The two most common challenges faced by scaling Software as a Service (SaaS) and Financial Technology (FinTech) startups include aligning with strict compliance requirements and keeping operational compliance solutions costs low. Thus, selecting the right AML for fast-growing companies is vital to meet regulatory compliance and foster strong customer and investor loyalty. This guide highlights top KYC providers for startups, focusing on fintech compliance tools tailored for companies demanding agility, scale, and speed in compliance.

Why KYC and AML Matter for Startups

Complex compliance regulations are now being enforced on a wider range of industries, not just the financial industry. FinTech and SaaS startups, in particular, are now under scrutiny to implement robust compliance programs to boost money laundering and fraud prevention efforts.

The UK economy is estimated to lose over £100 billion annually to money laundering, underscoring the urgency of robust anti-money laundering measures.

As a result, Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance is no longer optional but foundational to businesses seeking to scale in today’s environment. Leveraging KYC and AML is essential for startups due to several factors:

- Regulatory Scrutiny for FinTech and SaaS Firms

As regulatory bodies tighten their oversight across digital finance and SaaS sectors, startups must implement robust compliance and risk management controls from day one to avoid enforcement actions and licensing setbacks. Startups must focus on ensuring compliance with local and global KYC, KYB, and AML standards to successfully navigate complex regulatory environments. - Risks of Fines for Non-Compliance

Startups failing to meet AML or KYC compliance standards risk severe financial penalties, public reputational damage, and loss of customer relationships and investor trust, all of which can derail growth or trigger operational shutdowns. - Investor and Partner Due Diligence Expectations

Venture capital firms, banking partners, and payment processors increasingly expect early-stage companies to demonstrate strong compliance maturity and dedication to prevent money laundering and other financial crime. Without this commitment, startups lose out on funding, integrations, or distribution channels.

