REAL-TIME EMAIL INTELLIGENCE

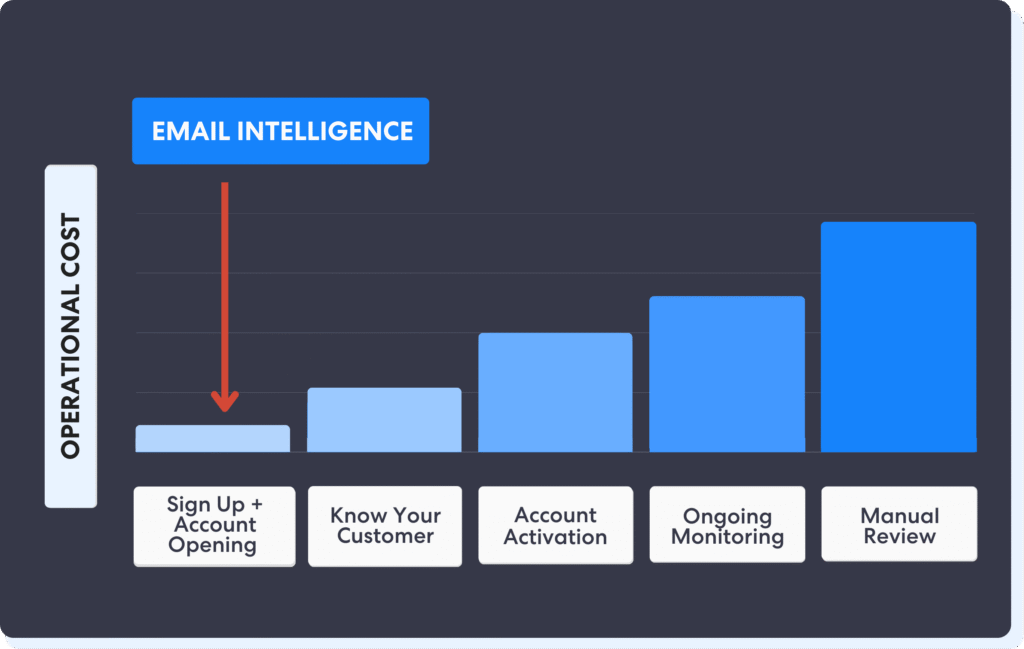

Get fraud risk insights from emails in seconds

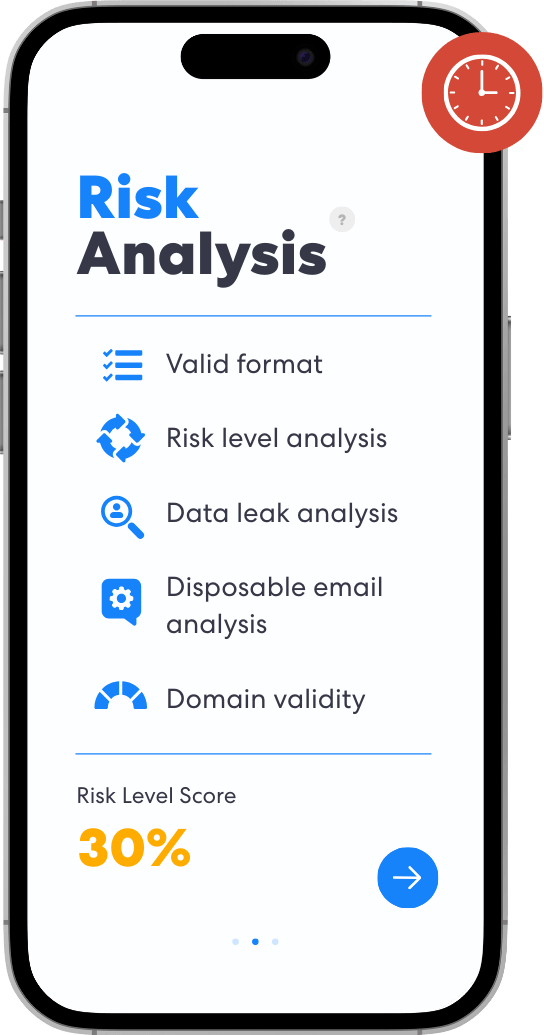

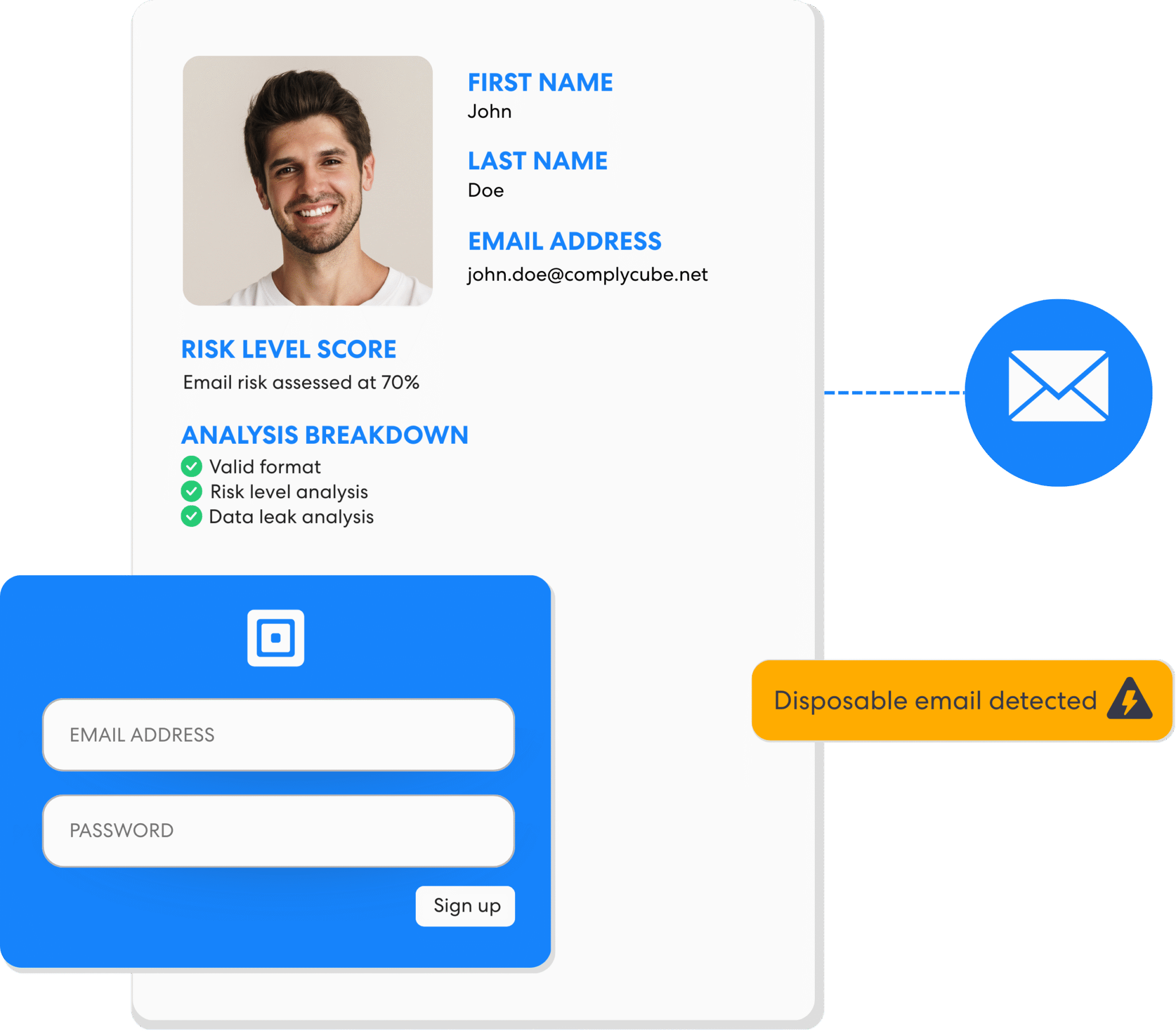

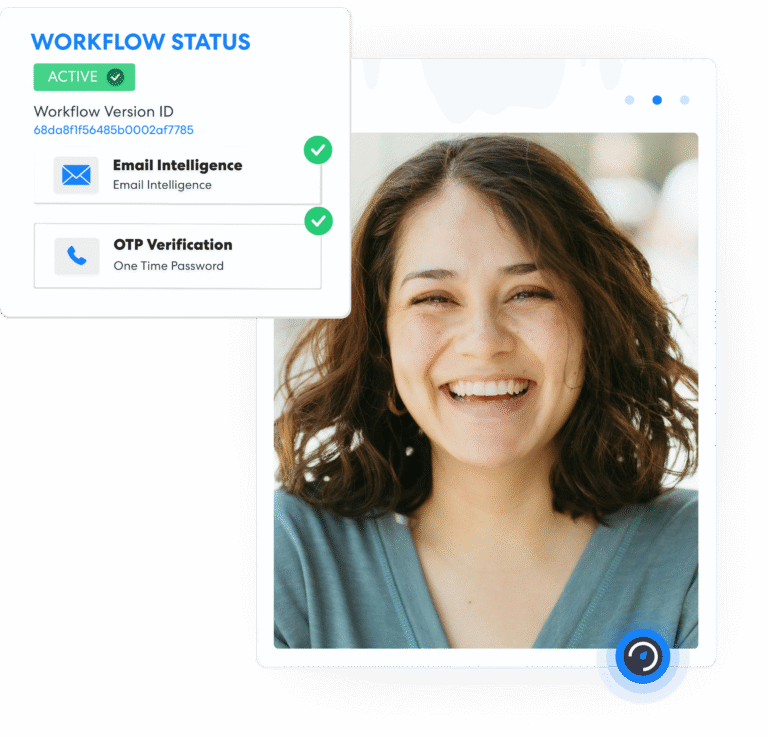

ComplyCube’s email intelligence solution enables instant user risk evaluation through a single input. By analysing key indicators such as domain validity, breach history, and disposability, the system delivers a real-time email risk score. Integrated via our flexible email verification API, it fits seamlessly into onboarding flows and helps teams assess fraud likelihood without collecting documents or biometric data.