Know Your Customer (KYC) compliance in the UK is not optional; it is a growing necessity, especially for firms operating in regulated industries. However, with UK retail bank cost of KYC surging over the recent years, compliance obligations have become a significant operational dilemma. For retail banks, the strict expectations from global regulatory bodies have forced a higher need to reassess how strong KYC can be obtained and scaled efficiently.

From crafting automated onboarding workflows to producing clear risk assessments, UK banks must navigate stringent KYC obligations while managing compliance budgets. This guide will delve into the crucial factors driving KYC costs in UK retail banking and discover how modern digital solutions can ease the growing burden of compliance.

Introduction to KYC Compliance in the UK

KYC is a process that allows financial institutions to verify consumers’ identity and assess an individual’s risk. Adopting a robust KYC framework is vital as it is the main defence against money laundering, terrorist financing, and broader financial crimes. For financial services, KYC is tightly interlinked with Anti-Money Laundering (AML) regulations.

Compliance Cost and the Impact it has on UK Firms

A 2024 survey by PWC found that 65% of UK financial institutions reported increased spending on AML and Counter-Terrorist Financing (CTF) compliance over the past 24 months, with 15% stating their costs rose by more than 30%.

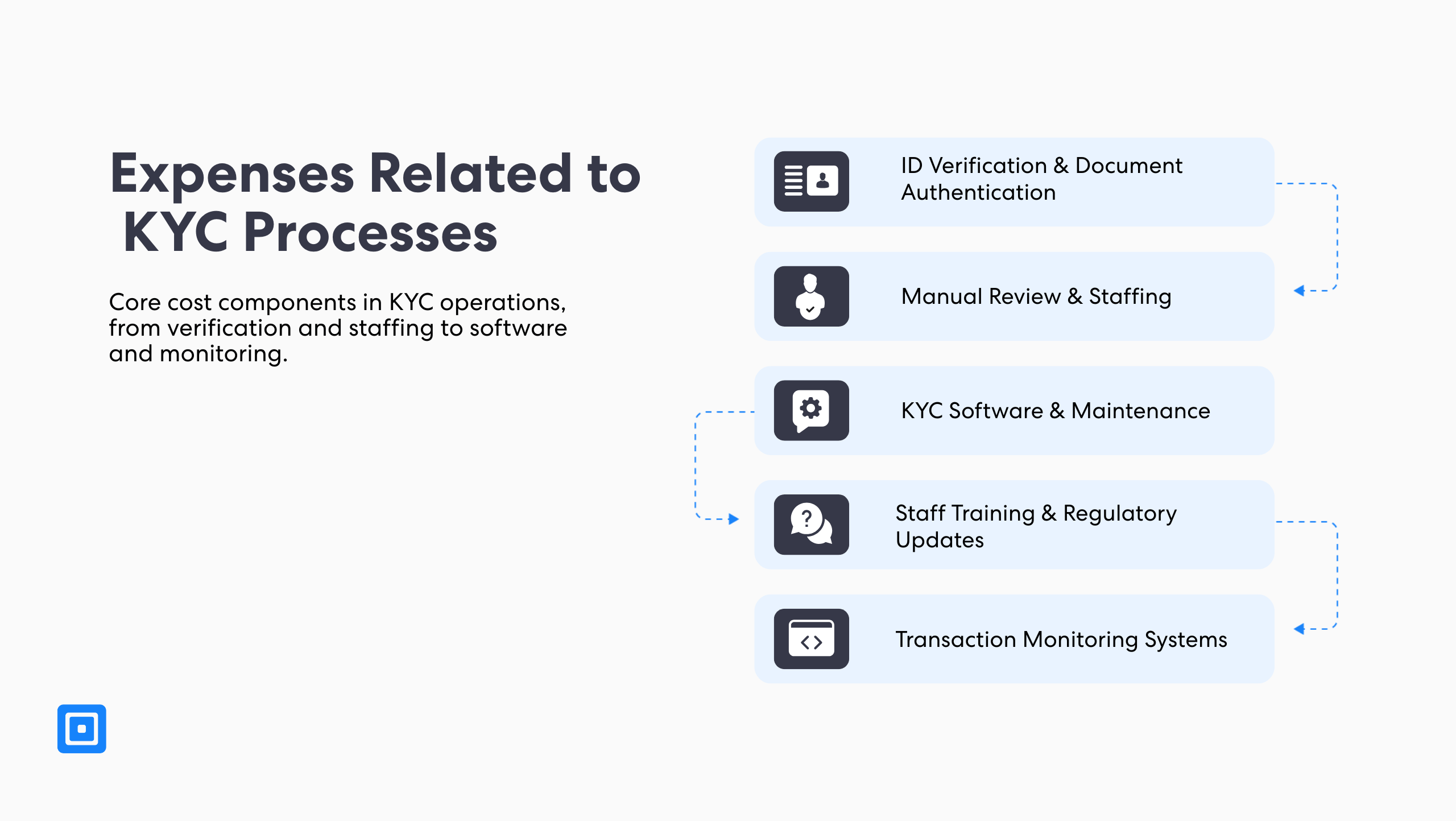

This increase can significantly rise for financial institutions that rely on manual KYC processes, as compliance budgets need to be allocated for manual intervention and outdated systems. The typical compliance operational cost in a firm includes identity verification technology, such as liveness checks and frequent staff training:

- Identity verification technology investment and document authentication services

- Labour-intensive manual review and compliance staffing

- Specialist KYC software accounts, licenses, and maintenance

- Ongoing staff training and updates to reflect current regulations

- Implementation of transaction monitoring and audit systems

Together, these factors contribute to the broader cost of AML compliance in the UK, putting pressure on operational budgets and underscoring the necessity for intelligent, scalable solutions. Learn more about AML compliance in the UK here: A Complete Guide to AML Compliance.

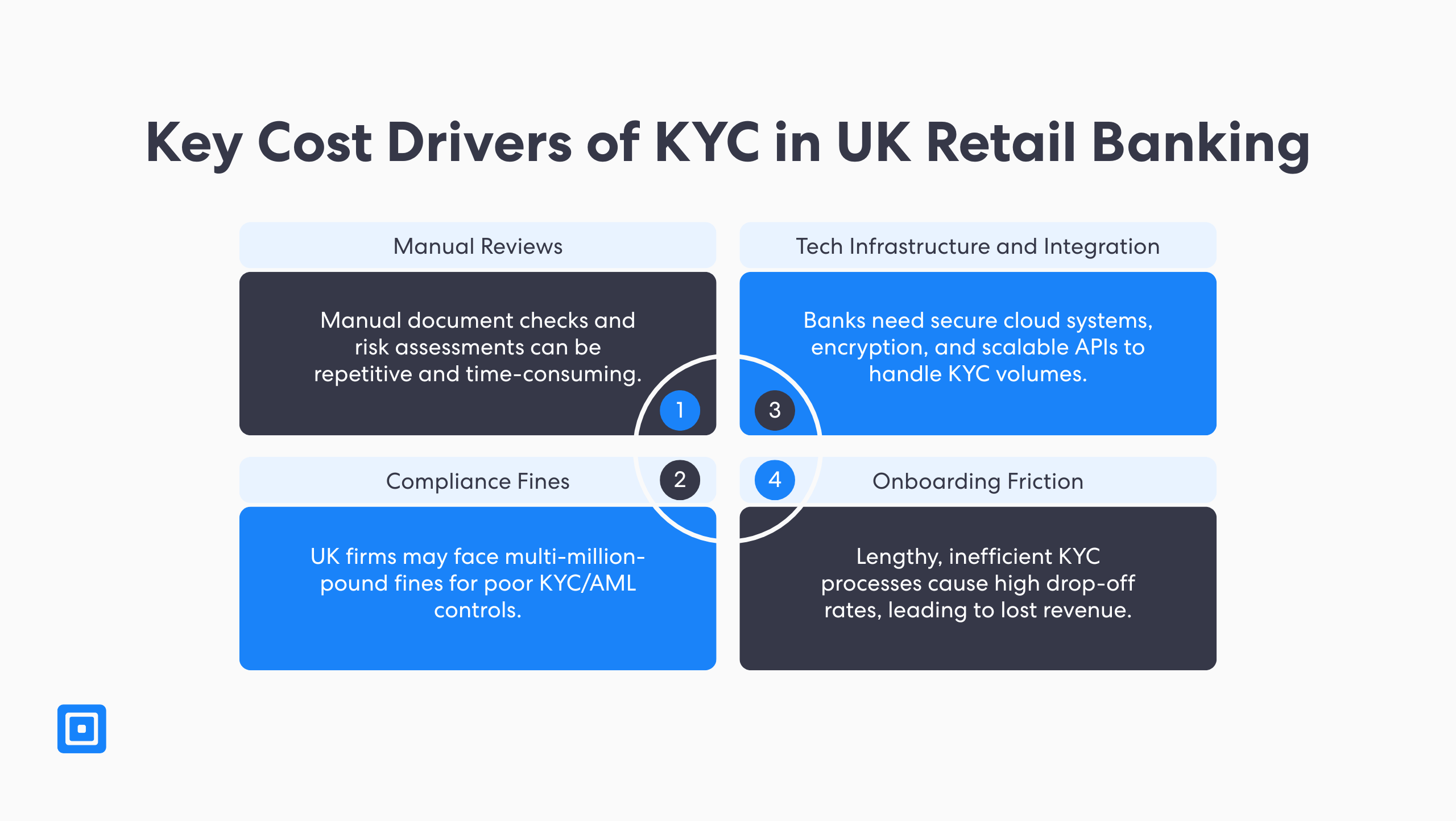

Key Cost Drivers for KYC in Retail Banks

For retail banks in the UK, a better understanding of what influences KYC cost can be instrumental. Maintaining legal alignment is paramount to avoiding penalties and preventing financial crime. Thus, an overview of the overall i mpact and ROI of KYC software is vital.