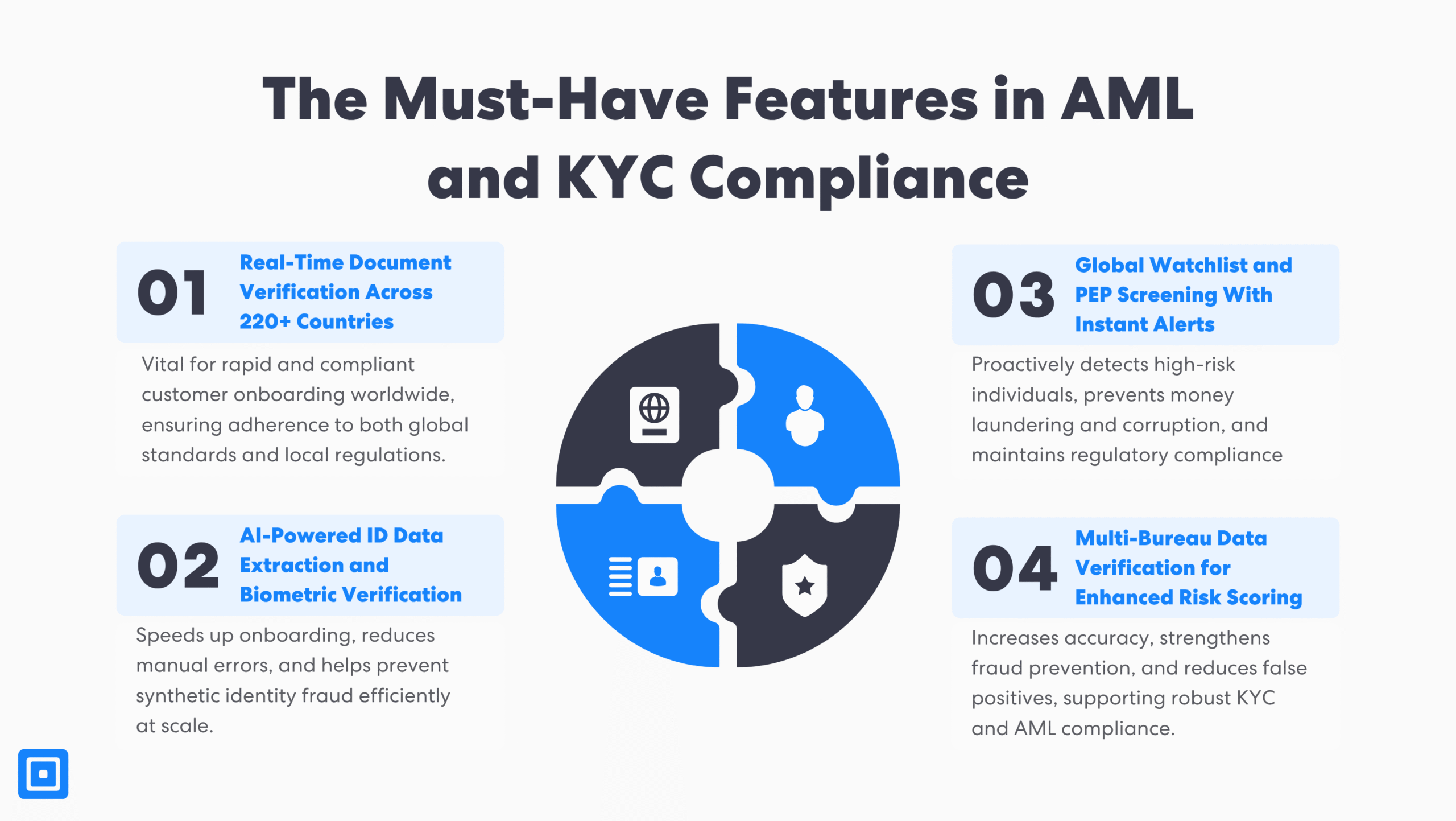

Must-Have Features in AML and KYC Compliance Solutions

Unlike traditional financial institutions, SaaS and FinTech startups must avoid manual processes such as running basic identity checks. Verifying a customer’s identity is a crucial part of the KYC process, often involving official documents and digital technologies to ensure accuracy and security. Fast-growing startups require a smarter and flexible compliance infrastructure that can evolve with product changes and high user volume.

Most early-stage companies leverage advanced AML and KYC processes from the beginning to adhere to complex compliance requirements and prevent operational drag. Automation in KYC and AML processes also helps startups streamline operations, improving efficiency and reducing operational complexity. Some of the key features to look for include:

Real-Time Document Verification Across 220+ Countries

Startups require rapid and global customer onboarding processes. When operating worldwide, ongoing compliance across multiple jurisdictions is vital. Hence, startups choose AML and KYC solutions that offer real-time document verification of government-issued IDs from various countries. This is especially true for FinTech and SaaS platforms operating cross-border in the payment and financial sectors.

AI-Powered ID Data Extraction and Biometric Verification

Current AML and KYC software now integrates artificial intelligence and machine learning models. This model is trained on millions of identity documents to automatically extract PII (Personally Identifiable Information) with extreme precision. For startups, this can deliver faster customer onboarding rates and a reduction of synthetic identity fraud during biometric authentication.

