London, Jul 5, 2023 – ComplyCube, globally recognized for its identity verification solutions, has officially unveiled ARC™ (Accelerate Revenue with ComplyCube), a multifaceted partnership program designed to level the playing field in the Anti-money Laundering (AML) sector. The initiative empowers partners to speed up their go-to-market strategies, capitalize on their networks’ revenue-generating capabilities, and engage with a vast, worldwide audience.

Accelerate Revenue with ComplyCube

ARC™ exhibits ComplyCube’s commitment to fostering trust at scale, as CEO Dr. Tarek Nechma expressed.

Our team has invested significant effort to ensure that ARC™ stands out as the most beneficial partner program. It’s crafted to catalyze members’ growth at an unparalleled speed while upholding stringent global compliance standards.

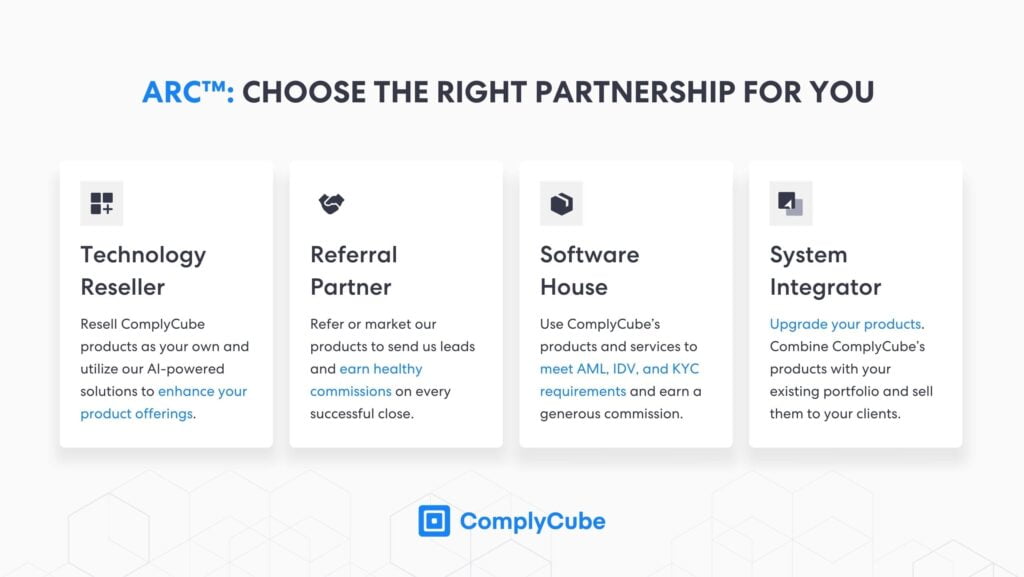

The initiative offers a variety of collaborative avenues, providing options to engage as a Technology Reseller, Referral Partner, Software House, or System Integrator, contingent on the partner’s business model and market strategy.

The Benefits of Joining ARC

ARC™ provides members with an opportunity to unlock an impressive array of advantages. At its core, the program features an enticing referral scheme designed to reward collaboration while presenting partners with opportunities for global expansion, an invaluable asset in today’s increasingly interconnected business landscape. Complementing these opportunities, the initiative delivers access to consultations with industry specialists, promising insights and guidance from seasoned professionals.

Moreover, ARC™ supports partners’ business architecture, helping to streamline operations and augment efficiency. A vital feature of the program is the provision of an all-in-one, secure, and GDPR-compliant KYC solution that simplifies due diligence. The effortless integration, first-class support, and highly scalable, resilient, and enterprise-grade security system further reinforce the promise of growth and security for partners.

Partner Focus

ComplyCube’s Commercial Director, Benjamin Davies, points out that their comprehensive verification platform is a critical tool for partners. It elevates the customer experience, ensures regulatory compliance, and fuels revenue growth.

Our partners depend on us to add value to their brands, products, and services, opening up fresh pathways for expansion.

He also underscores the indispensable contribution of partner insights in sculpting ARC™, a purpose-built scheme designed to accelerate growth and optimize return on investment.

Following closely on the successful rollout of ComplyCube’s competitive Startup Program — a scheme offering qualifying companies up to $50,000 in credit — this new partnership initiative reinforces the company’s steadfast dedication to nurturing and bolstering businesses across the board. This move showcases the SaaS platform’s unwavering support towards enterprises of varying sizes. For further details and to benefit from this opportunity, visit www.complycube.com/partner-program.

About ComplyCube

ComplyCube is an award-winning SaaS & API platform that offers innovative solutions for Identity Verification (IDV), Anti-Money Laundering (AML), and Know Your Customer (KYC) compliance. Its broad customer base covers multiple sectors, including financial services, transport, healthcare, e-commerce, cryptocurrency, FinTech, telecoms, and beyond, positioning ComplyCube as a frontrunner in the global IDV arena.

The ISO-certified platform stands out for its speed in omnichannel integration and the breadth of its services. It offers a suite of Low/No-Code solutions, robust API, Mobile SDKs, Client Libraries, and seamless CRM integrations.

Learn more at www.complycube.com.