Anti-Money Laundering (AML) screening is a significant aspect of the UK financial landscape, particularly for accountants with immediate access to customers’ financial information. Screening against money laundering, fraud, and terrorist financing is a fundamental aspect in protecting businesses against exploitation for criminal purposes. With stringent regulations surrounding every move, accountants must exercise caution and adhere to such regulations to guarantee the healthiness of the financial system. In this guide, we’ll explore the importance of AML checks for accountants UK, the key regulations to be aware of, and the steps accountants should take to ensure compliance.

What Are AML Checks?

AML screening is a KYC process aimed at detecting and discouraging money laundering activities. Money laundering is making illegally obtained proceeds appear legal. It typically consists of three stages: placement (depositing illegal money), layering (concealing the illegal source of money), and integration (making the illegal money appear legal).

For accountants, this means they must do due diligence on their clients, their clients’ transactions, and even, in some cases, their clients’ customers, to ensure that the funds flowing through the financial system are not from crime.

Each firm’s AML compliance also needs to be unique.

David Winch, the AML & Onboarding Adviser at MLRO Support Ltd, argues, “Each accountancy firm is unique – not least because the partners in it have a unique experience, knowledge, and interests,” said Winch. “In my opinion, each firm’s AML compliance also needs to be unique.” For more on UK AML regulation, read “Achieving Compliance: UK AML Regulation.”

Why Are AML Checks Important for Accountants?

Since they are gatekeepers to the financial system, accountants have an excellent opportunity to report suspicious transactions. Non-compliance with AML regulations can be extremely costly for accountants and their firms, such as hefty fines, loss of reputation, or even prosecution. In doing so, accountants are not only helping preserve the integrity of the financial system but also keeping themselves from being a passive facilitator of illicit activity.

UK Accountants’ Key AML Legislation

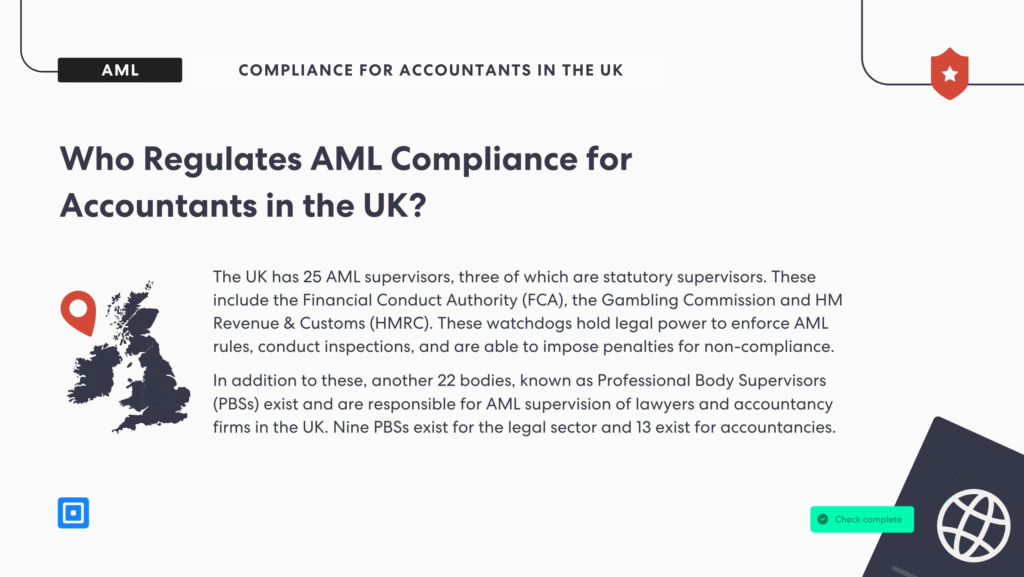

The UK boasts a robust anti-money laundering regime, based on a risk-based approach, and it is crucial that accountants know which specific legislation applies to their practice. Some of the key acts are listed below:

1. The Proceeds of Crime Act 2002 (POCA)

The POCA forms the basis of UK anti-money laundering. It criminalizes money laundering and establishes the obligations of UK businesses, including accountants, to report suspicious transactions.

2. The Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017

These regulations, more commonly referred to as the “MLR 2017,” set the detailed requirements of the regulated business entities, i.e., accounting firms. They prescribe requirements such as Customer Due Diligence (CDD), record-keeping, and reporting of suspicious transactions.

3. The Terrorism Act 2000

This legislation renders financing terrorism a crime, and accountants need to be sensitive to the possibility of clients’ terrorism finance involvement.

4. The Criminal Finances Act 2017

This legislation established new corporate crime offences for the inability to prevent the facilitation of tax evasion, an additional burden on accountants and their firms. This law made important amendments to the Proceeds of Crime Act 2002, Terrorism Act 2000 and the Anti-terrorism Crime and Security Act 2001.

The Criminal Finances Act 2017 introduces consequences that are far more severe for businesses who facilitate this criminal activity. The UK government states that, “CFA 2017 introduces corporate criminal offences of failing to prevent tax evasion which may apply to businesses who facilitate this criminal activity. This means that businesses can be criminally liable where they fail to prevent those who act for, or on behalf of, the business from criminally facilitating tax evasion.”