Global Watchlist and PEP Screening With Instant Alerts

In the current regulatory landscape, continuous monitoring and due diligence processes are non-negotiable for startups. AML and KYC software that integrates with real-time global sanctions and watchlists ensures that high-risk situations, such as Politically Exposed Persons (PEPs), do not bypass controls. Instant notifications further mitigate risk and strengthen financial security via swift responses.

Multi-Bureau Data Verification for Enhanced Risk Scoring

A digital identity verification process that encompasses customer data across multiple national ID registries, credit bureaus, and utility databases supports startups in fraud prevention more efficiently. Multi-bureau data matching strengthens regulatory compliance under KYC and Customer Due Diligence (CDD) requirements and reduces false positives that can alienate legitimate users.

Cost-Efficient AML for Fast-Growing Companies

SaaS and FinTech startups need to balance rapid expansion demands with disciplined resource allocation in their existing systems. Implementing an Anti-Money Laundering (AML) compliance process that delivers enterprise-grade protection without draining capital is no longer a luxury; it’s a competitive advantage. The right KYC and AML solutions shield startups from regulatory blowback and help unlock leaner, cost-effective, and scalable multi-jurisdictional compliance operations:

- Pay-as-you-go Pricing Versus Subscription Models: Startups might find themselves in inflexible annual contracts that fail to align with fluctuating user checks or evolving use cases. Modern RegTech providers offer granular, pay-as-you-go pricing, allowing startups to scale verification and screening activity together with customer acquisition, seasonal peaks, or product rollouts.

