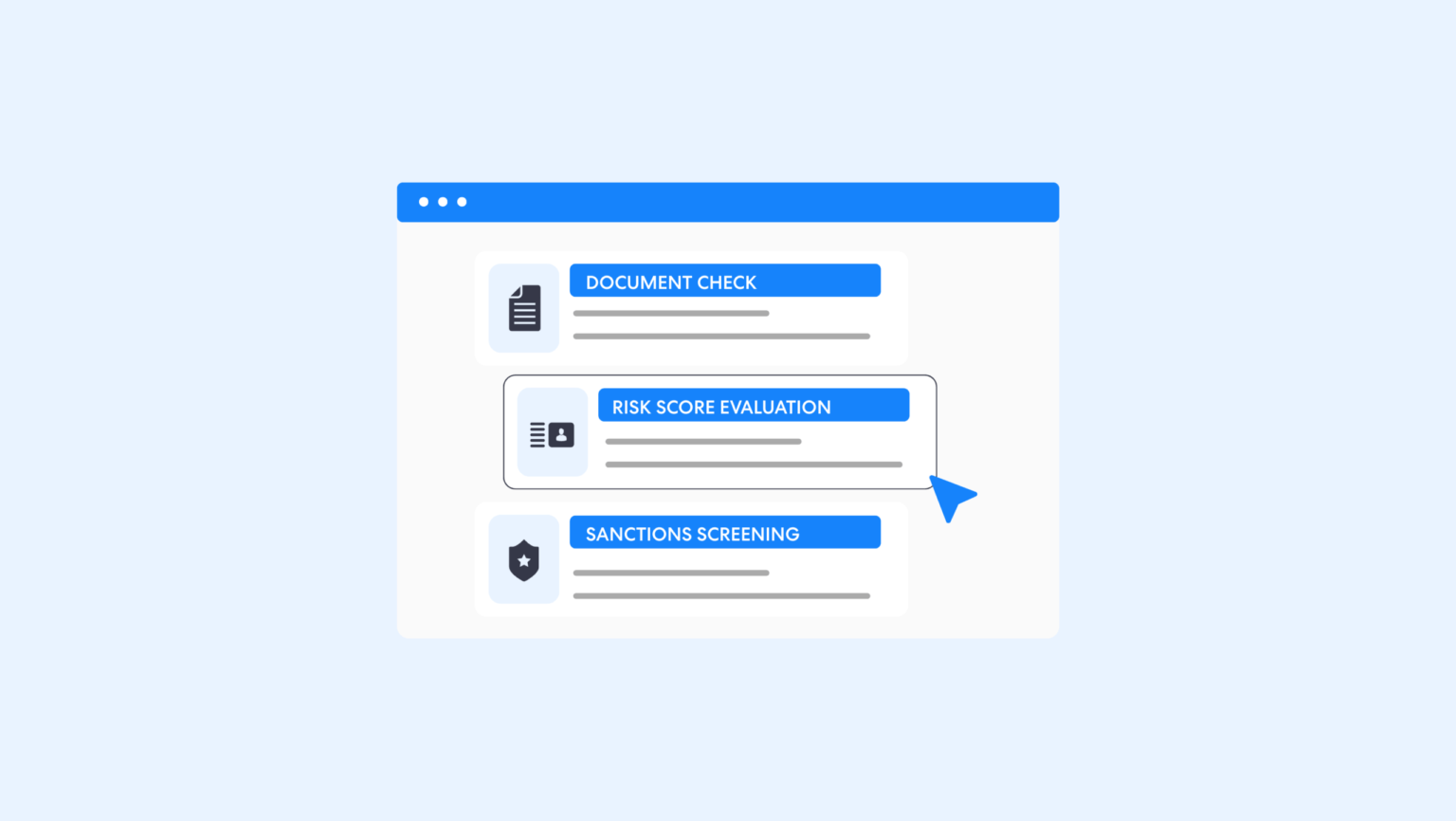

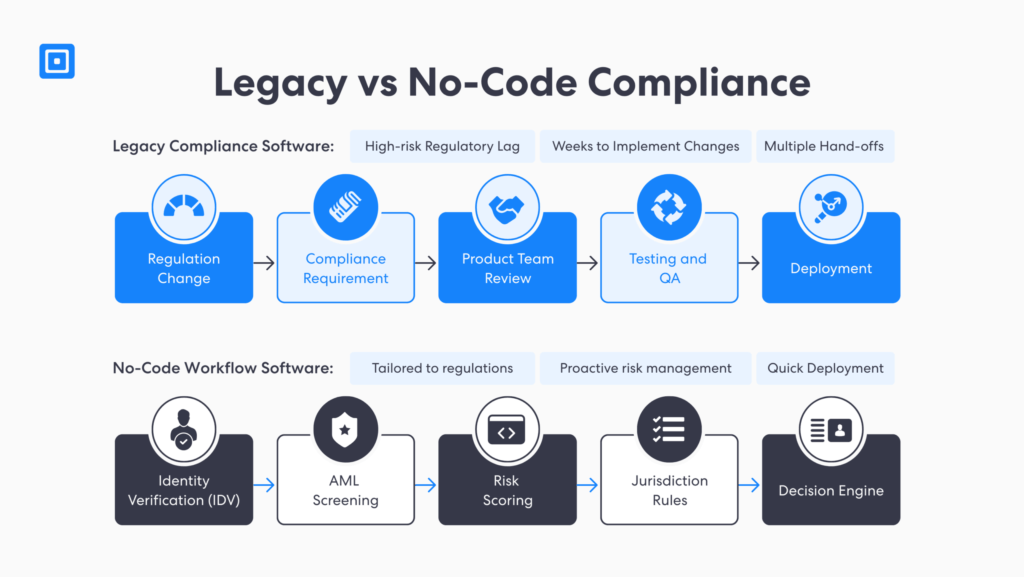

Unlike legacy systems, low or no-code compliance workflow software works by using visual drag-and-drop interfaces instead of custom coding. Compliance professionals can efficiently adapt regulations by layering the relevant checks without requiring advanced coding knowledge. As such, compliance teams remain more agile in responding to changing regulatory requirements.

Staying current with regulatory changes is a near-constant responsibility for compliance professionals.

According to Thomson Reuters, senior management is faced with the responsibility of paying closer attention to every aspect of compliance. This is because regulatory authorities are demanding more data, reporting, and transparency as quickly as possible, or even in real time. With no-code automated workflows, regulatory demands can be iterated rapidly without dependency on IT teams.

