Sanctions screening software is a tool or service built to support organizations in identifying parties listed on official sanctions list. It plays a vital role in ensuring that businesses are not caught up in transactions with sanctioned entities, thus ensuring compliance with regulatory requirements. Sanctions Screening Software plays a key role in Anti-Money Laundering (AML) and is paramount for preventing financial crimes and the risks of legal penalties.

The Importance of Modern Sanction Screening Software

Leveraging screening software is essential for businesses to meet compliance requirements and mitigate sanctions risk efficiently. Compliance software significantly streamlines operations by reducing manual workloads, enhancing real-time detection of potential risks, and minimizing false positives. By automating the screening process, companies can avoid hefty fines, legal action, and even restrictions on business operations.

How Sanctions Screening Software Detects Risks

Modern sanction screening systems are typically integrated into a company’s existing tech stack, allowing them to automatically screen customers, partners, and users against global sanctions lists through automated screening. This integration ensures that all transactions are monitored continuously, providing international organizations with an additional layer of security against potential risks.

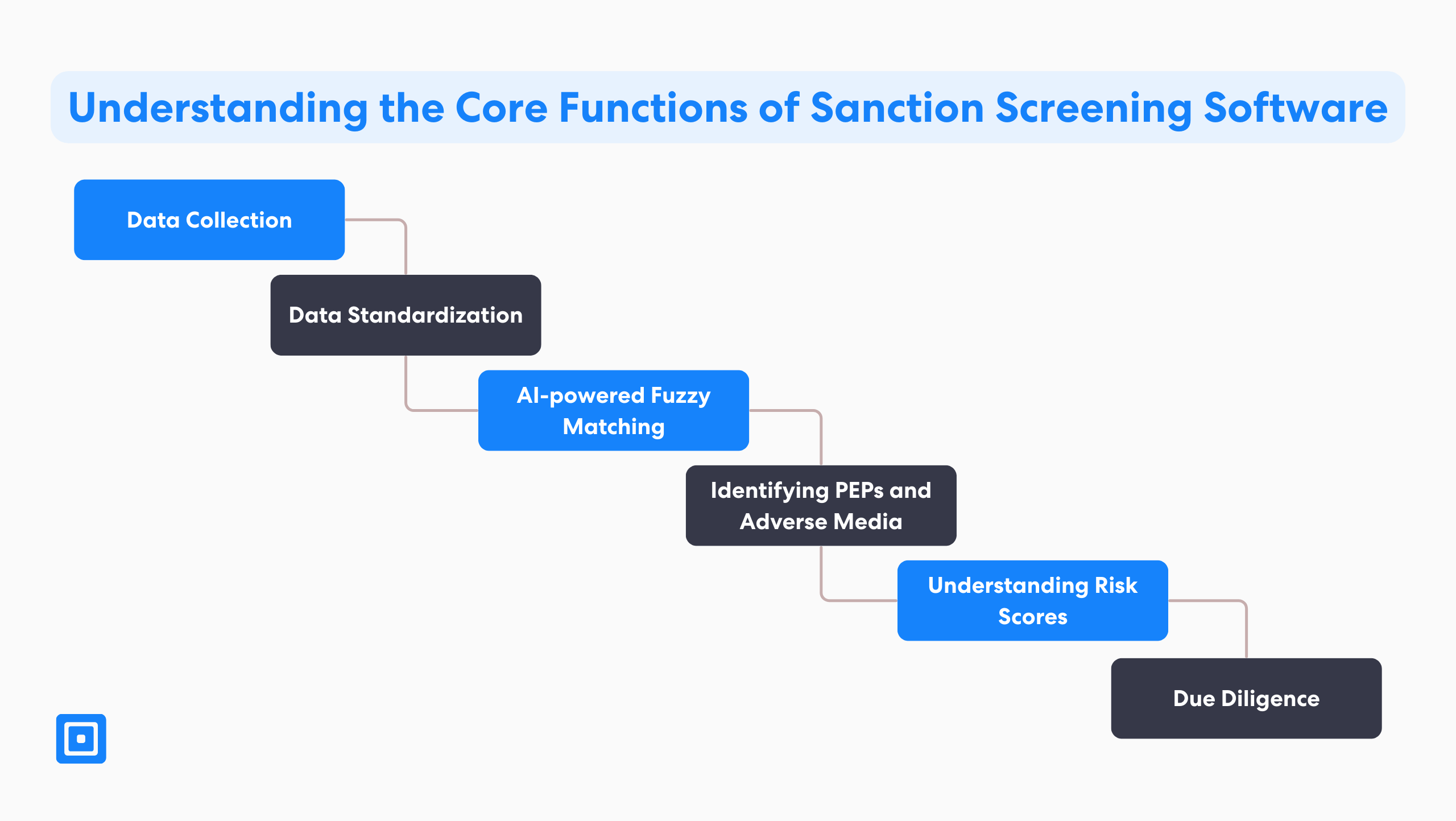

The Mechanics Behind Sanction Screening Software

Sanctions screening is a wider part of the Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) process. Comprehensive screening involves an initial risk assessment, ongoing monitoring, and advanced due diligence to address sanctions breaches, financial sanctions implementation, and sanctions violations enforced by regulatory bodies, such as the European Union, OFAC, and other sanctioning bodies. Let’s look at a detailed example of how it operates.

Data Collection

The first stage is collecting essential information to verify a user’s identity and assess potential risks. This involves the initial screening of documents such as a government-issued ID, passport, bank statements, or utility bills. The documents collected will provide essential customer data and details, including one’s full name, address, date of birth, nationality, and more. In certain cases, additional data can be gathered through facial recognition or biometric verification.

Data Standardization

The customer data then undergoes data standardization, which ensures consistency and accuracy across all records. The process involves converting all information to a uniform format, such as converting names or addresses to upper case and removing special characters to facilitate accurate comparisons against official government sanctions lists. This minimizes any discrepancies that can arise due to spelling and abbreviation variations.