- ROI of Automation and No-Code Workflows: Utilizing low-code or no-code compliance solutions enables startups to automate workflows without having coding knowledge. This reduces time-to-deployment from weeks to hours and slashes operational overhead.

- Avoiding Hidden Costs: Startups, particularly those in the financial services industry, might encounter unexpected, abrupt fees from certain AML and KYC vendors. To prevent this, startups must have clear discussions and consider insights from leading review platforms before purchase.

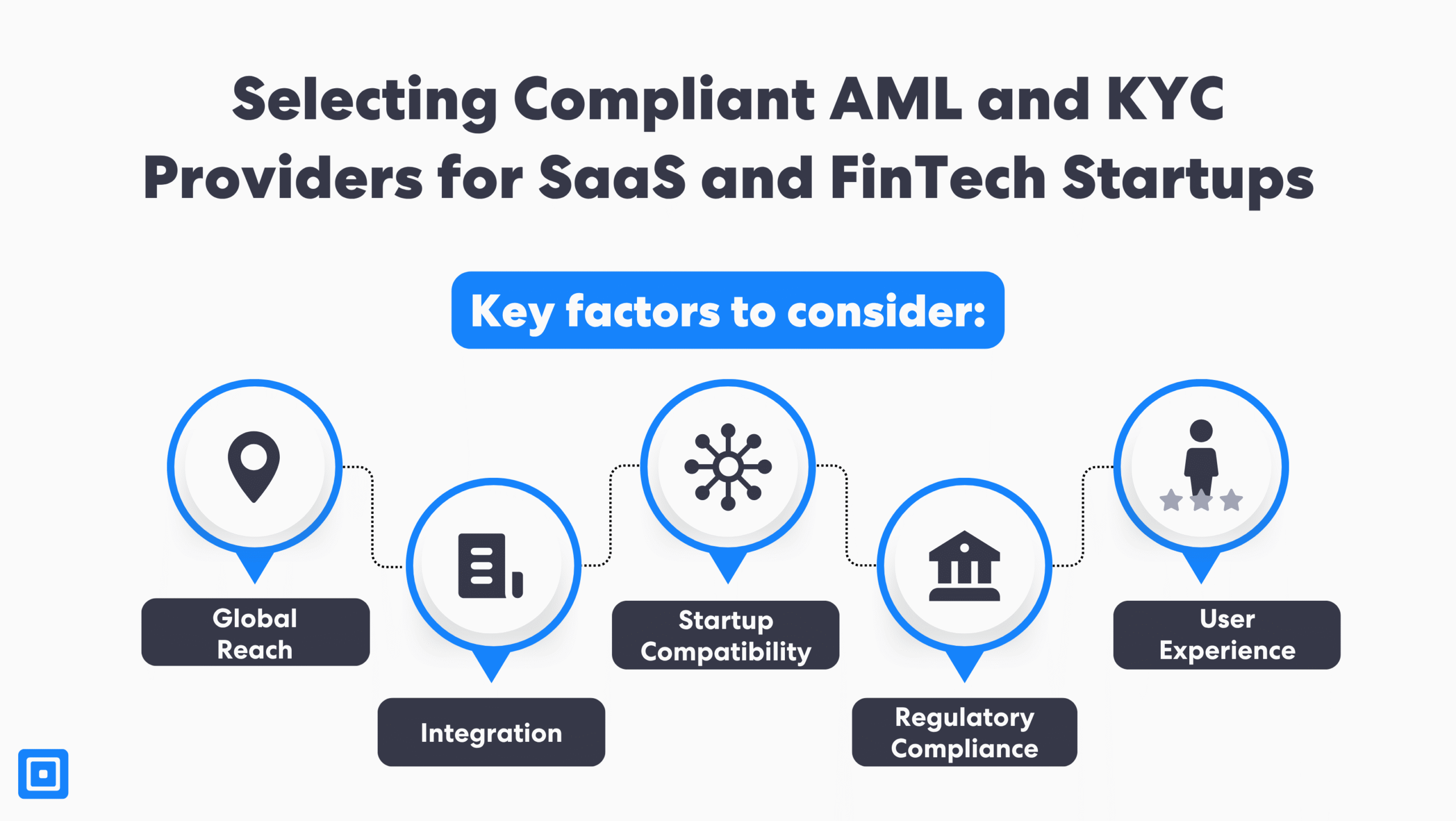

Key Factors to Consider when Selecting Top KYC Providers for Startups

When selecting compliance providers, a thorough understanding of evolving regulatory standards and KYC regulations, ensuring solutions can adapt to changing requirements and support ongoing compliance, is crucial. Here are the key factors for startups to consider:

- Global Reach: Startups with international ambitions need the ability to perform digital identity verification and business verification across multiple countries, which helps them maintain compliance with international regulations and regulatory authorities.

- Technology Integration: Advanced technologies such as machine learning, AI, and biometric authentication are leveraged for accurate and efficient identity verification, ongoing monitoring, and transaction monitoring, ensuring a robust verification system that adapts to emerging risks and regulatory changes.

- Startup Compatibility: Flexibility in integrating existing systems (APIs, SDKs), scalable solutions, and startup-friendly pricing models enables startups to implement effective compliance programs and KYC processes without hindering growth.

- Regulatory Compliance: Adherence to global regulatory requirements, including GDPR, AML, the Bank Secrecy Act, and KYC compliance, is fundamental. It ensures that startups meet the expectations of regulatory bodies and authorities while protecting data integrity and complying with data protection laws.

- User Experience: A seamless verification process and customer onboarding journey are prioritized to enhance user satisfaction and retention, while maintaining rigorous security measures and risk intelligence data to detect politically exposed persons and prevent financial crime such as money laundering.

By focusing on these criteria, startups can select Know Your Customer (KYC) processes and AML solutions that ensure compliance with regulatory reporting and standards, strengthen their defenses against financial crime, support fintech compliance, and build trust with customers and financial institutions.

