Detect and block fraud at the point of entry

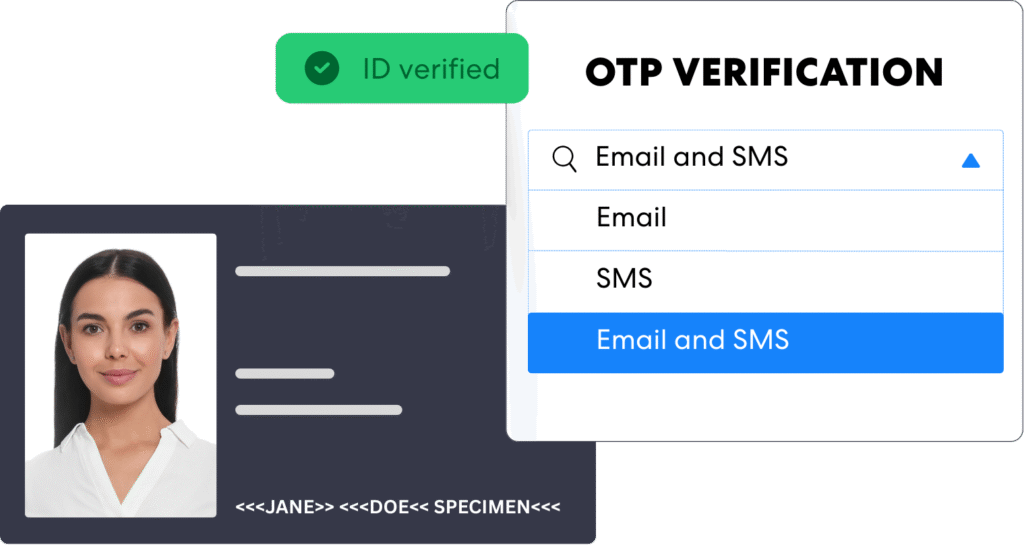

ComplyCube’s SMS verification significantly enhances security by blocking high-impact fraud such as account takeovers, SIM swap scams, and phishing attempts.

With dynamic, time-limited codes, businesses can verify an individual’s real-time access to their phone number or email with minimal intervention.