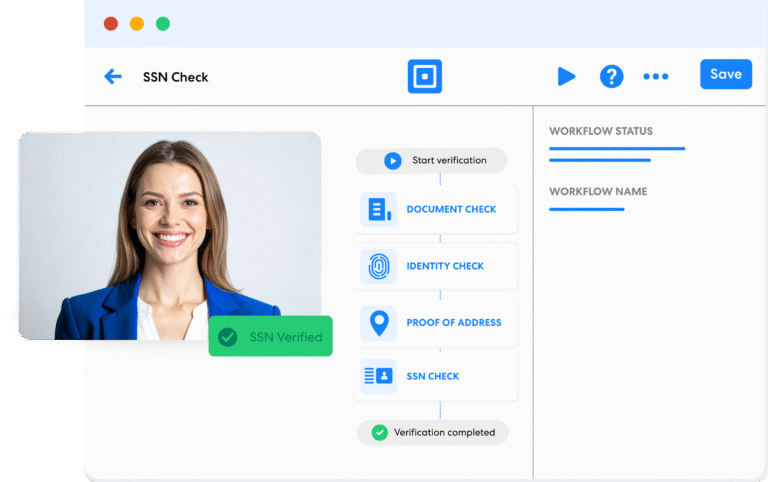

SEAMLESS CUSTOMER ONBOARDING

Verify social security in seconds

Run a focused SSN verification that returns outcomes in seconds. Collect the SSN within your flow, validate structure and issuance instantly. ComplyCube automates the check end to end, keeping users in flow and reducing queue backlogs during peak volumes. The result is faster decisions, fewer retries and a smoother path to approval.