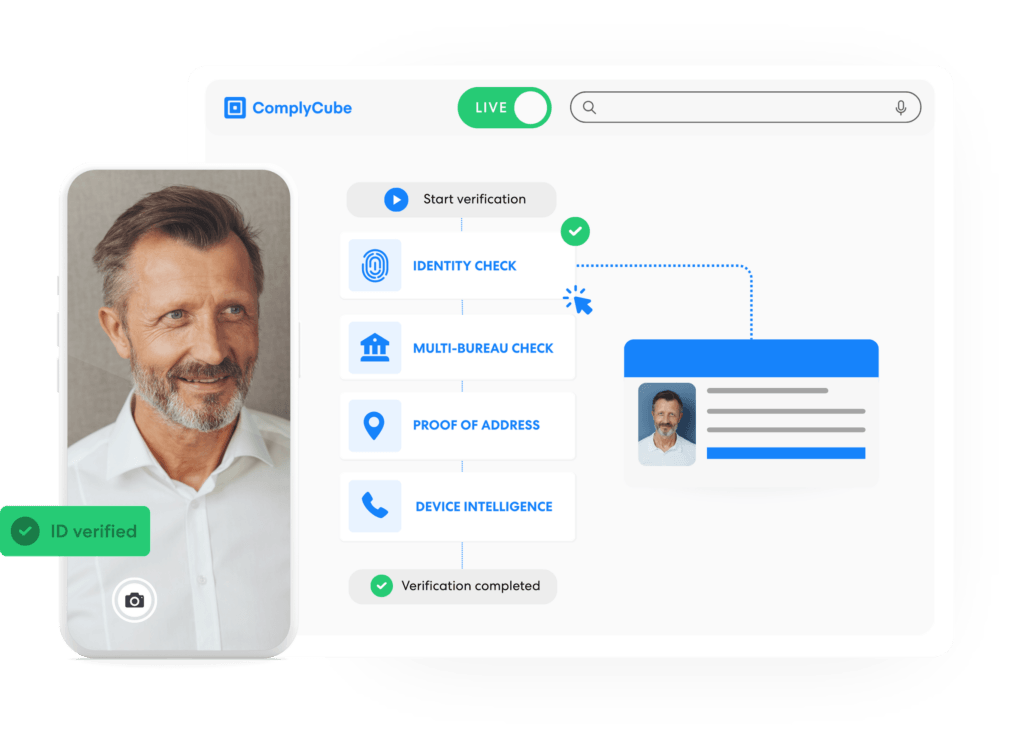

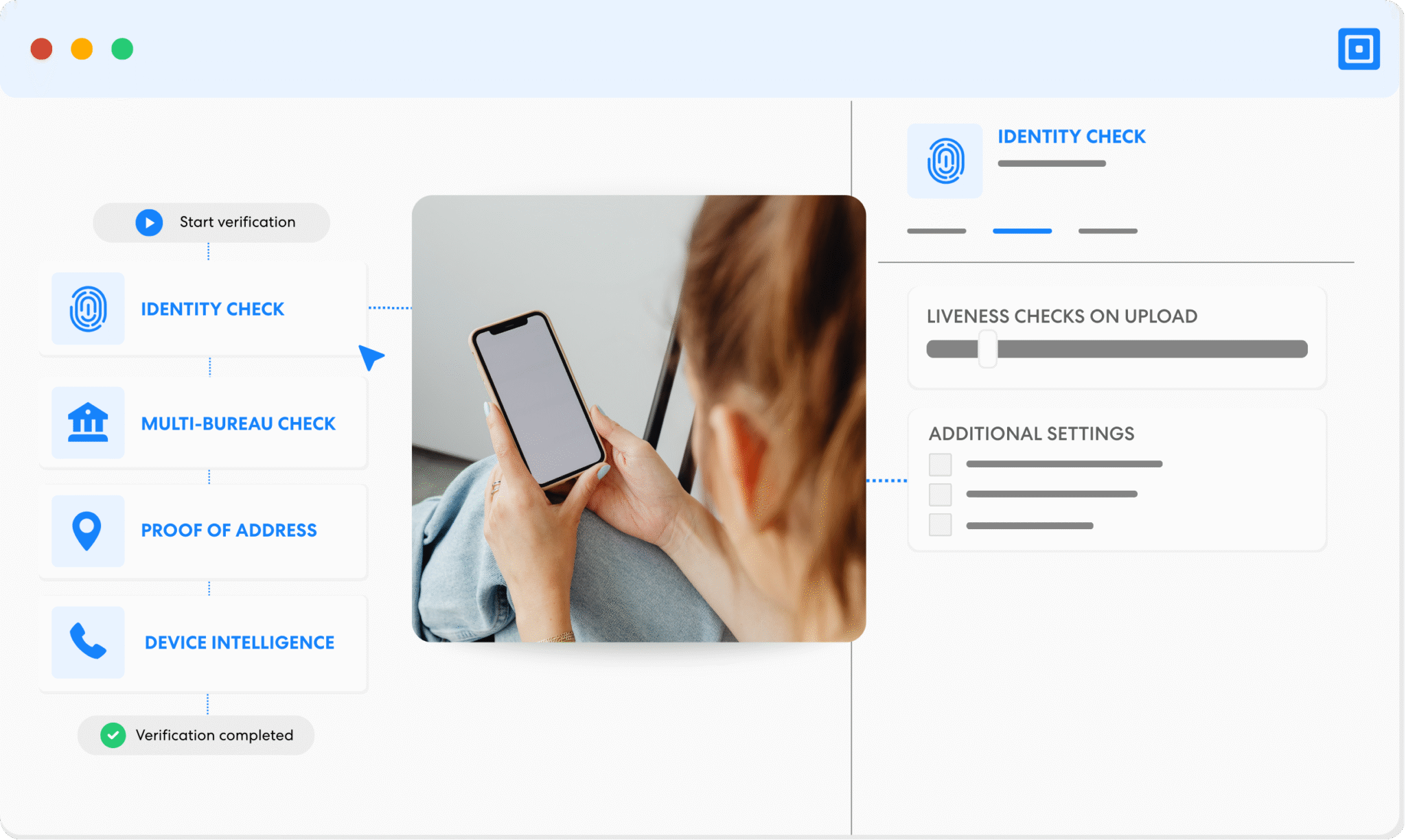

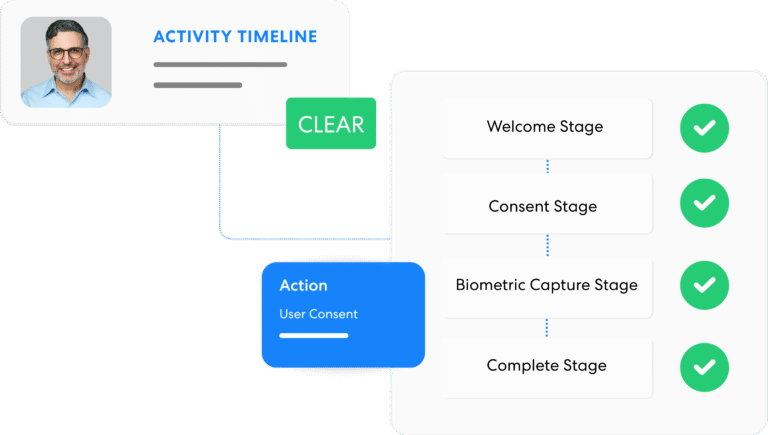

VISUAL FLOW BUILDER

Create and control no-code workflows

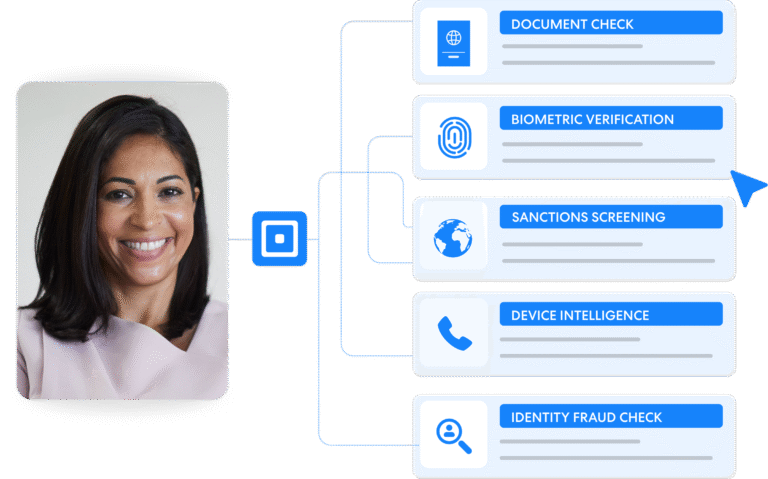

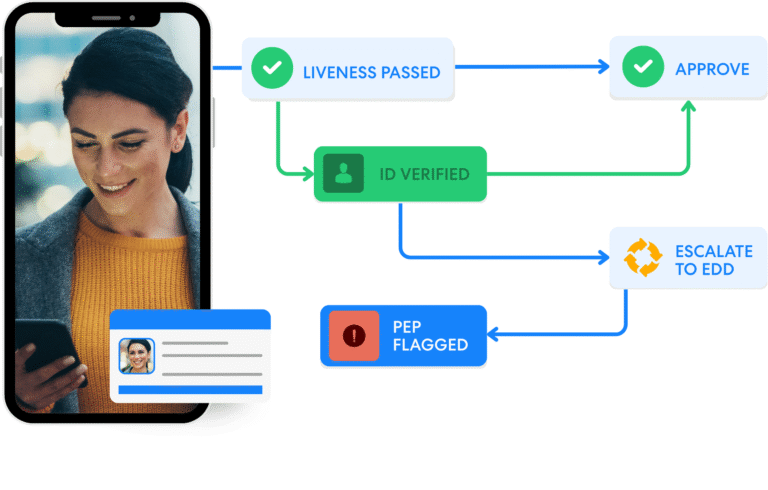

ComplyCube’s no-code workflow builder empowers compliance and operations teams to create, test, and deploy their KYC workflow without writing a single line of code. Using a drag-and-drop flow editor, teams can configure verification flows with document checks, biometric liveness, registry lookups, sanctions screening, and more.