TL;DR: eKYC verification is changing customer onboarding by digitizing identity checks and lowering fraud. Navigating regulatory requirements is difficult, as compliance standards for electronic KYC vary across regions. Organizations need ekyc solutions that balance smooth verification with regulatory compliance.

What is eKYC Verification?

Electronic KYC verification shifts how businesses bring on and verify customers. eKYC solutions are being accepted worldwide as regulations become more strict with growing digital fraud. Overall, by switching paper-based identity checks for AI-powered systems, companies can verify users in seconds. Again, this lowers costs, lowers fraud risk, and improves the customer flow.

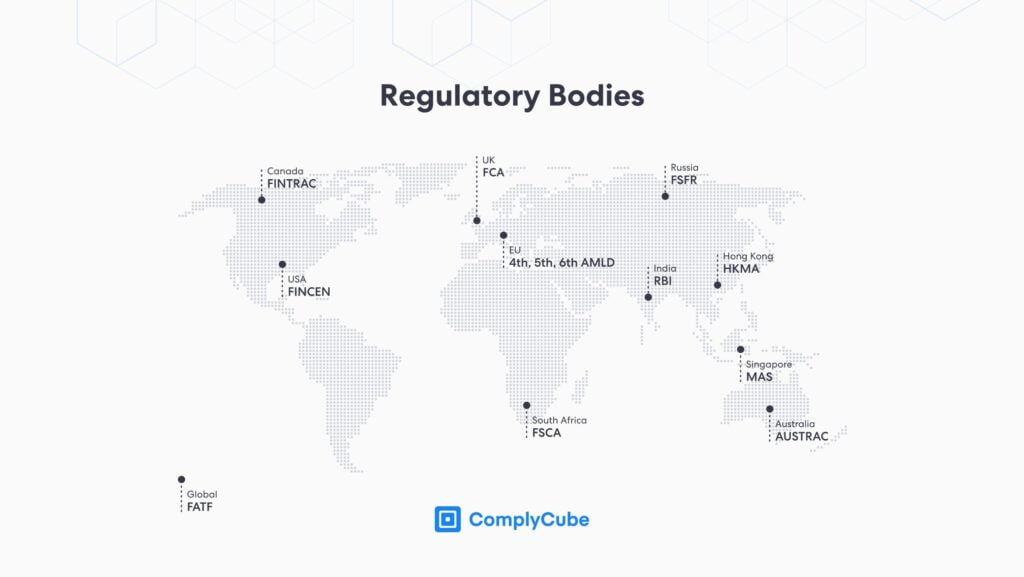

In addition, moving through the regulatory landscape around electronic KYC is still a big challenge. This is because compliance rules can vary across regions and industries. From global bodies such as the Financial Action Task Force (FATF) to national ones such as the Monetary Authority of Singapore (MAS), businesses must adhere to changing standards. Nevertheless, many companies struggle to achieve compliance. Therefore, choosing an eKYC solutions partner is important for businesses to scale safely, remain compliant, and build trust with their customers.

The Need for Global eKYC Verification Processes

The global eKYC market was valued at $518 million in 2022. By 2030, it will likely reach $2.46 billion with a compound annual growth rate of 21.40%. Obviously, the growing demand for eKYC solutions has increased with money laundering and fraudulent practices. For this reason, electronic KYC methods are a needed next-step to fight fraud now.

About 5% of a business’s annual revenues are lost to fraud each year.

According to the United Nations Office on Drugs and Crime (UNODC), between 2% and 5% of global GDP is laundered each year. This amounts to a shocking €715 billion to €1.87 trillion worldwide. As a result, businesses must hold customer identity data to reduce their risk of fraud. In essence, identity theft and false personas created online expose businesses to the risk of onboarding customers involved in illicit activities, threatening both the security and reputation of the organization.

The FTC has received 5.7 million total fraud and identity theft reports in 2024, 1.4 million of which were identity theft cases.

Ultimately, businesses must protect themselves from leading scams. An example of this, is preventing identity fraud with a thorough electronic KYC process. These practices should include a thorough Identity Check and a Document Check. It verifies that customers are who they claim to be, and in fact, that their documentation is valid.

eKYC Verification Solutions and Increasing Regulatory Pressures

Presently, regulatory bodies across the globe are pushing for tighter Identity Verification (IDV) and Anti-money Laundering (AML) practices. Quoted in a DW news report, the EU Commission Executive Vice President Valdis Dombrovskis stated:

The rules we have in place to prevent money laundering are amongst the toughest in the world, but they must also now be applied.

United States

Section 326 of the USA Patriot Act requires banks and other financial institutions put in place a Customer Identification Program (CIP). This process must collect specific information from customers, including their name, date of birth, address, and ID number.

In the United States, the Financial Industry Regulatory Authority (FINRA) Rule 2090 states that financial organisations must put in place detailed due diligence process. This practice is in place to identify and retain customer data or anyone acting on behalf of said customer. Ultimately, the rule states the following:

Every member shall use reasonable diligence, in regard to the opening and maintenance of every account, to know (and retain) the essential facts concerning every customer and concerning the authority of each person acting on behalf of such customer.

The Bank Secrecy Act aims to put an end to money-laundering practices. This establishes the Customer Due Diligence (CDD) enforcement as part of their efforts to improve financial transparency.

Accordingly, the CDD has four main rules for financial institutions regarding KYC practices. Firstly, companies need to look at doing a thorough identity verification. Collecting customer data including name, email address, phone number, occupation, and tax identification and more is crucial. Then, it is shortly followed by business review. In particular, business reviews where financial institutions look at the business interests of their consumer, followed by a customer risk assessment and continuous monitoring.

