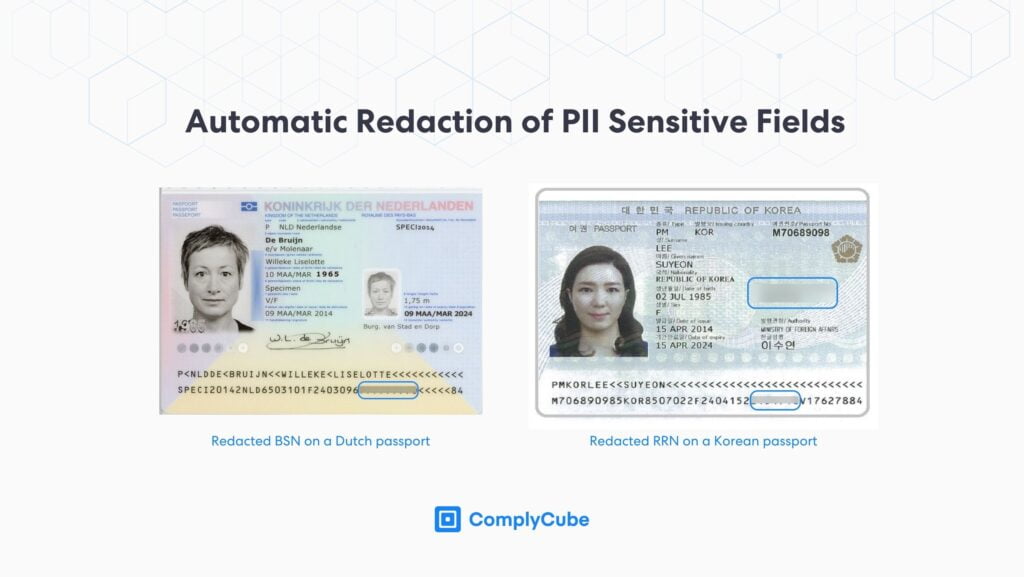

LONDON, AUG 30, 2023 – ComplyCube, the leading AML & KYC SaaS platform, upgraded its Document Checks solution to include automated Field Redaction. This function efficiently obscures sensitive Personal Identifiable Information (PII) such as the Dutch BSN, aiding businesses in adhering to international data privacy regulations without compromising user experience.

Examples of Key Sensitive Fields Eligible for Redaction

Typical Redactable Sensitive Fields Include, but are not limited to:

- Dutch Burgerservicenummer (BSN) or Dutch Citizen Service Number

- Singaporean National Registration Identity Card Number (NRIC)

- Korean Resident Registration Number (RRN)

The National Registration Identity Card serves as the primary ID for those residing in Singapore, concealing sensitive information ranging from financial to criminal records. Each individual has a unique nine-digit NRIC Number, which is required for several services, such as the opening of a bank account. In the Netherlands, the Dutch BSN acts as a unique personal code, streamlining the interaction between its citizens and the government. During customer onboarding, businesses may face delays as users have to manually conceal such sensitive markers.

Balancing Privacy and Compliance

According to a Deloitte study, 71% of businesses anticipate stricter data protection regulations next year. With growing worries about sensitive data, it’s clear that companies should shift from classic encryption techniques to advanced approaches such as redaction for complete compliance.

According to a Deloitte study, 71% of businesses anticipate stricter data protection regulations next year.

Sensitive field redaction balances individual privacy with the need to fulfill global compliance requirements. While regulations such as the Dutch “Wet bescherming persoonsgegevens” (Wbp) and France’s “Loi Informatique et Libertés” emphasize citizen data protection, organizations like FINRA and MiFID mandate thorough record-keeping. By redacting sensitive data, businesses can keep key records, seamlessly merging the objectives of privacy and compliance.

The state-of-the-art AI platform mentioned that document snapshots are immediately subjected to field redaction and data obfuscation upon capture. This means that any instances within the document, even within QR codes, are eliminated or masked. This includes elements such as the Visual Inspection Zone (VIZ), Machine Readable Zone (MRZ), and barcodes. For tailored data management, businesses have the option to set their own field masking guidelines.

Commitment to Excellent UX and Compliance

“Understanding and serving our clients’ diverse requirements is at our core,” emphasizes Tarek Nechma, ComplyCube’s CEO. “Our Premium and Enterprise packages come with superior customization features, allowing users to easily broaden their redaction scope. Our devoted Support and Account Management teams are always ready to guide and fine-tune these processes, ensuring a balance of stringent yet flexible compliance.”

Mohamed Alsalehi, ComplyCube’s CTO, comments, “In our relentless drive for an optimal user experience and unwavering compliance, we ensure that sensitive fields aren’t stored or processed by ComplyCube. This approach not only refines user experience but also makes customer integration smoother, all in line with current privacy standards.” During the Document Check processing, redacted text is masked within the API, Web Portal, and reports.

Redaction of PII data not only refines user experience but also makes customer integration smoother, all in line with current privacy standards.

Following the recent Document Liveness enhancement, ComplyCube’s latest update to its Document Checks solution marks another substantial step in reinforcing user privacy and efficiency. The leading IDV platform asserts that partner businesses can now anticipate an even smoother and more secure experience.

About ComplyCube

ComplyCube is a leading SaaS platform for Identity Verification (IDV), Anti-Money Laundering (AML) & Know Your Customer (KYC) compliance, with a global customer base across financial services, transport, healthcare, e-commerce, cryptocurrency, FinTech, telecoms, and more.

ComplyCube’s ISO-certified platform boasts the fastest omnichannel integration turnaround in the market with Low/No-Code solutions, API, Mobile SDKs, Client Libraries, and CRM Integrations.