Businesses increasingly rely on automated systems to handle processes that were once done manually, as global regulations become more complex. One such process that’s essential for security, compliance, and fraud prevention across all sectors is Identity Verification. Businesses must accurately verify their clients’ identities during onboarding processes to ensure compliance with regulations and mitigate risks. By using an Identity Verification API, firms can integrate cutting-edge KYC and IDV solutions easily within their existing tech stack.

Identity Verification APIs allow businesses to make these verification process quicker, more reliable, and more secure. In this guide, we’ll explore what an Identity Verification API is, how it works, its benefits, and how businesses can leverage it to integrate advanced technology with their existing systems.

Understanding Identity Verification APIs

An Identity Verification API (Application Programming Interface) is a set of tools and protocols that allow businesses to integrate identity verification checks and solutions directly into their applications, websites, or services. Instead of relying on manual checks, companies can use an API to automate the verification process. An Identity Verification API handles everything from document scanning and biometrics to Anti-Money Laundering (AML) checks and Know Your Customer (KYC) compliance in a matter of seconds.

Identity Verification is critical to ensure that individuals or businesses are who they claim to be. It is essential in preventing financial crimes such as money laundering and terrorism financing, and plays a key role in regulatory compliance. Global and national regulatory bodies, such as the Financial Industry Regulatory Authority (FINRA) and the Financial Crimes Enforcement Network (FinCEN), and many more, oversee these processes to ensure that financial institutions adhere to strict guidelines. Large fines are often handed out to those businesses that don’t invest in secure KYC and AML infrastructure.

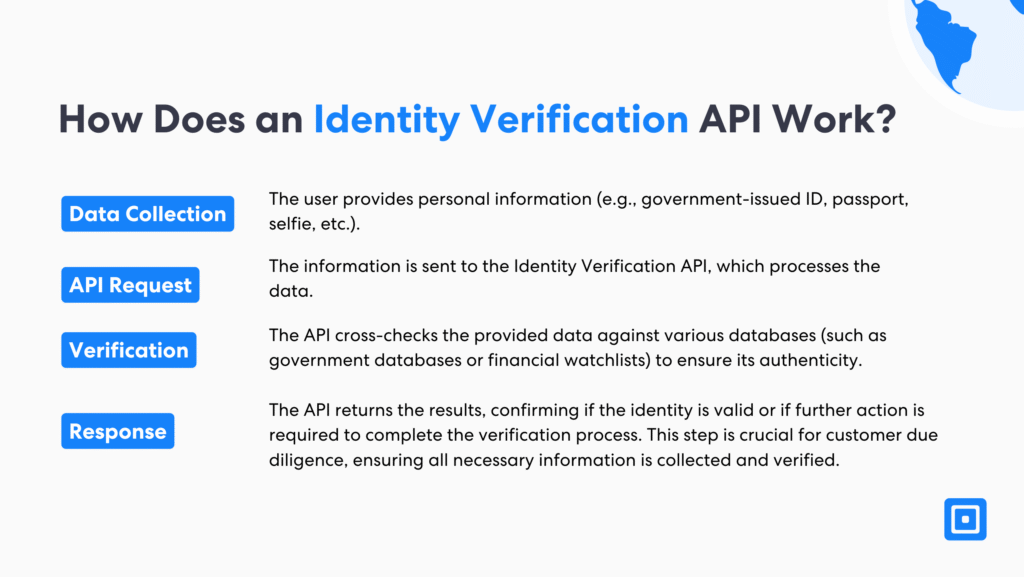

How Does an Identity Verification API Work?

An Identity Verification API is designed to integrate with an existing system seamlessly. Here’s a simple breakdown of how it works:

- Data Collection: The user provides personal information (e.g., government-issued ID, passport, selfie, etc.).

- API Request: The information is sent to the Identity Verification API, which processes the data.