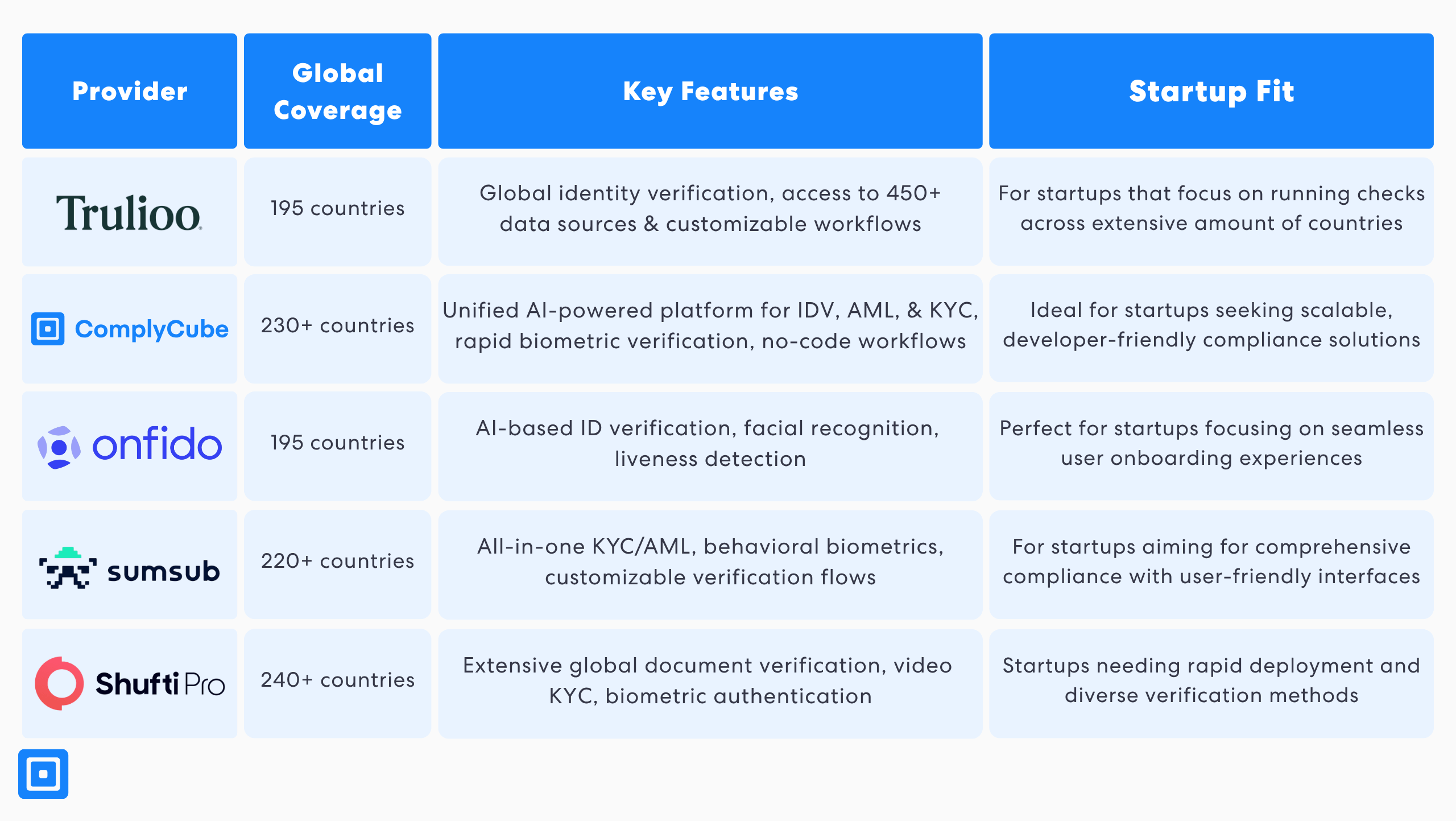

Comparison of Top KYC and AML Providers for Startups

The best KYC and AML providers deliver a robust fraud prevention framework, effective risk management, and customizable workflows for seamless customer onboarding. Ultimately, the right KYC and AML Vendor for startups will depend on the type of checks, verification process, and compliance operations desired. This section highlights the top KYC solutions and AML providers, particularly for SaaS and FinTech startups, based on the evaluation factors above and popular SaaS review sites such as G2 and TrustRadius:

Case Study: How ComplyCube Supports GRVT’s Next Million Crypto User

Fraud and deepfake attacks are increasingly becoming common in the crypto sector. For startups, this can have detrimental impacts on sustainability and growth. GRVT, a leading decentralized exchange (DEX), demonstrates how prioritizing compliance with the right provider can counter this threat and support trusted and scalable onboarding.

Building a compliance-first culture, combined with sophisticated tech, has enabled the fintech giant to amass over 2.5 million users ready to onboard the platform before launch, and raise over $14.3 million in funding rounds. To meet its large onboarding demands while maintaining accuracy and adhering to global regulations, GRVT leveraged ComplyCube’s unified AML/KYC platform for several reasons:

- ComplyCube’s proprietary technology meant that GRVT did not rely on third-party data or vendors, enhancing cost-effectiveness.

- The platform’s automated and tailored workflows enabled rapid and agile onboarding without compromising security and user experience.

- Advanced AML and KYC checks included sophisticated EDD and real-time monitoring, achieving proactive fraud prevention.

Selecting the right KYC/AML is a strategic move that must align with current and future use cases. GRVT’s example highlights the importance of deeply understanding key business needs and compliance challenges.

Safeguarding Startups with Advanced AML and KYC Solutions

Navigating KYC and AML requirements doesn’t have to limit growth for SaaS and FinTech startups. By leveraging advanced KYC solutions with robust identity verification, biometric authentication, and ongoing monitoring, startups can meet compliance requirements, support fraud prevention, and adapt to regulatory changes. Effective risk management, transaction monitoring, and business verification ensure compliance with regulatory reporting, boost trust with financial institutions, and protect against financial crime in the evolving financial services landscape.

Speak to a member of the team today or sign up for ComplyCube’s Startup Program.