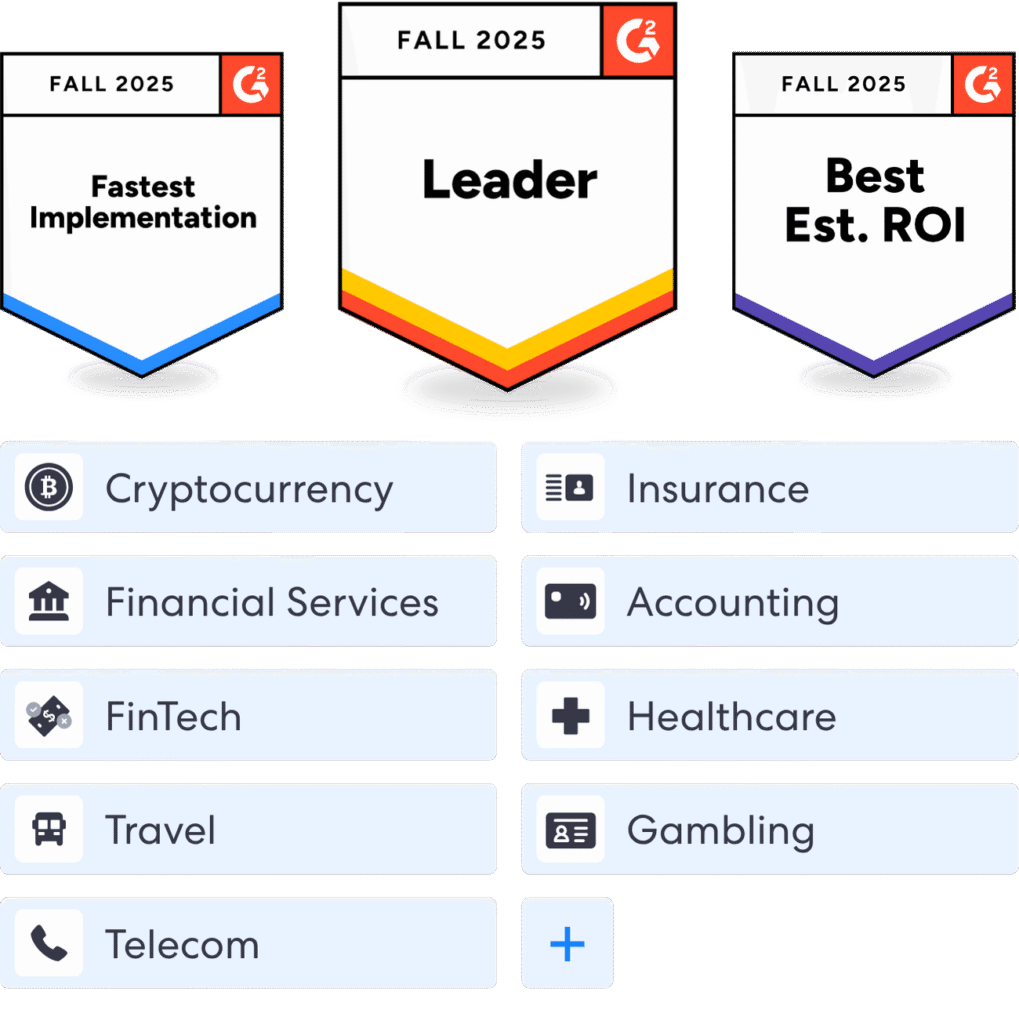

Robust risk signals

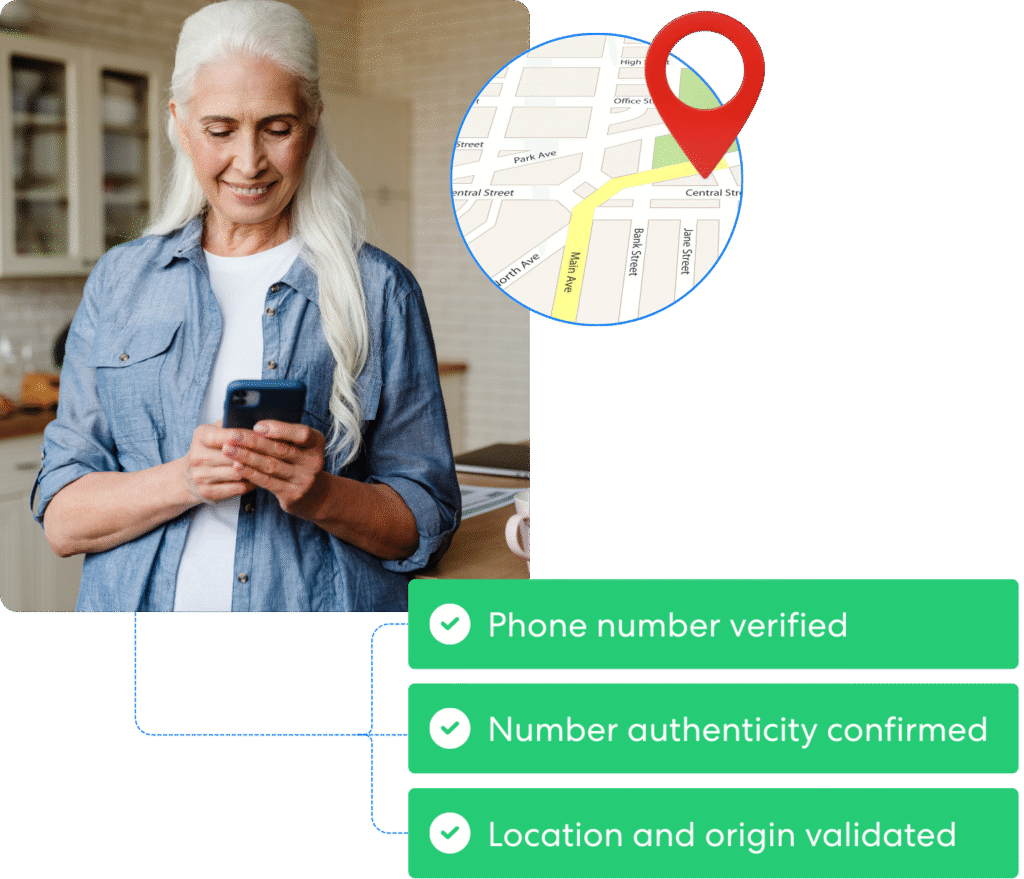

Onboard low-risk customers easily

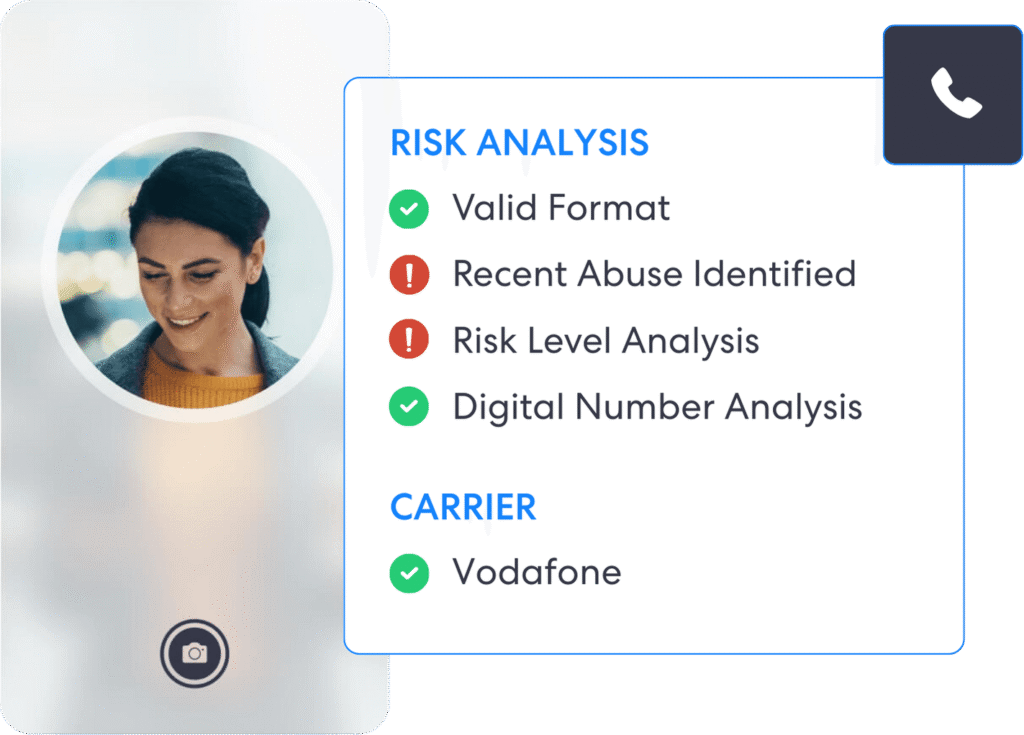