One way to reduce costs is to adopt KYC solutions to increase operational efficiencies. This can be delivered through enhanced automation capabilities such as data extraction. Check out some of the most influential cost drivers:

Labour-Intensive Manual Reviews

KYC costs are heavily influenced by human capital. Teams tasked with verifying documents and performing risk assessments often encounter repetitive, time-intensive work, especially when dealing with incomplete or irregular documentation. In response to evolving customer behaviour, many banks have closed physical branches and shifted to digital onboarding and account opening.

At the same time, attracting and keeping skilled compliance professionals has become increasingly difficult. The Financial Conduct Authority (FCA) has flagged high turnover in AML personnel as a concern, warning that such workforce instability can weaken the overall integrity of UK firms’ compliance operations.

Compliance Fines and Risk Buffers

UK financial services can face fines amounting to millions for not implementing robust KYC or AML regulations. For instance, the FCA recently issued leading bank Monzo, with £21 million for compliance failures. Regulators such as the FCA often impose fines on companies that are found with inadequate compliance, including customer due diligence and insufficient monitoring. These fines serve as a warning to firms to maintain strong KYC for financial crime prevention.

Technology Infrastructure

To manage large volumes of identity verification and KYC checks, UK banks are required to invest in secure cloud infrastructure, strong data encryption, scalable API-based systems, and dependable backup solutions. Open banking, when implemented with customer consent, allows real-time access to bank data which streamlines processes for KYC, AML, and fraud detection. However, integrating these technologies with legacy platforms often proves both technically demanding and costly.

Integration Requirements

Ongoing responsibilities such as sanctions screening, periodic reviews, and identifying Politically Exposed Persons (PEPs) require interconnected systems that are secure, auditable, and capable of real-time updates. As banks aim to reduce KYC friction, protect against identity theft, and prevent fraud, investing in scalable, intelligent infrastructure becomes critical to balancing risk and compliance with consumers’ user experience.

Client Onboarding Friction and Abandonment

Poorly optimised KYC flows introduce friction that deters new customers. According to a 2024 survey by Encompass Corporation, 87% of corporate treasurers in the UK and the US have abandoned banking applications due to lengthy and inefficient onboarding processes. Some of the most common reasons for drop-offs in customer onboarding processes include the lack of key identity credentials such as passports or digital IDs. Every consumer that abandons the onboarding process signifies a missed opportunity for revenue.