- Verification: The API cross-checks the provided data against various databases (such as government databases or financial watchlists) to ensure its authenticity.

- Response: The API returns the results, confirming if the identity is valid or if further action is required to complete the verification process. This step is crucial for customer due diligence, ensuring all necessary information is collected and verified.

This entire process happens quickly, reducing the risk of human error while ensuring that businesses comply with regulatory standards.

Key Features of Identity Verification APIs

Speed and accuracy are key in the KYC process. Customers want fast onboarding and a slow verification process will have higher drop off rates. Top KYC platforms give real-time verification so you can verify documents, assess risk and complete the KYC process fast. This not only improves the user experience but reduces operational delays and keeps you ahead of the game.

Onboarding should be short and sweet to avoid high drop off rates. Providers that use cutting edge AI-powered tech can provide secure onboarding with robust KYC in under a minute per customer. Leading KYC providers, such as ComplyCube, can onboard customers in less than a minute with market-leading technology that leverages liveness detection and advanced biometrics.

Understanding Know Your Customer (KYC) Requirements

Know Your Customer (KYC) is a set of regulations and guidelines that require financial institutions to verify the identity of their customers and assess their risk profiles. This process is crucial for preventing financial crimes and ensuring regulatory compliance. KYC involves collecting identifying information such as name, date of birth, and address, and verifying this information through various means, including KYC checks, document verification, and biometric verification.

A key component of KYC is the Customer Identification Program (CIP), which mandates that financial institutions collect and verify identifying information from their customers. This program helps ensure that financial institutions know who their customers are, reducing the risk of fraud and other financial crimes. By implementing KYC processes, financial institutions can maintain the integrity of their customer relationships and comply with regulatory requirements.

Customer Identification Program

The Customer Identification Program (CIP) is a cornerstone of Know Your Customer (KYC) regulations, mandating financial institutions to verify the identity of their customers. This program involves collecting and verifying key identifying information, such as the customer’s name, date of birth, address, and identification number. The goal is to ensure that customers are who they claim to be, thereby preventing financial crimes like money laundering and terrorism financing.

Compliance and Regulatory Aspects

Compliance with KYC regulations is essential for financial institutions to prevent financial crimes and maintain regulatory compliance. The Financial Industry Regulatory Authority (FINRA) and the Financial Crimes Enforcement Network (FinCEN) oversee these regulations, which are mandatory for all financial institutions.

KYC regulations aim to prevent money laundering, terrorism financing, and other financial crimes by verifying customers’ identities and assessing their risk profiles. Financial institutions must ensure that their KYC processes are robust and effective in identifying and mitigating risks associated with customer relationships. By adhering to these regulations, institutions can protect themselves and their customers from financial crimes.

Anti-Money Laundering

Anti-Money Laundering (AML) regulations are designed to prevent the laundering of illicit funds and the financing of terrorism. These regulations require financial institutions to implement comprehensive KYC processes, monitor customer transactions, and report any suspicious activity to the relevant authorities.

Regulated by the Financial Crimes Enforcement Network (FinCEN) and the Financial Industry Regulatory Authority (FINRA), AML requirements are stringent and must be followed by all financial institutions. Effective AML measures are crucial for preventing financial crimes and ensuring regulatory compliance. By adhering to AML regulations, financial institutions can safeguard their operations and maintain the financial system’s integrity.

Enhanced Due Diligence

Enhanced Due Diligence (EDD) is a more rigorous form of due diligence for high-risk customers or transactions. EDD involves collecting and verifying additional information, such as beneficial ownership details, business activities, and comprehensive risk profiles, to assess the customer’s risk thoroughly.

To ensure compliance with KYC regulations, financial institutions must conduct EDD on high-risk customers, including politically exposed persons (PEPs) and individuals from high-risk countries. EDD is essential for preventing money laundering, terrorism financing, and other financial crimes. By implementing EDD, financial institutions can better manage risks and ensure compliance with regulatory requirements.