European Union

The Payments Services Directive (PSD2) secures online payments as it requires that customers must go through a Secure Customer Authentication (SCA) within the EU. Therefore, businesses must now put in place this two-factor authentication process across all high-value payments, making it the new standard.

Similarly, the General Data Protection Regulation (GDPR) needs organizations to carry out identity checks and keep sensitive information about their customers, though they must be fully transparent in their use of data.

Other Prominent Regulatory Bodies Worldwide

Australian Transaction Reports and Analysis Centre (AUSTRAC):

The AUSTRAC is an Australian government financial intelligence agency. It identifies activities such as money laundering and terrorism financing. The organisation needs businesses to verify their customers and documentation, underlining the threat of fraud.

Reserve Bank of India (RBI):

The RBI has revised and standardised its KYC regulations. It needs financial institutions to put in place updated processes to identify customers correctly. To manage risks, the RBI suggests adopting measures such as tagging high-risk customers to prevent fraud, money-laundering and identity theft.

Monetary Authority of Singapore (MAS):

The MAS is the central bank and financial regulatory authority of Singapore. MAS needs financial institutions to implement eKYC solutions to stop money laundering and financing of terrorism. MAS’s regulatory framework says that customer identities must be verified through multiple channels. This includes independent verification of mobile phone numbers, addresses, salary details and more. For example, in the case of high-risk customers, enhanced due-diligence processes that include ongoing monitoring are necessary.

Case Study: HSBC Modernising Customer Onboarding with eKYC Verification

HSBC faced pressure to smoothen its onboarding process across different markets. The bank needs to stick to stringent electronic KYC and AML regulations. Manual identity verification processes were creating bottlenecks. Soon, this led to delayed onboarding, higher operational costs, and an increased risk of fraud exposure.

Implementing advanced eKYC solutions for automation

As a result, HSBC put in place advanced eKYC solutions to automate identity verification across its digital banking platforms. By blending biometric authentication, real-time document scanning, and AI-powered fraud detection, the bank was able to meet electronic KYC compliance rules. They met this across key regions including the EU, UK, and Singapore.

Outcomes

Reduced customer onboarding time by 60%, dropping from an average of 5 days to under 48 hours.

Achieved a 40% reduction in identity fraud cases following the rollout of eKYC verification.

Reported a 35% decrease in compliance-related costs within the first year of implementation.

How Can Businesses Remain Compliant with eKYC Regulations?

Prior to today, traditional eKYC verification processes tried to verify identity documents manually. Obviously, this was highly-prone to human error. Automated systems provide enhanced data security and verify customer identities quickly and accurately, smoothly meeting regulatory needs and allowing businesses to scale safely.

So, a strong electronic KYC process must include biometric verification with liveness detection. This allows for processes to identify presentation attacks fast, along with a document verification process to verify the validity of a document.

Biometric Verification

Biometric authentication is a key part of the eKYC verification process, in which biometric data are taken from images, videos, or even speech. It analyzes this information to verify a customer’s identity. In any event, liveness detection looks at micro-expressions, analyze skin textures, and spot signs of a spoofed image or deepfake attack.

Document Verification

A Document Check can verify whether a presented document might be compromised, forged, copied from the internet, expired, or blacklisted. Using Optical Character Recognition (OCR) technology, document checks can take all available data from IDs, passports, and other key documents. For the most part, OCR extracts data, processes documents in real-time, and finds anomalies to ensure compliance with regulatory standards.

Key Takeaways

The global eKYC market is looking to reach $2.46 billion by 2030.

Businesses lose around 5% of annual revenues to fraud each year.

Businesses must move through complex and varying electronic KYC regulations across regions.

Effective eKYC verification mixes biometric authentication with document verification.

The right eKYC solution helps businesses grow safely and stay compliant.

eKYC Verification with ComplyCube

In summary, ComplyCube is an award-winning eKYC solution provider. From TrustRadius in their ‘Best Of’ awards category, to their inclusion in the RegTech100 list, to achieve a Momentum leader status by G2 for multiple categories within their latest report, and more. Their state-of-the-art compliance platform gives market-leading eKYC solutions, including document and identity checks, that and protect global businesses.

Sooner or later, you will need a eKYC provider. Come to ComplyCube and check out the broad range of global eKYC solutions. Alternatively, get in touch with an electronic KYC/AML specialist to talk about what a tailored eKYC solution could look like for you.

Frequently Asked Questions

What is eKYC verification and how does it work?

eKYC verification is a digital identity verification process that replaces manual, paper-based checks with AI-powered solutions. It uses biometric authentication, liveness detection, and document verification with OCR technology to verify customer identities quickly and accurately.

What are the eKYC regulatory requirements in the United States?

In the US, businesses must comply with several regulations supporting eKYC verification, including FINRA Rule 2090, Section 326 of the USA Patriot Act, and the Bank Secrecy Act, which collectively mandate thorough customer identification and due diligence processes.

What electronic KYC regulations apply to businesses operating in Singapore?

The Monetary Authority of Singapore (MAS) requires financial institutions to implement eKYC solutions to prevent money laundering and terrorism financing, mandating identity verification across multiple channels and enhanced due diligence for high-risk customers.

How do eKYC solutions help businesses combat fraud in the EU?

In the EU, electronic KYC compliance is governed by regulations such as PSD2 and GDPR. Therefore, it requires businesses to implement secure customer authentication and thorough data protection practices to reduce fraud and safeguard customer information.

Why should global businesses choose ComplyCube as their eKYC solutions partner?

With electronic KYC regulations varying across regions, businesses need a trusted partner to stay compliant globally. So, ComplyCube’s eKYC verification platform helps businesses meet regional regulatory requirements, reduce fraud, and scale safely worldwide.