AI-powered Fuzzy Matching

Advanced screening software leverages Artificial Intelligence (AI) and Machine Learning (ML) techniques, such as fuzzy matching, to enhance the accuracy of identity verification. Fuzzy matching enables the system to recognize and account for data variations, including misspellings or transliterations. This ensures that potential matches are not flagged or missed unintentionally due to minor discrepancies.

Identifying PEPs and Adverse Media

A key aspect of sanction screening is identifying politically exposed persons (PEPs) and assessing an individual’s media presence to detect potential risks. The software cross-references global PEP databases, news articles, or other publicly available sources to determine if such individuals have been involved in illegal activities. This real-time screening allows firms to make informed decisions before proceeding with customer transactions and onboarding.

Understanding Risk Scores

The entity being screened will be given a risk score based on the comprehensive data consolidated, such as the closeness of the name match or data credibility. A higher risk score indicates a greater likelihood of non-compliance or financial crime exposure. Compliance officers can set alerts to determine the validity of the data proposed and choose to report the party or pass them through the onboarding stage.

Due Diligence

Due diligence refers to monitoring a customer’s transactions or behavior. Since sanctions lists and risk factors are prone to frequent changes, it is essential to implement ongoing monitoring should any risks arise over time. Utilizing screening software enables businesses to stay up-to-date with any emerging or evolving changes to the sanctions list and watchlist.

The Key Components of Sanctions Screening Software

Sanctions screening solutions can include a multitude of features that strengthen compliance efforts. Here, we’ve compiled the most common terms used and what they mean.

- Sanctions Screening: Cross-references entities against government-issued and international sanctions lists.

- Adverse Media Screening: Flags if an individual or company has been mentioned negatively in media reports, indicating potential risks.

- Politically Exposed Persons (PEPs): Identifies if an individual who holds prominent public positions or is closely related to such individuals. They are considered higher risk due to their potential influence and access to resources.

- Watchlist Screening: A broader term that includes checking a party against various databases, including Sanctions Lists, Politically Exposed Persons (PEPs), and Adverse Media Lists.

