With financial crime at an all-time high, Anti-Money Laundering (AML) Watchlist Screening Software has become a critical tool for financial institutions, fintech, and regulated enterprises. The tools are designed to proactively identify and mitigate risks associated with money laundering, terrorist financing, and other illicit activities by screening customers and transactions against vast global watchlists. This guide will explain how Watchlist Screening Software can fortify your business and ensure AML compliance.

What Is AML Watchlist Screening?

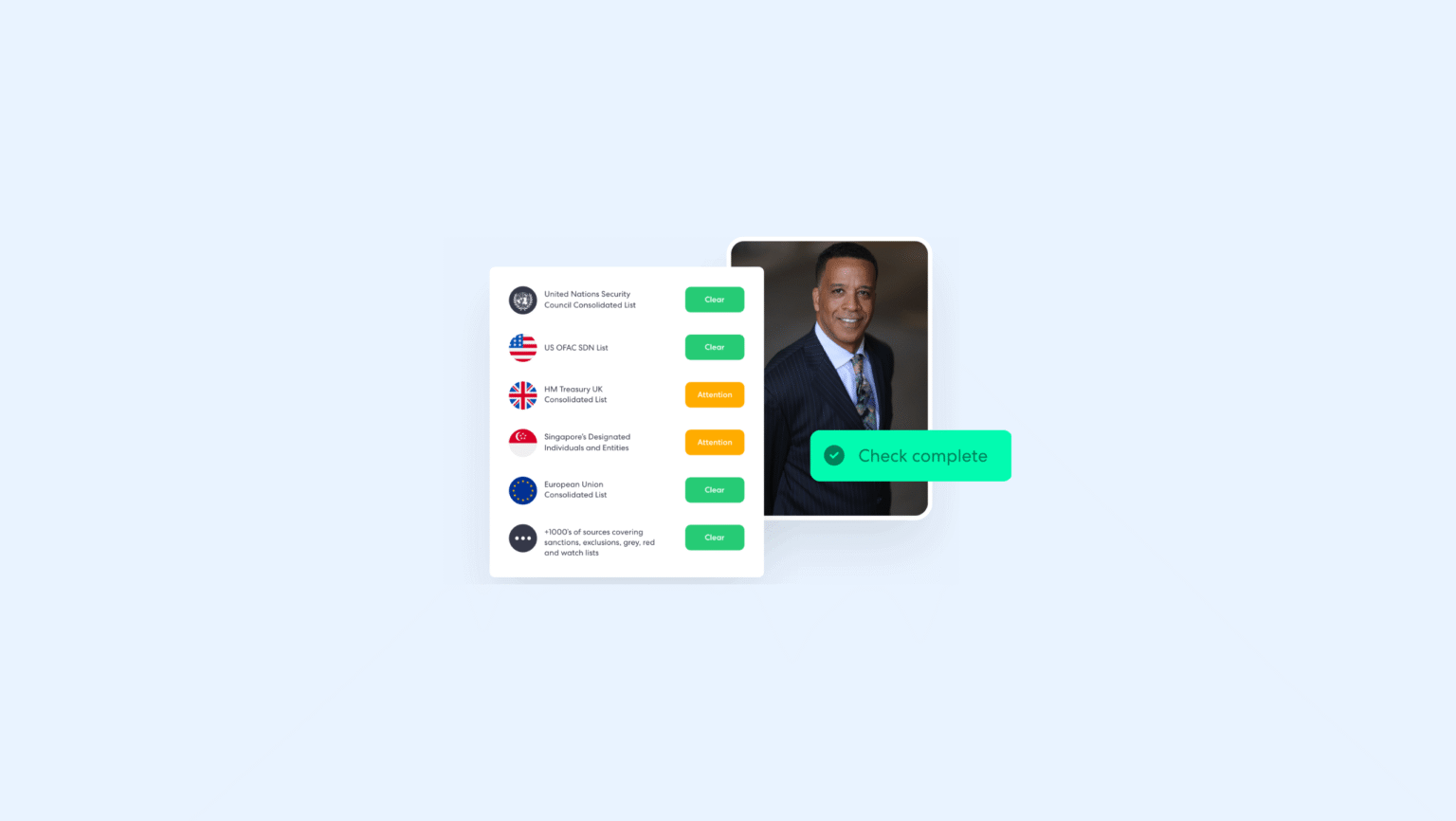

AML Watchlist Screening is the automated matching of customer data, names, addresses, and identification numbers, with several authoritative lists such as:

- Sanctions Lists: Government and international issuances.

- Politically Exposed Persons (PEPs): Individuals with public influence worthy of note.

- Adverse Media: Media sources that could be indicative of potential risk.

- Law Enforcement and Enforcement Actions: Agencies under investigation or the subject of enforcement.

The screening is performed for detection and prevention of association with persons or entities that are high-risk and to determine compliance with regulatory requirements.

The Major Features in AML Screening Solutions

Sophisticated AML Watchlist Screening Software has advanced capabilities to enhance compliance processes:

1. International Coverage

Leading platforms offer access to global watchlists such as the UK HM Treasury, US Department of the Treasury, OFAC, FBI, and more. The comprehensive international, regional, and local watchlists encompass over 220 countries and territories. This ensures that businesses can carry out needed risk assessment on each client through global sanctions screening to ensure regulatory compliance.

2. AI-Based Matching and Minimal False Positives

Fuzzy matching, phonetic verification, and other automated workflows are implemented by sophisticated AI engines to accurately choose potential matches without charging high false positives. Such precision minimizes manual review workloads and maximizes the efficiency of operations.