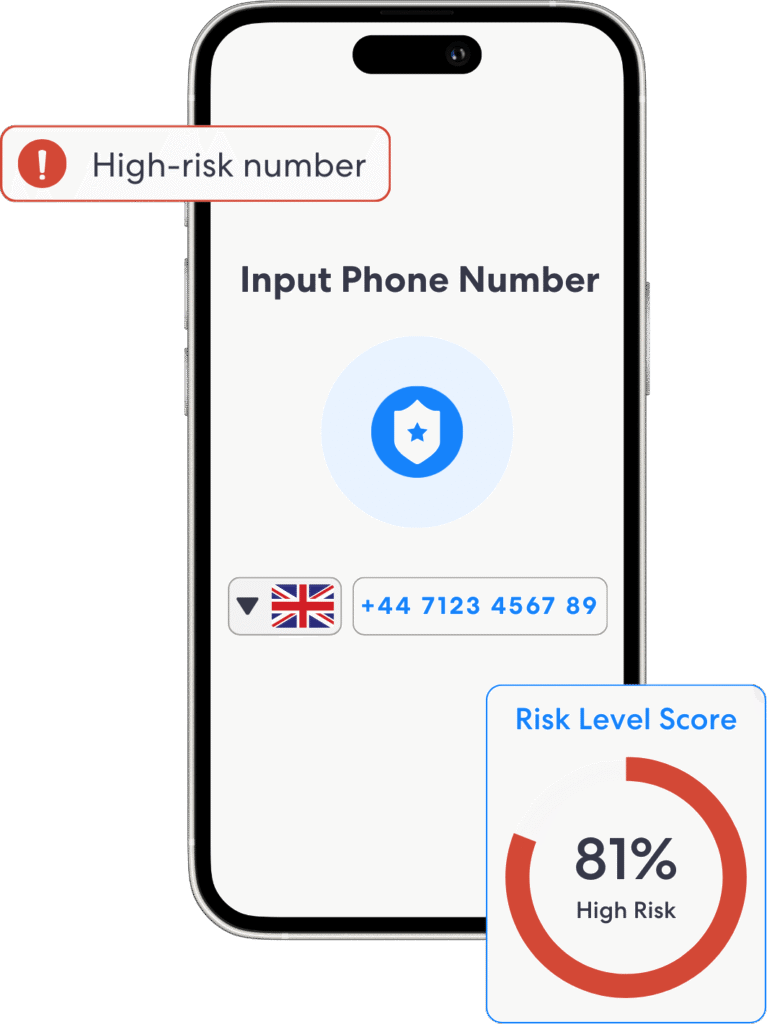

Enhance phone number identity verification with granular insights, including carrier risk, number hygiene, porting history, and geolocation consistency. Achieve aggregated risk scores to detect suspicious patterns and identify fraudulent numbers quickly. Instantly evaluate fraud likelihood, boost conversions and reduce costs.