Benefits of Using an Identity Verification API

- Automation: Manual identity verification can be time-consuming and error-prone. Businesses can automate this entire process by using an Identity Verification API, improving efficiency and accuracy. The API can handle a large volume of requests in real-time, ensuring that your verification workflows are always up-to-date. Additionally, ongoing monitoring of customer accounts ensures continuous compliance and security. These solutions help businesses streamline their verification processes and improve overall efficiency.

- Enhanced Security: Identity theft and fraud are significant concerns for businesses, particularly in industries like banking, e-commerce, and healthcare. Using an Identity Verification API significantly reduces the risk of fraudulent activity. Advanced features like biometric matching, document verification, and liveness detection make it harder for malicious actors to fake their identities.

- Compliance: Financial institutions, healthcare providers, and other regulated industries must follow strict KYC and AML regulations. An Identity Verification API helps businesses easily comply with these laws by automating checks and ensuring that only legitimate customers are onboarded.

- Cost Efficiency: Building an in-house identity verification system can be expensive, requiring investment in software development, maintenance, and security. By using an external API, businesses can save on these costs while accessing cutting-edge technology provided by the API service. For more on the breakdown of AML and KYC costs, read “AML Check Cost: Hidden Fees in Compliance.”

- Faster Onboarding and User Experience: Customers demand convenience and speed, and an Identity Verification API helps businesses streamline the onboarding process. Users can verify their identities quickly through the system, improving overall customer experience and reducing the chances of abandonment during sign-up or checkout. For more on how onboarding can be fortified with KYC and AML checks, read “KYC Checks For a Secure Onboarding Process.”

Fighting Fraudulent Activities

Fraudulent activities, such as identity theft and money laundering, pose significant risks to financial institutions and regulatory bodies. These activities can lead to substantial economic losses and damage a financial institution’s reputation. To combat these threats, financial institutions must implement robust Identity Verification processes, including KYC and AML regulations, to ensure their customers are who they claim to be.

In addition to verifying identities, financial institutions must monitor their customers’ transactions and report any suspicious activity to the relevant authorities. Advanced technologies, such as biometric verification and machine learning, can enhance these efforts by detecting and preventing suspicious transactions in real-time. By adopting these measures, financial institutions can help prevent fraudulent activities and maintain the integrity of their customer relationships. Identity Verification APIs are a convenient way to plug into cutting-edge technology to ensure financial safety and maintain cost efficiency through accurate verifications.

Choosing the Right Identity Verification API and Provider

With many Identity Verification API providers, how do you choose the right one for your business? Here are some factors to consider:

- Accuracy: Look for a provider that offers reliable and accurate verification services. Providers should be highly certified, and should leverage cutting-edge technology, such as PAD Level 2 Liveness Detection, to ensure a high rate of accuracy.

- Compliance: Ensure the API complies with your region’s compliance requirements and regulations, especially if you’re in a highly regulated industry. Looking for industry acknowledgements, such as ISO certifications, is a step in the right direction.

- Integration: Choose an API that is easy to integrate with your existing systems and has clear documentation and support.

- Scalability: As your business grows, ensure the API can handle increasing verification volumes and provide timely responses.

Leveraging Identity Verification for Financial Security

Securing user identities is more important than ever, and choosing the right solution can make all the difference. An Identity Verification API provides an automated, accurate, and secure way to confirm the legitimacy of your customers. Not only does it help businesses meet regulatory requirements, but it also reduces the risks associated with fraud and identity theft. Regular review of the verification processes ensures that they remain effective and up-to-date with the latest security standards.

By implementing an Identity Verification API, businesses can improve customer experience, save on operational costs, and ensure compliance with industry regulations. Whether in finance, e-commerce, healthcare, or any other industry, adopting this technology is essential to building trust and security in the digital world.

Contact our expert compliance team for more information on ComplyCube’s Identity Verification services and API.