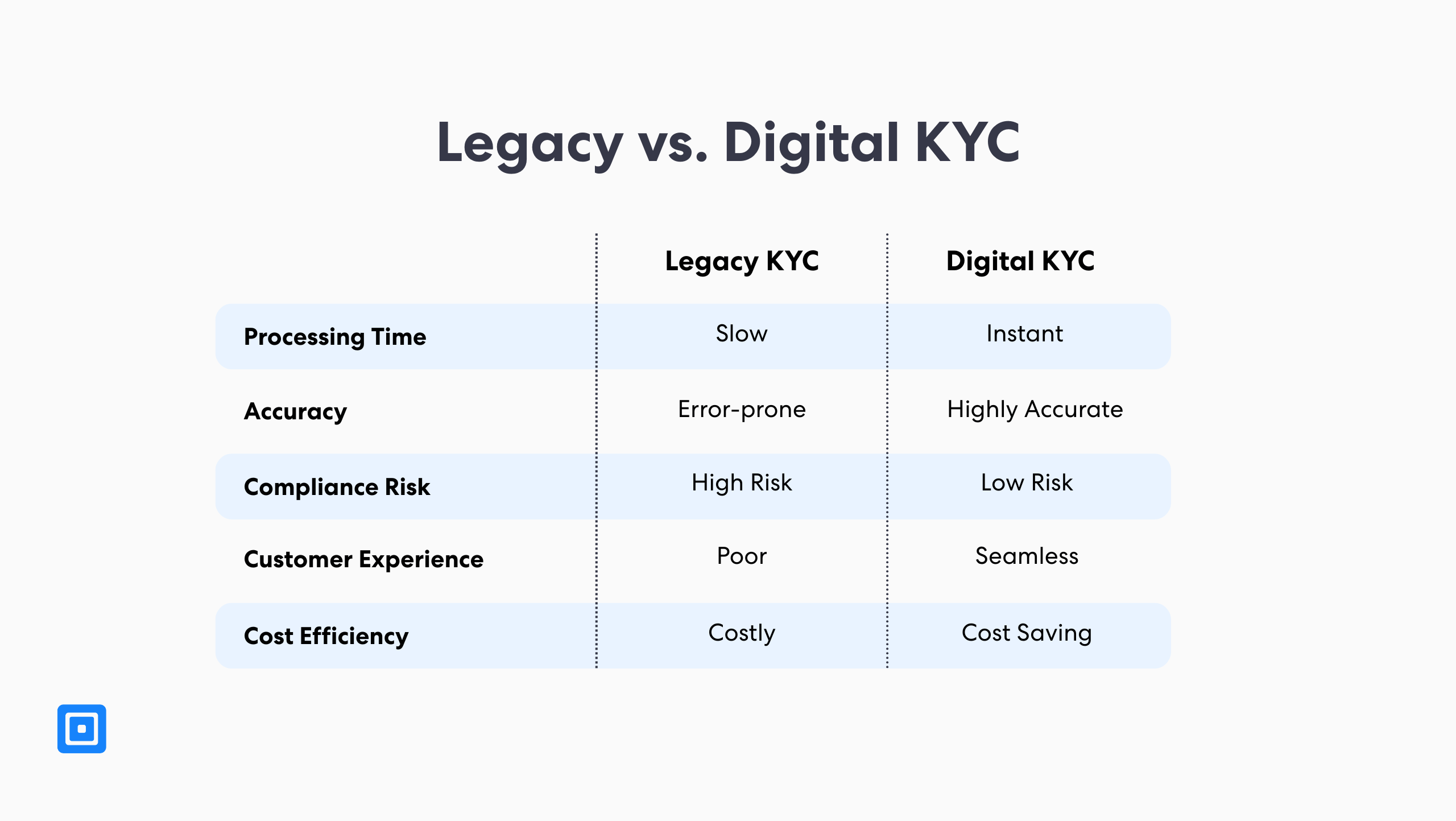

Why Traditional KYC Approaches Are Unsustainable

Traditional KYC solutions that rely on physical branches and manual processing is a hinderence to long-term scalability. Additionally, it causes inaccurate verification due to human error and much longer processing times.

A KYC framework can be as basic as an ID check to something more complex, such as running due diligence checks for PEPs. Any gaps in control can translate to significant business risk. Perpetual KYC monitoring is vital for effective risk management and regulatory compliance. In a rapidly evolving online environment, timely detection of financial crimes will distinguish banks from their competition.

By clinging to conventional workflows and forgoing innovations such as machine learning–powered analytics or automation, institutions risk non-compliance, inflated costs, and an inability to meet modern regulatory requirements or customer expectations. A multi-case study on legacy system migration in the banking industry reveals that monolithic legacy architectures hinder the implementation of new banking models.

Optimising KYC Through Advanced Analytics and AI

Digital transformation in compliance is enabling retail banks to reduce onboarding costs through automation, biometrics, and intelligent analytics. These technologies not only accelerate processes but also enhance accuracy, reduce operational burdens, and support robust regulatory alignment.

Leveraging Cutting-Edge Digital Identity Verification

Advanced technologies, such as Optical Character Recognition (OCR), facial biometrics, and liveness detection enable real-time document validation and identity assurance. These innovations streamline KYC workflows, flag potential fraud, and significantly reduce manual work, leading to fewer errors and reducing onboarding costs for retail banks.

Device Intelligence and AML Screening

Device Intelligence adds an extra layer of security by detecting anomalies in user behaviour and device profiles. Adverse Media Screening enhances financial crime compliance by identifying high-risk individuals through global news sources and watchlists. These solutions are built for flexible integration. Banks can rapidly deploy systems that fit their infrastructure maturity, whether through SDKs, RESTful APIs, or no-code/low-code setups.

The Regulatory Incentive to Modernise KYC

UK and EU regulators are pushing for risk-based KYC approaches. The FCA urges tailored due diligence, while the Financial Action Task Force (FATF) endorses digital tools such as identity verification and automation, provided data safeguards are in place.

Laws such as the Money Laundering Regulations and 6AMLD align with the FATF’s principles but stop short of requiring digital adoption. UK regulators, including the FCA, expect firms to screen customers against up-to-date watchlists, PEPs, and adverse media sources.

Final Thoughts: Future-Proofing KYC for the UK Retail Banking Sector

Retail banks are under pressure to cut costs while staying compliant. Addressing the UK retail bank cost of KYC means replacing legacy processes with smarter tools that automate identity verification, reduce errors, and streamline onboarding to build customer trust. With ComplyCube, financial institutions gain fast and scalable compliance through automated checks, global screenings, and real-time monitoring, meeting regulations without the overhead. Future-proof your compliance with ComplyCube today.