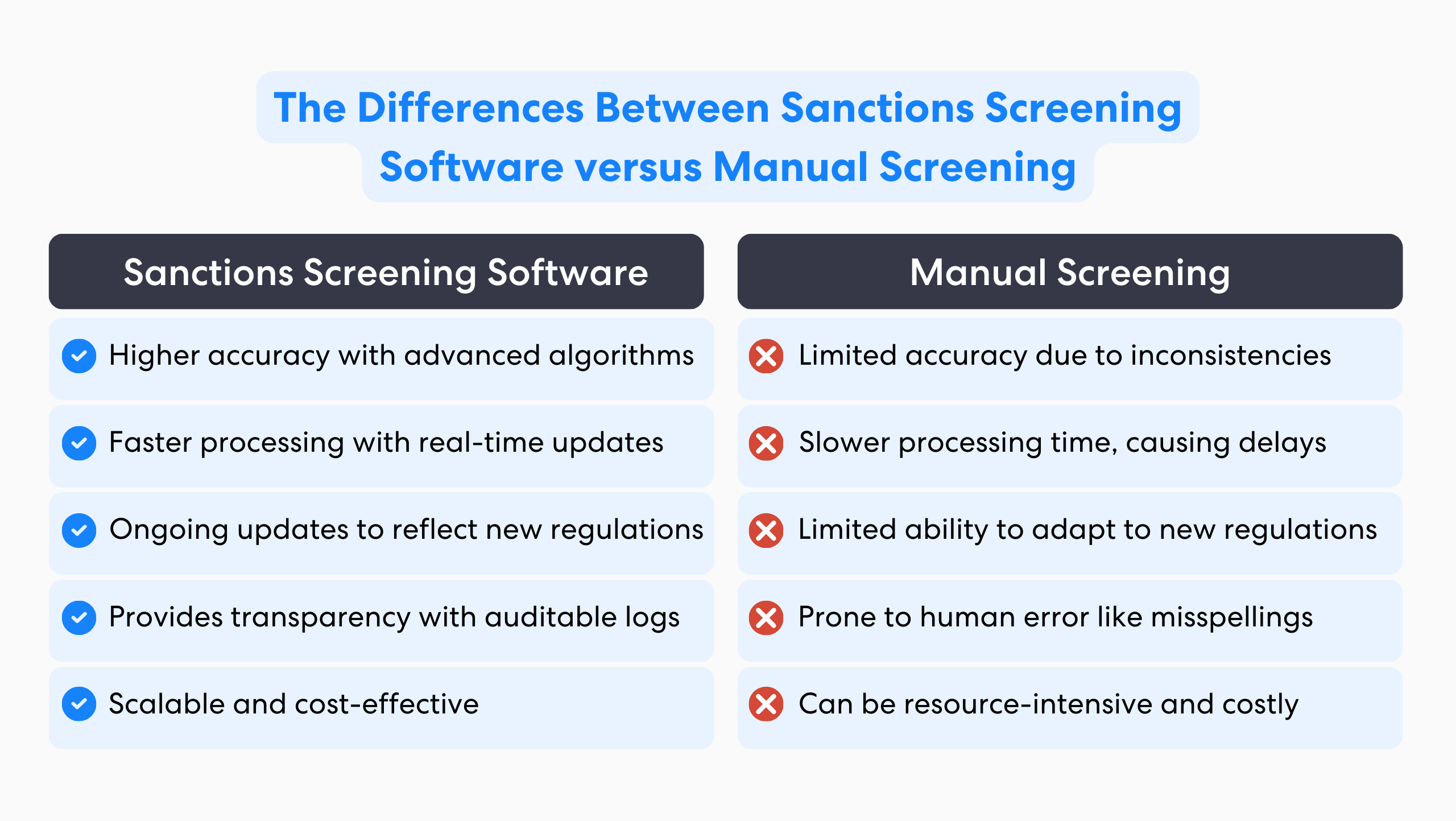

Sanctions Screening Software versus Manual Screening

Historically, companies relied on manual screening methods, which are time-consuming and prone to human error. Modern compliance software, such as ComplyCube’s all-in-one platform, offers a more efficient alternative for international organizations to manage risk and maintain compliance.