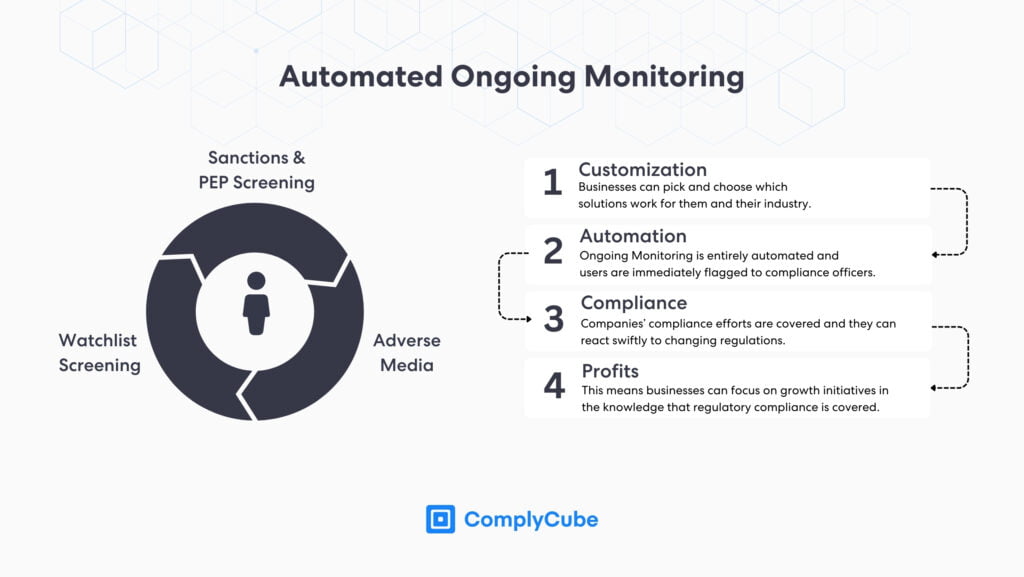

3. Monitoring in Real-Time and Ongoing

Real-time monitoring capability allows rescans of customer data daily against updated watchlists. This allows any changes to a customer’s risk profile to be automatically identified, allowing timely compliance action.

Businesses can use ongoing monitoring as a way to ensure their risk tolerance is respected through the necessary screening process to identify any changes in risk, such as a client appearing in adverse media or on a sanctions list. For more on the Risk-Based Approach, read “What is a Risk-Based Approach (RBA)?”

4. Customizable Risk Profiles and Workflows

AML screening solutions allow organizations to make risk profiles and screening logic customizable by jurisdiction, customer type, and so on. Workflow-based workflows can route alerts to the correct teams so that investigations can be effective and contextual.

Most regulators suggest following a risk-based approach to AML, which is why creating customisable risk profiles and workflows is critical to meeting compliance requirements. High risk individuals can be identified based on a wide variety of data points obtained from watch list screening. High risk profiles often require enhanced due diligence, to verify that the business or individual is not tied to any illegal activities.

5. Smooth Scalability and Integration

New solutions are smoothly incorporated into existing systems through APIs and SDKs. This scalability enables AML screening to grow in tandem with the organization, accommodating expanding volumes of transactions and rising regulatory pressures.

Partnering with a compliance platform that allows for easy integration with their technology allows compliance teams to ensure compliance easily as well as to support the customer lifecycle as a whole.

Top Best Practices for Successful AML Watchlist Screening

To achieve the best outcomes from AML Watchlist Screening Software, implement the following best practices:

- Periodically Update Watchlists: Ensure watchlists are updated periodically to reflect the latest sanctions and regulatory information.

- Emphasize Risk-Based Screening: Focus on more risky customers and transactions to optimize compliance measures.

- Compliance Staff Training: Train personnel with the capability to interpret the output of screening and process alerts in a proper manner.

- Leverage Sophisticated Analytics: Employ data analytics to identify patterns and trends that can indicate future risk.

Real-World Applications of AML Watchlist Screening Software by Sector

1. Financial Institutions (Banks & Credit Unions)

Banks use AML software to screen new and existing customers against global watchlists (sanctions, PEPs) during onboarding and transactions. The finance sector is the main target of AML related crimes, so this sector specifically must ensure a strong risk-based approach when onboarding new clients, as well as using ongoing monitoring to be notified if any existing clients pose a risk.

2. Fintech Companies (Payment Platforms & Digital Wallets)

Fintech platforms screen users during account creation and for large transactions, matching their data against sanctions and PEP lists. This allows them to quickly onboard customers while minimizing fraud and illegal activity risks.

3. Casinos & Gambling Platforms

Casinos use AML screening to monitor large bets and withdrawals, screening players against sanctions lists. This helps prevent money laundering and ensures compliance with gambling regulations.

4. Real Estate

Real estate agents screen buyers and sellers against sanctions lists to prevent money laundering through property transactions. High-value deals trigger enhanced due diligence for flagged individuals or entities.

5. E-commerce

E-commerce platforms screen sellers and large transactions for potential money laundering risks, especially in cross-border sales, by comparing data to global sanctions and PEP lists.

The Future of AML Screening Software

The future of AML Watchlist Screening Software rests on how fast and deep the adoption of new technologies such as machine learning, natural language processing, and blockchain analytics takes place. These technologies can potentially drive screening accuracy and efficiency even higher, and organizations will be able to stay ahead of evolving financial crime schemes.

Businesses that want to stay ahead of their competition in terms of both security and compliance should prioritise meeting AML standards globally, and using sophisticated AML watchlist screening software is a great place to start. For more information on how to integrate AML watchlist screening and fortify your business operations, get in touch with one of our compliance experts.