The Operational Challenge Facing Modern Compliance Teams

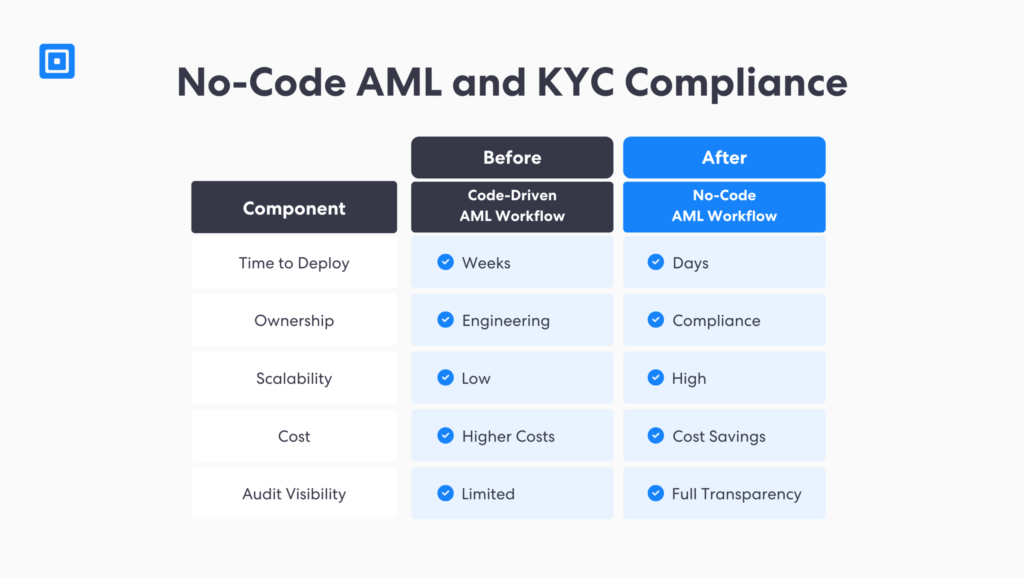

Legacy Anti-Money Laundering (AML) and Know Your Customer (KYC) software are constrained by manual processes, which restricts operational flow between product, engineering, and risk management teams. Additionally, manual tasks in code-driven compliance models include embedding compliance logic directly into application code, thus making changing regulations costly and complex to implement.

This challenge becomes more complicated as business operations grow across different jurisdictions. Each country operates on varying regulatory reporting, customer due diligence procedures, and audit protocols. Updating one workflow can take several weeks of developing, testing, and deployment. Therefore, businesses are forced to operate reactively rather than proactively in risk assessment. No-code compliance workflow software addresses this challenge by separating compliance logic from application code.

