LONDON, FEBRUARY 11, 2026 – As synthetic identity fraud accelerates, generative AI has made deception easier to scale. Even today, The Federal Reserve repeatedly flagged synthetic identity fraud and financial institutions attribute over 40% of onboarding fraud to synthetic or identity‑related attacks. In response to this urgency, ComplyCube launched a no‑code KYC workflow tool, also known as a KYC workflow orchestration tool. It helps compliance teams create, deploy, and orchestrate KYC workflows without engineering bottlenecks.

That “why now” pressure is not limited to just banks. Fraud journeys increasingly start off-platform and regulators are steadily raising expectations for demonstrable, auditable controls across onboarding and account lifecycle decisioning.

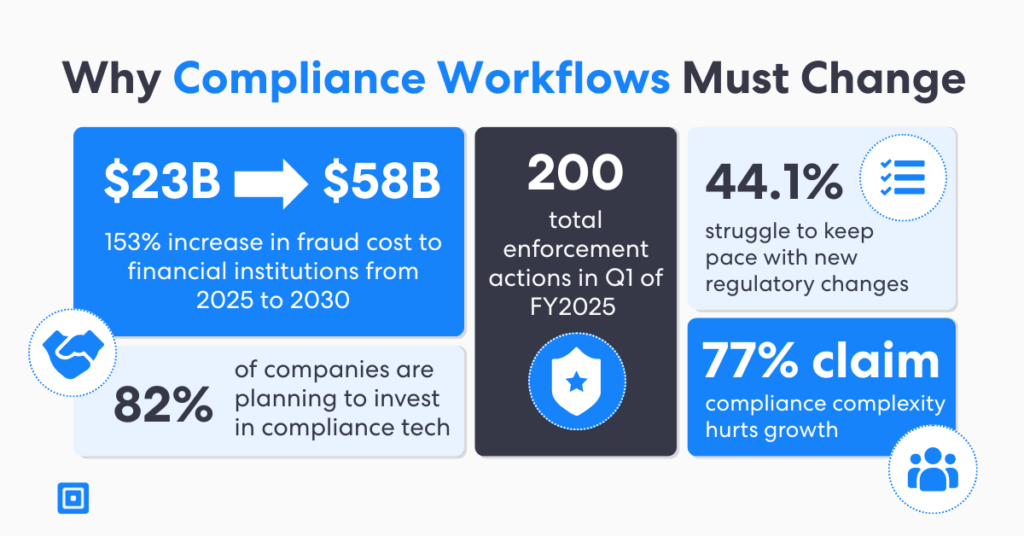

Why Compliance Workflows Must Change

Traditional onboarding systems are fragmented and inflexible, making it difficult for compliance teams to maintain consistency and speed at scale. Without unified KYC workflow tools, verifying customers often requires patching together different services and relying on engineering to adjust workflows slowing response times to regulatory changes and emerging fraud risks.

Critically, today’s scams originate outside of onboarding flows. According to Juniper Research reports that global fraud losses to financial institutions were forecast to rise from $23B in 2025 to $58.3B by 2030. That’s a rise of 153% in five years. That trend means that controls can’t remain static or siloed if any threats are multi-channel and fast-moving.

The most common challenges include:

- Rising synthetic identity fraud, which requires additional verification steps

- Manual reviews and delays, leading to customer drop-off and operational overhead

- Disjointed logic across products and markets, increasing compliance risk

Moreover, addressing these issues means giving teams greater control over their KYC workflow orchestration. Then, when teams can design and update onboarding logic themselves, they’re no longer dependent on engineering backlogs or lengthy release cycles. This autonomy accelerates time-to-market for new rules or risk strategies. As a result, it ensures that verification flows remain consistent, compliant, and responsive to emerging threats.

Real-Time KYC Workflow Tool for Structured Identity Journeys

In a report from KPMG, 34% of CCOs say that new regulatory requirements are the greatest compliance challenges over the next two years. ComplyCube’s drag-and-drop KYC workflow tool brings together identity checks, fraud signals, and decision logic into one orchestrated flow. This enables compliance teams to design and launch structured KYC processes tailored to risk tiers, user types, or jurisdiction-specific rules. It allows for quick updates when guidance or threat patterns for change.

Teams can:

- Define escalation paths using dynamic risk signals

- Map identity, AML, and fraud checks into a single journey

- Update workflows instantly in response to changing regulations

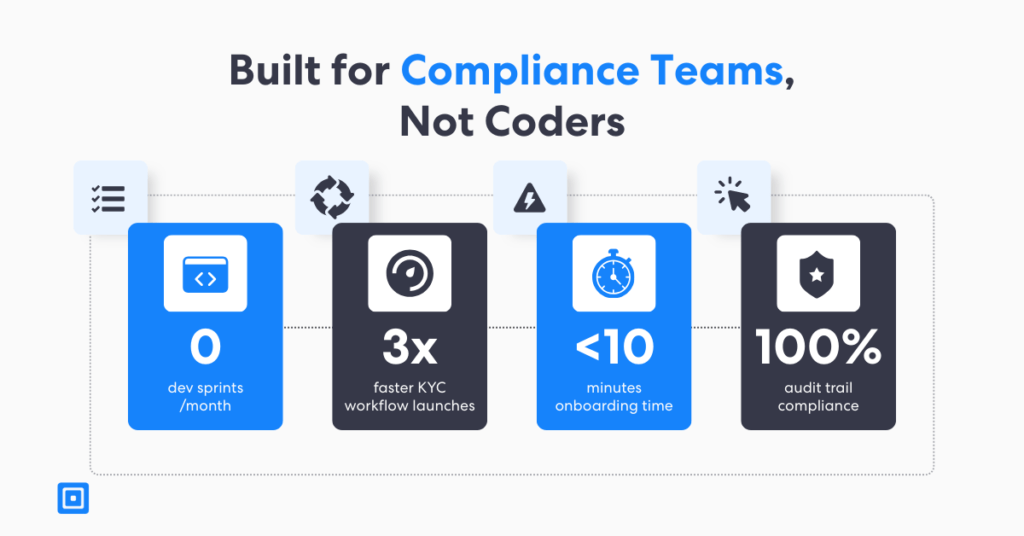

This reduces reliance on engineering. A KYC workflow tool can empower compliance leads to adapt onboarding journeys faster. It enables faster responses to regulatory change while improving operational efficiency. This maintains alignment with internal policies and legal requirements. This KYC workflow orchestration tool also aligns with broader direction of industry guidance by building layered controls, improving detection and strengthening operational readiness as synthetic identity fraud evolves.

KYC Workflow Tool Consistency Without Engineering Bottlenecks

Across the world’s biggest compliance markets, KYC workflow orchestration is being pushed to public infrastructure. The EU is simultaneously hard-wiring a continent-wide digital identity regime (eIDAS 2.0) and rolling out a single AML rulebook. It is also bringing in a new central supervisor (AMLA) aimed at harmonising identity assurance and enforcement across borders. Accordingly, the UK moved in parallel, turning its digital identity trust framework into statutory rules from 1 December 2025, effectively setting a legal baseline for reusable digital ID in the private sector.

Soon after, it wasn’t long before the US followed suite, and FinCEN has widened the AML perimeter by bringing investment advisors into the core AML/CFT program and SAR reporting architecture. Without delay, Australia and Canada have advanced regulatory upgrades that expand and modernize AML obligations. This change is happening everywhere.

As a result, maintaining consistent onboarding experiences across platforms and regions is difficult when each flow relies on hardcoded logic. For example, ComplyCube’s no-code KYC workflow orchestration tool gives compliance professionals the ability to update customer journeys directly ensuring policy alignment without developer intervention.

With this in mind about self-service approach, teams can:

- Deploy region- and product-specific flows that enforce global standards

- Ensure uniform application of checks for different risk profiles

- Implement changes immediately, controlling their own release governance

Workflows are about giving compliance teams the controls they need to move faster.

Chief Product Officer at ComplyCube, Harry Varatharasan goes on to say, “Our KYC workflow orchestration tool lets teams build and update workflows in real time. That agility helps teams stay compliant while delivering more efficient onboarding.”

Full Audit Trails for Operational Oversight

Each KYC workflow orchestration is executed as a single session that captures every verification step and decision in real time. This organised structure supports clearer audits, simplifies investigations, and gives compliance teams better visibility into how identity checks are performing. Furthermore, this is important as fraud losses continue to rise and oversight expectations evolve.

These sessions include:

- Timestamps and event logs for each decision point

- Escalation paths and reason codes tied to outcomes

- Structured records for internal reviews and regulatory inquiries

By logging each journey from start to finish, ComplyCube helps teams identify friction points. Their KYC workflow tool monitors performance, and fine-tunes workflows to improve pass rates therefore reduce false positives.

Flexible Deployment via API, SDK, or Hosted Flow

To support multiple product lines and user interfaces, ComplyCube’s KYC workflow orchestration tool can create workflows to be deployed across different environments. It ensures that any verification logic remains consistent across all onboarding channels. In either case, whether embedded in mobile apps or hosted externally, organisations can implement workflows through:

- Hosted onboarding flows, ready to launch and customise

- SDKs, to embed directly into web and mobile apps

- APIs, for deep integration with internal systems

In summary, this flexibility allows compliance teams to manage policies centrally. Customising onboarding for different products, user types and requirements ensures every customer journey aligns with internal standards and regulatory obligations.

About ComplyCube

Trusted by over 300 global clients across fintech, telecoms, crypto, government, and financial services, ComplyCube is an award-winning compliance platform. It empowers businesses to design, manage, and optimise onboarding through intuitive visual KYC workflow orchestration tools and developer-friendly APIs. Recognised in the G2 AML Leaders Report and named to the FinCrimeTech50, ComplyCube’s modular suite spans document and biometric verification, sanctions and PEP screening, and dynamic risk logic.