Reducing False Positives

One of the most significant challenges in sanctions screening is managing false positives, which refer to instances where legitimate entities are incorrectly flagged. In this context, ComplyCube uses sophisticated proprietary AI and algorithms to screen users across a myriad of touchpoints, enabling accuracy and consistency in verification.

Advanced Machine Learning and Natural Language Processing

Compliance software leverages advanced technology and extensive databases involving artificial intelligence and machine learning to help businesses better match names, handle linguistic variations, and analyze complex data sets more effectively. The results include faster transaction processing times, reduced delays, and enhanced customer experience.

Global Coverage

Screening software enables businesses to comply with regulations across a multitude of different jurisdictions. Given the constantly evolving nature of global sanctions and regulatory requirements, these tools provide access to updated comprehensive databases that reflect the most recent changes to sanctions lists worldwide.

Enhanced Due Diligence and Risk Management

Businesses are empowered to make informed decisions through a systematic and auditable trail of activities, making compliance accessible, transparent, and efficient. Additionally, real-time updates and notifications of a customer’s changed status can be accessed, allowing businesses to proactively mitigate risks before they escalate.

Tailored Solutions

Another significant advantage of screening software is its flexibility. It allows organizations to customize their compliance workflow to fit their unique needs. Many platforms provide low-code or no-code options, APIs, and CRM integrations, allowing firms to adjust screening parameters according to their risk appetite and regulatory requirements.

The Hefty Costs of Ignoring Sanctions

Any organization that fails to implement secure sanctions screening and anti-money laundering measures can face severe regulatory penalties, monetary damages, and reputational risk. Businesses across industries, including financial institutions, tech, hospitality, or retail, can be penalized for engaging with sanctioned parties. The damages can range from million-dollar fines to having their operations completely halted. Some of the most significant cases involve major financial institutions facing substantial consequences due to inadequate sanctions screening.

The Sanctions Slip-ups at Starling Bank — 2024

In 2024, the leading finance firm Starling Bank was fined a massive £28.96 million by the UK’s Financial Conduct Authority (FCA) for its shortcomings in its anti-money laundering and financial crime sanctions screening process. The bank had used an outdated system, screening only a fraction of the full sanctions list since 2017. This led to over 54,000 bank accounts being opened for 49,000 high-risk customers who were able to make financial transactions between September 2021 and November 2023.

Barclays Under Anti Money Laundering Scrutiny — 2025

Barclays, the banking giant, previously faced a £72 million fine in 2015 for failing to manage financial crime risks related to ultra-high-net-worth politically exposed persons (PEPs). The company is now facing a second financial crime investigation in just under three years for its weak implementation of robust identity verification and screening of customers. Get the complete information here.

TD Bank’s Record-Breaking Fine — 2024

Just last year, TD Bank was fined nearly C$9.2 million by Canada’s anti-money laundering agency. This is a first look at a case of this scale in Canada. The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) found that the bank had failed to submit suspicious transaction reports for high-risk clients and did not document money laundering and terrorist financing risks, highlighting the importance of regulatory compliance.

In today’s ever-changing sanctions landscape, financial institutions must stay ahead of evolving sanctions screening requirements to protect the financial system and prevent financial crimes such as money laundering and terrorist financing. With stricter enforcement from regulatory bodies like the European Union, OFAC, and other sanctioning bodies, businesses need reliable sanctions screening solutions to manage risk and avoid significant penalties.

Safeguarding Businesses with Enhanced Sanction Software

Beyond the financial institution industry examples above, navigating global sanctions programs is essential for ensuring compliance with international regulations. Effective sanctions screening solutions are vital to help detect sanctioned entities, high-risk individuals, and politically exposed persons, mitigating financial crime risks and prohibiting illicit activities. As regulatory bodies stricten compliance requirements, organizations must adopt enhanced due diligence and alert management to prevent sanctions breaches and reduce false positives.

Automated compliance platforms, such as modern sanction screening software, enable firms to quickly onboard clients and make secure financial transactions while managing risks associated with high-risk individuals and sanctioned entities. Solutions like ComplyCube support financial institutions in screening sanctions, performing initial risk assessments, and ensuring compliance with financial sanctions, trade restrictions, and international regulations.