Applying No-Code Workflows Across KYC and AML Compliance Programs

Effective KYC and AML compliance programs are essential for combating money laundering, terrorist financing, and other financial crimes. Regulations such as the US Bank Secrecy Act (BSA) and the EU’s 6th Anti-Money Laundering Directive (6EUAMLD) require firms to maintain high standards in AML and KYC procedures throughout the customer lifecycle. Entities must apply strong customer due diligence measures, including identifying and verifying customers and beneficial owners, and conduct ongoing monitoring of the business relationship.

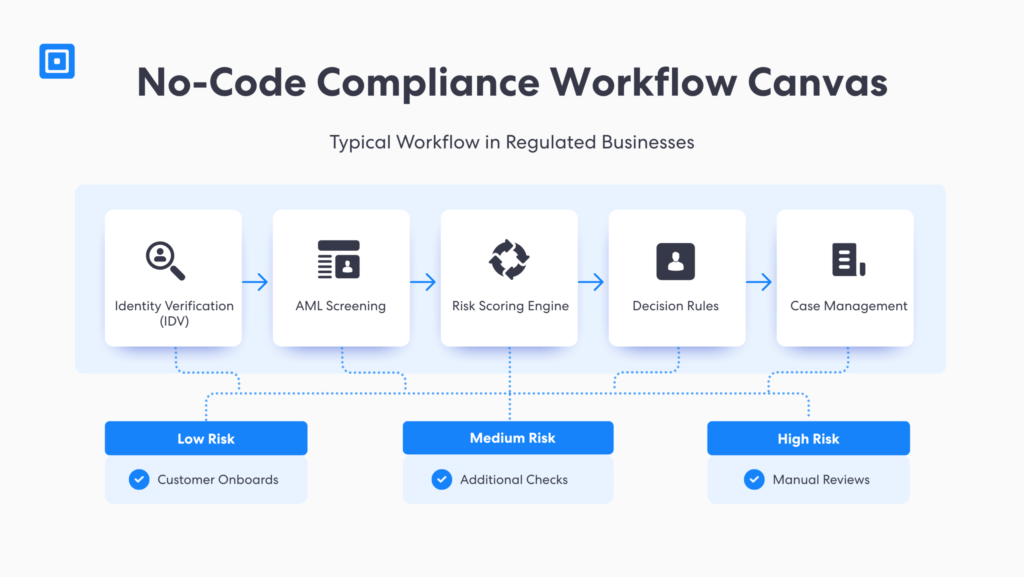

No-code orchestration is most effective when applied across the entire KYC lifecycle.

As such, no-code workflows are most effective when applied from the initial onboarding stage through to customer retention. For example, low-risk customers can go through standard customer due diligence with minimal friction through document verification. According to Harry V, Chief Product Officer at ComplyCube, “No-code orchestration is most effective when applied across the entire KYC lifecycle, rather than isolated onboarding steps”.

For high-risk users, workflows must trigger enhanced verification, including Politically Exposed Person (PEP) screening, adverse media checks, and watchlist screening, to identify suspicious activity early. These paths and triggers are built directly within a compliance workflow software rather than embedded in application logic. Financial institutions can remain flexible while consistently ensuring compliance throughout the organization.

What No-Code Compliance Workflow Automation Enables

No-code compliance workflows empower non-technical compliance professionals to visually design, automate, and execute effective KYC and AML programs without writing a single line of code. With automation, compliance teams can maintain greater control over internal processes, such as auditing and data management, with simple, repeatable steps. Implementing compliance workflow automation enables businesses to tap into a large number of benefits:

- Reduces manual work: Automation replaces repetitive compliance efforts, including manual data entry and reporting. Less time will be spent by labor on compliance tasks, forcing efforts to be placed on higher-risk scenarios.

- Eliminates human errors: Compliance workflow automation ensures consistency across an organization, encompassing policies, approvals, and access controls. This improves accuracy by eliminating the potential risk of human error.

- Adapt to evolving compliance regulations: As regulations or company policies change, compliance and engineering teams must stay agile. Automation streamlines updates to workflows, eliminating lengthy testing and deployment cycles.

- Lowers costs: Since workflow automation increases the speed of execution without requiring large IT resources, costs are dramatically reduced. Additionally, with increased accuracy, firms can avoid costly penalties from non-compliance.

While modern compliance workflow software utilize automation, managing them with guardrails is crucial to avoid costly mistakes. Due to the ease of implementation, automation may pose several challenges, including duplicate workflows from multiple team members and a loss of visibility over individual changes. For successful implementation, senior team member oversight and internal controls remain critical. You can learn more here: 5 Critical Errors to Dodge in AML Software Implementation

Case Study: Building Security and Agility While Maximizing Global Growth

The Complexity of Compliance in Global Jurisdictions

Bots, the leading trailblazer in global blockchain innovation, aimed to expand its operations worldwide. However, the large volume verification and cross-border operations presented a key challenge: ensuring complete adherence to AML and identity verification regulatory requirements in different countries.