AML Obligations for Accountants

Accountants are required to comply with several key requirements in the UK’s anti-money laundering legislation. These include:

1. Customer Due Diligence (CDD)

Before entering into a business relationship or for certain transactions, accountants will be required to conduct CDD on their customers. This involves identifying the customer, verifying their identity, and identifying their business. For high-risk customers, there is the possibility of needing enhanced due diligence (EDD).

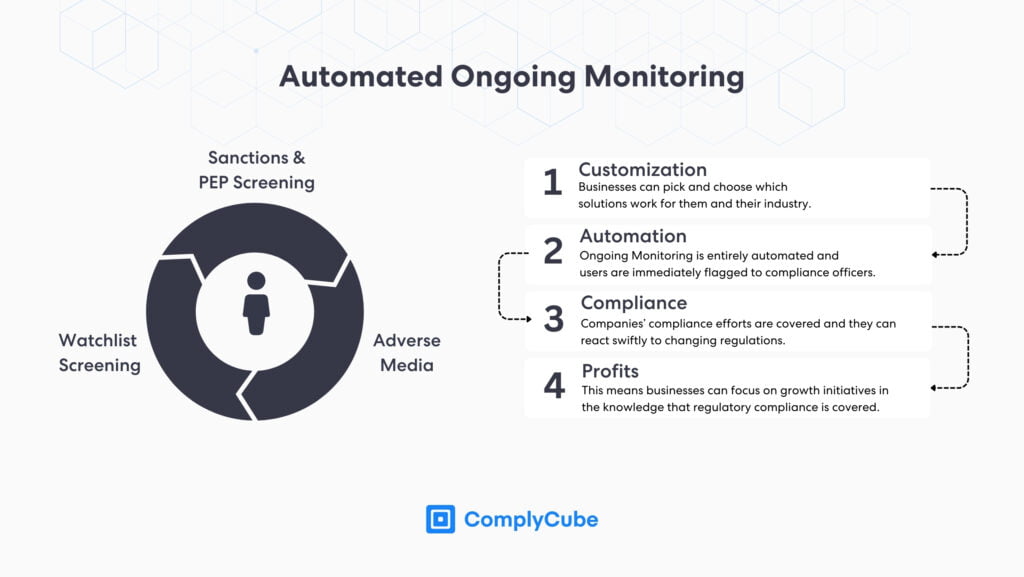

2. Ongoing Monitoring

AML rules necessitate accountants to always keep a check on their clients’ transactions to verify that they are aligned with what is known regarding the client and business. Suspicious or unusual transactions need to be identified and reported.

3. Record-Keeping

Accountants must retain their AML screening for a minimum of five years. This must include all their records on CDD, transactions, and the reports to the authorities.

4. Suspicious Activity Reporting (SAR)

If there is any suspicion that an accountant’s client is involved in money laundering or terrorist financing, the accountant is required to file a SAR to the National Crime Agency (NCA). Criminal liability will be attracted if this is not done.

5. Training and Awareness

Accountants must ensure their staff are regularly trained in AML procedures and comprehend what their responsibilities are to report and identify suspicious transactions. This is an essential part of building a compliance culture within the firm.

6. Independent Audits

Firms are required to conduct independent audits of their AML procedures to guarantee efficacy and adherence to the rules. This guarantees that loopholes within the process are addressed as soon as possible.

The Role of Technology in AML Checks

The modern era of technology has revolutionized the implementation of AML checks. Most accountancy firms employ technology to aid in customer identification, risk management, transaction monitoring, and reporting. AML software facilitates many parts of the process to be automated, thus being more accurate and efficient.

For example, digital verification software for identification may automate the CDD process by instant verification of clients’ details from government records and biometric data. Transaction monitoring systems may also flag an activity based on predetermined parameters, enabling accountants to recognize red flags with simplicity.

Challenges in AML Compliance for Accountants

Even though the regulatory landscape is clear, AML compliance can be challenging for accountants. Some of the key challenges are:

1. Resource Shortages

Small accounting firms may not have the resources to implement effective AML procedures, and thus they fail to comply. Training and automation tools become more essential for small firms in such a scenario.

2. Complicated Clients and Transactions

For accountants handling foreign clients or high-risk industries, it is not always easy to make an objective judgment of the validity of transactions. This is particularly the case when handling advanced financial products or cross-jurisdictional transactions.

3. Staying Ahead of Evolving Regulations

AML regulations keep evolving, and accountants must be up-to-date with any modifications to stay compliant. It is a matter of ongoing learning and the adoption of new technologies to stay in accordance with regulations.

Anti-money laundering screening is a significant responsibility for accountants in the United Kingdom. It is high-risk, and non-compliance could lead to severe consequences. By being aware of the key regulations and proactive implementation of robust AML controls, accountants are able to safeguard the integrity of the financial system as well as maintain their own business safe from the risks of money laundering.

Leverage Robust AML Checks for Accountants UK

Adopting the right KYC and AML infrastructure can enhance your customer due diligence process and overall AML compliance. Financial crime is at an all time high, and money laundering regulations continue to tighten for accountants, meaning that those without advanced AML and KYC solutions will face consequences in the long run. If you’re looking to fortify your operations with advanced AML infrastructure, get in touch with one of our compliance experts today.