TrustVerifi

TrustVerifi is a global verified reputation platform that helps users build credibility through secure IDV. TrustVerifi aims to accelerate onboarding as it expands its operations. Learn more about their partnership with ComplyCube.

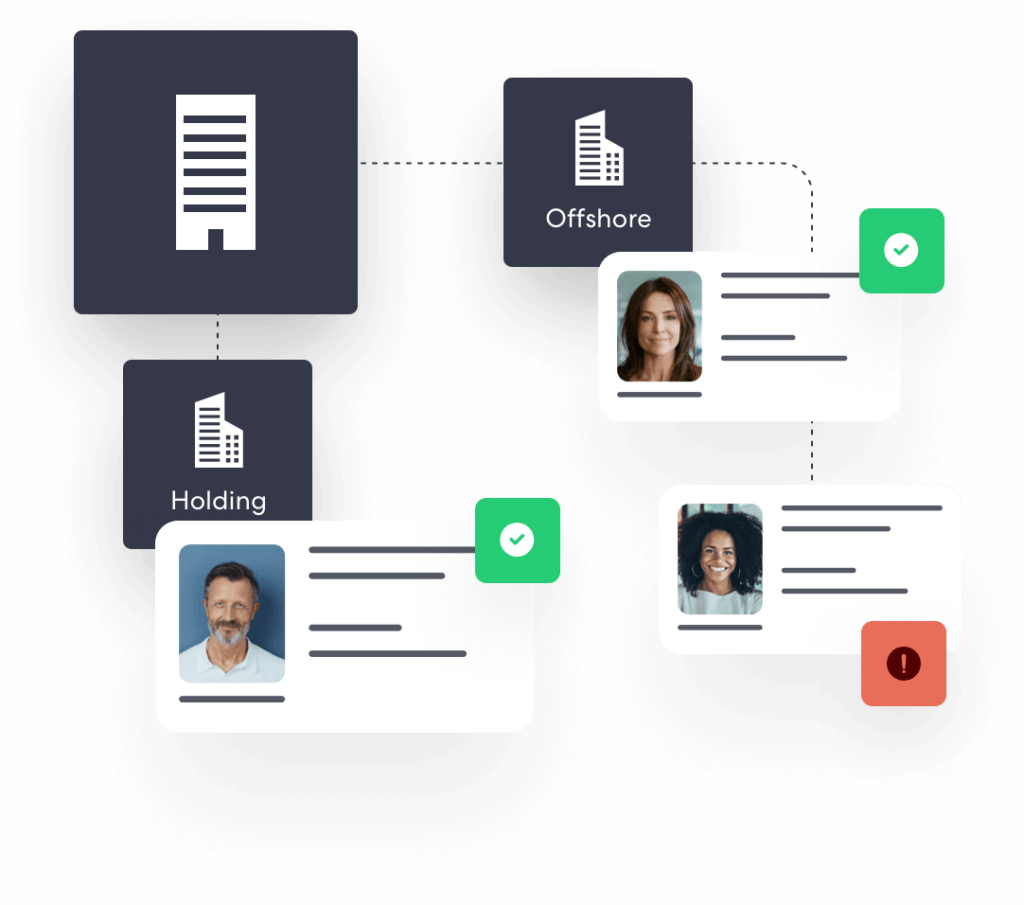

Regulations are rapidly evolving for Know Your Business (KYB) and UBO identification. ComplyCube can help you streamline director verification, company registry search, and disqualified director screening.

Pass your KYB and KYC verification to our experts and focus on your core business.

We access thousands of data sources to surface company insights for enhanced due diligence (EDD).

Meet the standards set by FATF, FINCEN, OFAC by using our real-time data alerts and global corporate registries.

bureau verification of shareholders

When onboarding legal entities, you want to be able to corroborate the information provided by owners for KYC with third parties.

Our access to data sources such as Governments and Credit Bureaus worldwide allows you to verify information such as SSN, Name, and Date of Birth with trusted third parties.

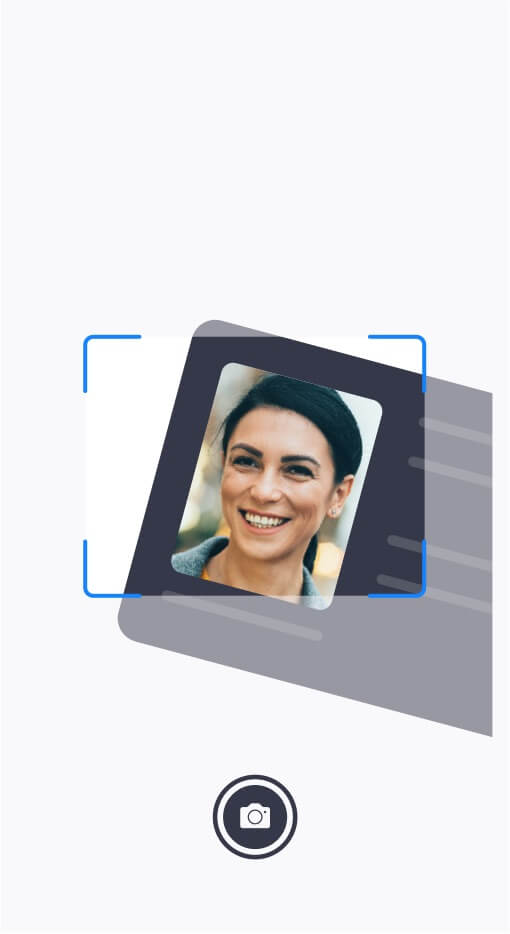

director document verification

Complex legal entity structures make obtaining the right information difficult already. Make verifying your directors, owners, and shareholders easier by using our guided document capture.

We provide you with solutions to get documentation from relevant parties with clear guided steps. By helping these individuals capture their documentation accurately our advanced AI can verify thousands of global documents in seconds.

case management workflow

Complex entity structure onboarding will ultimately lead to some form of investigation. Our tools provide customisable rules and thresholds to optimize your workflow. We also provide visualisations and detailed breakdowns to empower your customer onboarding specialists to make rapid onboarding decisions

Anti-money laundering in banking is essential. Flag and monitor inconsistent and potentially criminal financial activity in real time.

Understanding UBO Identification

Determining an entity’s Ultimate Beneficial Ownership (UBO) can be complex and requires using Know Your Business (KYB) technologies to ensure compliance. Learn more in our recent guide.

Deter fraudsters without adding unnecessary friction to genuine customers using our smart and configurable identity verification checks

ComplyCube’s comprehensive coverage of global AML watchlist sources and flexible automation features ensures that you comply with the most stringent regulations.

Keep on top of your Ongoing Due Diligence (ODD) obligations with ease, using our continuous monitoring service. You’ll get notified in real-time should your customers’ status change.

Numbers that back it up

The ComplyCube platform offers the most complete and flexible KYC tools to help you build trust in your business. Whether you’re a startup or a multinational enterprise, we’ve got you covered.

10+ million

Transactions are processed week in and week out across the globe.

200+

Countries and territories supported for a greater peace of mind.

3,000+

Data points from trusted sources and partners across the world, giving you the highest coverage.

95%

Client onboarding rate, helping you convert more customers and grow your business.

See all case studies