The Need for Speed, Compliance, and Agile Operations

High-volume cross-border compliance often forces companies to choose between speed and security. Bots, however, sought to achieve both. The firm partnered with ComplyCube to sustain its rapid expansion. With automated no/low-code workflows, Bots was able to streamline AML screening, address checks, and biometric verification on one platform without heavy IT resources.

Solutions & Outcomes

Bots were able to onboard 98% of customers in under 30 seconds through automated AML and KYC checks.

The company scaled its operations to over 34 countries confidently, utilizing ready-made, customizable workflow templates.

ComplyCube was able to deliver layered verification tailored to sector- and country-specific risks, supporting both KYC and AML compliance.

Governance, Access Controls, and Risk Management in No-Code Models

The most common misconception is that no-code workflows reduce governance. This misconception arises from the perception that no-code software leads to a loss of transparency on who made changes, when, and why. In reality, modern no-code platforms enhance oversight for each team member by implementing role-based permissions and maintaining real-time internal auditing logs.

Role-based access control ensures that only authorized staff can modify workflows. Additionally, audit logs provide a record of changes and actions made to workflow versions, thereby enhancing transparency. These features streamline document management, data collection, and audit preparation. Thus, compliance teams can own policy execution and meet regulatory compliance requirements without compromising security or control.

Why No-Code Is Becoming Crucial for Tech-Led Compliance Operations

The move towards no-code software highlights the shift towards how regulated technology teams operate. Speed and cross-functional agility are becoming crucial in a compliance journey, moving away from merely optional choices. The evolution from code-dependent compliance to no-code, policy-driven workflows enables organizations to:

- Accelerate compliance: No-code workflows enable faster data gathering, development, and deployment of workflows in accordance with evolving KYC and AML operations.

- Reduce operational bottlenecks: Dependence on technical coding knowledge is eliminated, placing higher ownership on risk assessment teams over the compliance funnel.

- Enhance compliance status visibility: Centralized dashboards, audits, and reporting are recorded in real-time, increasing transparency over compliance status.

- Enable consistency: Automated no-code frameworks support firms in achieving uniform enforcement of policies across products and systems.

For technology-led businesses, this model turns compliance from a bottleneck into an enabler of trust and growth. As regulatory scrutiny increases, workflows arise as a way for organizations to adapt to cross-border, changing regulatory requirements without introducing operational risk.

Key Takeaways

Automating compliance workflows reduces costs and improves accuracy by eliminating manual errors and tasks.

No-code compliance workflow models enhance agility throughout the KYC process, facilitating alignment with evolving regulations.

Role-based access and audit logs are key components of modern workflows, strengthening security and transparency in compliance frameworks.

Effective AML compliance programs can be achieved without heavy IT knowledge using drag-and-drop, no-code workflow interfaces.

Common compliance issues in no-code software can include weakened governance, loss of transparency, and security vulnerabilities.

Implement Compliance Workflow Automation Effectively

No-code orchestration in compliance processes offers multiple advantages. With reduced costs and increased accuracy, no-code workflows are becoming the standard operating model for many businesses, streamlining key business processes while meeting the requirements of external auditors. Additionally, compliance automation in no or low-code software enables faster responses to evolving regulatory standards and stronger governance across KYC and AML procedures. Businesses can maintain compliance while strengthening their financial system’s defenses.

Discover how ComplyCube’s low or no-code onboarding solutions can transform your compliance operations. Speak to a member of the team today.

Frequently Asked Questions

What is compliance workflow software?

Compliance workflow software encompasses key functions, including regulatory monitoring, risk assessment, and audit reporting mechanisms. It enables organizations to build customizable workflows by introducing different checks according to the level of risk. Organizations can meet regulatory requirements with modern workflow software.

How does a no-code compliance workflow differ from traditional systems?

Low- or no-code workflows enable compliance professionals to configure logic and rules visually using a drag-and-drop user interface, rather than relying on application logic. Thus, time and cost can be saved significantly.

Is no-code suitable for banking AML compliance workflow requirements?

Yes. Businesses in regulated markets, such as accounting, banking, and cryptocurrency, utilize no-code solutions to support strong governance controls, audit trails, and role-based access.

What is compliance automation in AML and KYC workflows?

Workflow automation utilizes Artificial Intelligence (AI) and machine learning to automate repetitive manual tasks. This streamlines the customer lifecycle journey, from initial KYC onboarding to ongoing monitoring.

How does ComplyCube’s no or low-code platform work?

ComplyCube’s workflow builder supports organizations in building tailored, drag-and-drop workflows aligned with sector-specific regulations and risk appetite, without requiring a single line of code. Its regulator-ready templates include those of the FATF, FinCEN, and eIDAS 2.0.